The RBA still retains the possibility of continuing to raise interest rates after pressing the pause button twice in a row

The decision to suspend interest rate hikes came as a surprise to the market, as previously expected, the RBA would have continued to raise interest rates by 25 basis points in this policy window。This unexpected suspension of interest rate hikes will hit the Australian dollar to some extent。

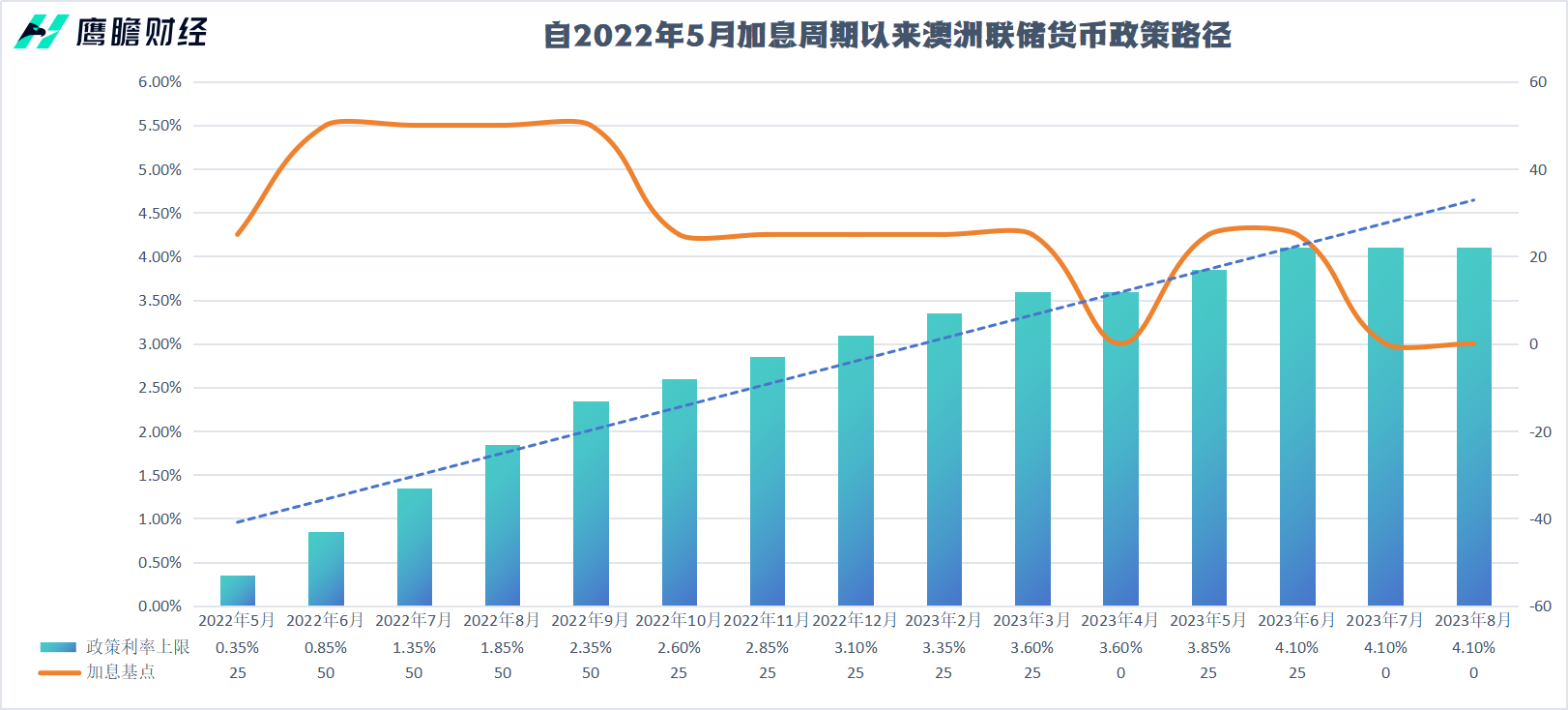

On Tuesday, local time, the RBA announced its interest rate decision until August 1.。Following the decision, the RBA suspended interest rate hikes for the second time in August, keeping the benchmark interest rate at 4.1%。

