UK financial services firms receive 1.86M complaints in H1 2024, FCA data shows

The UK Financial Conduct Authority (FCA) has published the latest data about complaints reported by financial services firms.

The UK Financial Conduct Authority (FCA) has published the latest data about complaints reported by financial services firms.

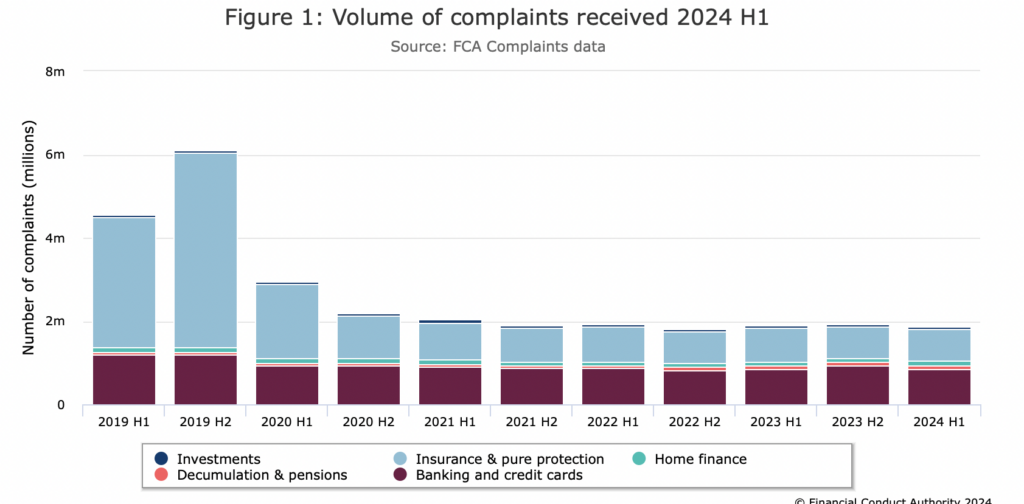

During the period from 1 January to 30 June 2024, financial services firms received 1.86 million complaints, a 4% decrease from 2023 H2 (1.94m). Since complaints about Payment Protection Insurance peaked in 2020, complaints have stayed relatively constant between 1.8m and 2m.

The product groups that experienced an increase in their complaint numbers were:

- Decumulation & pensions – up 7.1% from 86,885 (2023 H2) to 93,023 (2024 H1)

- Insurance & pure protection – up 1.4% from 754,010 (2023 H2) to 764,254 (2024 H1)

- Investments – up 2.1% from 61,513 (2023 H2) to 62,806 (2024 H1)

The product groups that experienced a decrease in their complaint numbers were:

- Banking and credit cards – down 9.6% from 941,664 (2023 H2) to 850,948 (2024 H1)

- Home finance – down 1.7% from 94,881 (2023 H2) to 93,237 (2024 H1)

There were decreases in the 3 most often complained about products:

- Current accounts from 515,639 in 2023 H2 to 492,557 in 2024 H1 (4.5%)

- Motor and transport from 281,148 in 2023 H2 to 276,469 in 2024 H1 (1.7%)

- Credit cards from 232,757 in 2023 H2 to 222,529 in 2024 H1 (4.4%)

The percentage of complaints that were upheld by firms remained at 57% between 2023 H2 and 2024 H1.

In 2024 H1 the total amount of redress was £243m. This is a 6.9% decrease on the 2023 H2 figure of £261m.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.