什么是市盈率?

一家公司的股价是由它产生利润的能力决定的,市盈率等于公司股价除以每股收益。

市盈率(Price-to-Earnings Ratio,简称P/E Ratio)是投资者用来评估股票价值的重要财务指标。它通过比较公司的股价与每股收益(Earnings Per Share, EPS),反映出投资者愿意为每一美元的盈利能力支付多少价格。市盈率有助于评估股票的“昂贵”或“便宜”程度,是股市分析中不可或缺的工具。

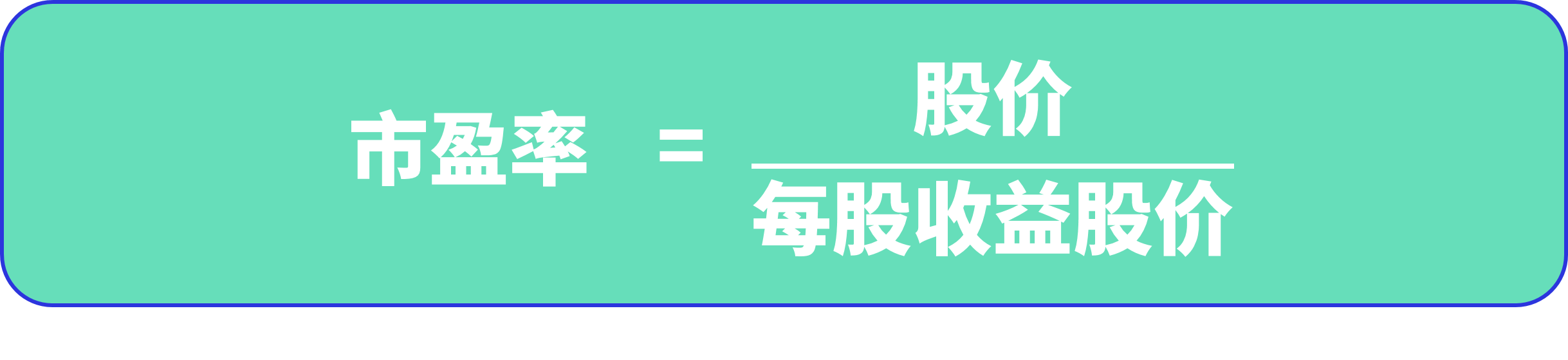

市盈率的计算

市盈率的计算公式为:

例子分析

以苹果公司(Apple Inc.,股票代码:AAPL)为例,假设在某一时点,苹果的股价为150美元,而其过去12个月的每股收益为5美元,那么其市盈率为:。

这意味着,投资者愿意为苹果每一美元的盈利能力支付30美元,反映出市场对其未来增长的预期。

市盈率的意义

市盈率不仅是一个简单的数字,它背后代表了市场对公司未来盈利能力的看法:

-

高市盈率:通常表明市场对公司的未来增长持乐观态度。例如,**特斯拉(Tesla,股票代码:TSLA)**的市盈率曾一度超过100,显示出投资者预期其将实现强劲的增长。

-

低市盈率:可能暗示市场对公司未来盈利的信心不足,尤其是在公司面临行业挑战或整体经济放缓的情况下。例如,某些传统能源公司的市盈率可能较低,反映出投资者对其未来增长的疑虑。

市盈率的比较方法

市盈率的比较可以为投资者提供重要的决策依据,主要可以通过以下几种方法进行基准比较:

-

市场基准比较:投资者可以将个别公司的市盈率与标准普尔500指数的市盈率进行比较。如果一只股票的市盈率显著高于标普500的平均水平,可能意味着该股票被高估。

-

行业平均比较:将个别公司的市盈率与同一行业的平均水平进行对比,能够帮助投资者判断公司的估值是否合理。例如,**沃尔玛(Walmart,股票代码:WMT)**的市盈率与零售行业的平均市盈率进行比较,可以揭示其在行业中的相对地位。

-

同业公司比较:在分析多家竞争公司时,通过比较其市盈率,可以帮助投资者识别哪一家公司更具投资价值。例如,如果谷歌(Alphabet Inc.,股票代码:GOOGL)的市盈率低于亚马逊(Amazon.com Inc.,股票代码:AMZN),投资者可能会进一步分析两者的增长潜力和风险。

市盈率的局限性

尽管市盈率是一个有用的评估工具,但其局限性也不容忽视:

-

负市盈率:若公司持续亏损,其每股收益为负,导致市盈率无法计算。在这种情况下,市盈率可能无法提供任何有用的信息,长期负市盈率可能反映出财务健康状况不佳。

-

历史数据的滞后性:市盈率基于过去12个月的每股收益,可能无法准确反映公司当前或未来的财务状况。因此,投资者需结合最新市场趋势和公司动态进行分析。

-

行业差异:不同行业的公司市盈率范围可能差异显著,因此在比较市盈率时,应考虑行业特性。高科技公司通常市盈率较高,而成熟的消费品公司则可能较低。

-

盈利波动性:公司盈利可能受到季节性或周期性因素的影响,导致每股收益波动。因此,单一时期的市盈率可能不代表公司长期的财务表现。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。