Australian Federal Reserve Chairman Philip Lowe said the decision to keep interest rates unchanged this month, given the uncertainty about the economic outlook, provided more time to assess further rate hikes and the economic outlook.。He also noted that while commodity price pressures in Australia have eased, prices for many services are rising rapidly and rental inflation has risen.。According to its forecast, Australian inflationary pressures will continue to fall, reaching 3 by 2024..5% or so, back in the 2-3% range by the end of 2025。

Suspended rate hike decision shocks markets Australian dollar short-term plunge

The decision to suspend interest rate hikes came as a surprise to the market, as previously expected, the RBA would have continued to raise interest rates by 25 basis points in this policy window。This unexpected suspension of interest rate hikes will hit the Australian dollar to some extent。Sure enough, after the announcement of the resolution, the Australian dollar against the U.S. dollar short-term dive, down nearly 40 points, in addition, the interest-sensitive three-year Treasury yield also quickly fell back to 3.82%。

For this decision, the RBA said in its monetary policy statement that it needs more time to assess the interest rate hike so far and the economic outlook - this point and the Fed previously stressed, the need to observe the cumulative effect of monetary policy and the lag effect of similar views, on behalf of both Australia and the United States central banks are from the monetary policy "operation period," slowly turning to the assessment period。

On the level of inflation, the RBA said that Australia's inflation is falling, but still at an excessively high level of 6%。Commodity price inflation has eased, but prices for many services are rising fast。Rent inflation also intensified。Our core forecast is that CPI inflation will continue to decline, falling to 3% by the end of 2024..5% or so and return to the 2% to 3% target range by the end of 2025。

According to data released by Australia last week, Australia's overall inflation slowed more than expected in the second quarter: its CPI index was still up 6% from a year earlier, still well above the RBA's 2% target, but below the 7% increase in the first quarter.。In addition, interest rate hikes are acting to slow consumer spending, with retail sales in June posting their biggest drop this year。

Worryingly, the country's services inflation is still rising, the job market remains tight and rental pressures continue。Because of this, there are many analysts believe that in today's RBA meeting, the bank still has a lot of room to raise interest rates。

The bank is also clearly aware of this, and with regard to the labour market, the RBA said in a statement that conditions in the labour market, although easing, remain very tight.。Job vacancies and hiring remain at very high levels despite businesses reporting an easing of labor shortages。However, the bank stressed that as economic and employment growth is expected to be below trend, the unemployment rate is expected to rise from the current 3..5% gradually rose to 4 by the end of next year.About 5%。Wage growth picks up on tight labor market and high inflation。At the aggregate level, wage growth remains consistent with the inflation target as long as productivity growth accelerates。

RBA open to future monetary tightening

The RBA also said that while recent data are consistent with a return to the 2 to 3 per cent target range for inflation and continued growth in output and employment over the forecast period, there is still significant uncertainty.。

First, service price inflation has unexpectedly persisted overseas, and the same is likely to happen in Australia。Second, with the labor market still tight, there is also uncertainty about the lag in the operation of monetary policy and how corporate pricing decisions and wages will respond to the slowdown.。Subsequently, the outlook for household consumption is also a constant source of uncertainty.。Finally, many households are suffering a painful squeeze on their finances, while some are benefiting from rising house prices, large savings buffers and higher interest income。Overall, consumption growth has slowed sharply due to cost-of-living pressures and rising interest rates.。

RBA once again issued a "military writ" on inflation governance。Returning inflation to target levels within a reasonable time remains the committee's top priority, the bank said.。High inflation makes life difficult for everyone and hurts the economy。It erodes the value of savings, hurts household budgets, makes it harder for businesses to plan and invest, and increases income inequality.。If high inflation is entrenched in people's expectations, the cost of reducing inflation in the future will be very high, including higher interest rates and a larger increase in unemployment.。

After two consecutive rate hikes, the RBA remains open to future monetary policy tightening。The bank said the committee may need to tighten monetary policy further to ensure inflation returns to target levels within a reasonable time frame, but this will depend on data and changing risk assessments.。In making its decision, the Committee will continue to closely monitor developments in the global economy, trends in household spending, and prospects for inflation and the labour market.。The Committee remains firmly determined to return inflation to its target level and will take the necessary measures to achieve it.。

As of press time, the Australian dollar fell 0 against the US dollar on the day..93%, reported 0.6655; AUD drops 0 against HKD on day.96%, reported 5.1884; the dollar index rose 0.41%, at 102.0420。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.