RBA restarts rate hike process in November: OCR raised to 4.35% is the highest level in 12 years

According to the RBA, the CPI index will reach 3 by the end of 2024..5% or so and fall further to the top of the 2% to 3% target range by the end of 2025。

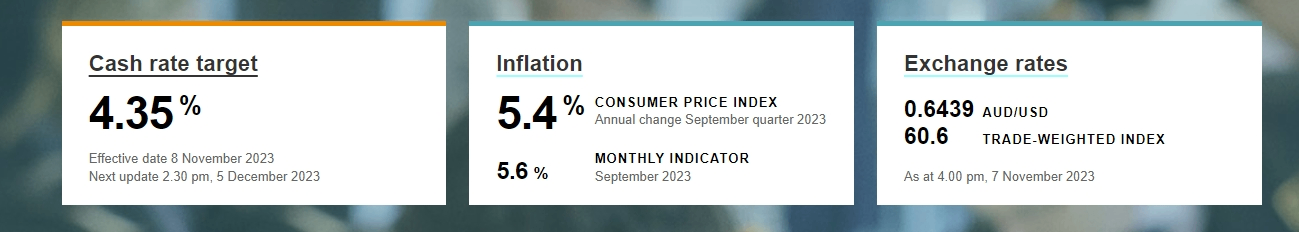

On November 7, the RBA issued an interest rate decision, restarting interest rate hikes after four consecutive stays on hold, taking the official cash rate (OCR) from 4.10% up to 4.35%, the highest level since November 2011。In addition, the bank raised the interest rate paid on foreign exchange settlement balances by 25 basis points to 4.25%, as a supplementary tightening measure to monetary policy。

The rise in inflation in the third quarter is obvious. The RBA's interest rate hike is not surprising.

According to data released at the end of October, Australia's inflation rate picked up significantly in the third quarter。Real inflation recorded 5 in the third quarter..4%, exceeding expectations of 5.1%。Among them, Australia's transportation costs surged 7% in the quarter due to soaring oil prices..2%, Rent Increase 2.2%, electricity bills up 4.2%, these price increases also contributed to Australia's monthly inflation rebounded for the third consecutive month, with a clear rise in inflation.。

From the perspective of the labor market, the tight situation of labor demand in Australia has not been alleviated.。Australia's unemployment rate remains at its lowest point of the year, according to published data 3.6%, which represents the possibility that labor costs will continue to rise.。As a result, the likelihood of the RBA restarting a rate hike in November soared directly from 5 per cent to 50 per cent after the data were released, and the extent of the labour market's impact on inflation is evident。

The market is not surprised by the RBA's interest rate hike.。According to a media survey of 39 economists, nearly 90 percent of those economists had successfully predicted a rate hike before the rate decision was announced。In his statement, RBA President Brock said: "The need for further monetary tightening to ensure inflation returns to target within a reasonable time frame will depend on the data and the ongoing assessment of risks.。"Bullock's comments directly led to Australia's 3-year bond yield falling 1 basis point to 4.26%, the Australian dollar is down nearly 50 points against the dollar in the short term.。

RBA: Inflation data expected to fall back to target range by the end of 2025

In its interest rate statement, the RBA made a forecast for the future path of the CPI index。The RBA said that while Australia's inflation had passed its peak, the reading was still too high and more persistent than expected a few months ago.。The latest CPI inflation data shows that while commodity price inflation has slowed further, the prices of many services continue to rise rapidly.。Although the CPI index will continue to decline according to previous forecasts, progress appears to be slower than previously expected.。Currently, according to the RBA, by the end of 2024, the CPI index will reach 3.5% or so and fall further to the top of the 2% to 3% target range by the end of 2025。

On inflation, the RBA says high inflation is putting pressure on people's real incomes, household consumption growth is weak, as is residential investment。Given that economic growth is expected to be below trend, employment growth is expected to be slower than labor force growth, and the unemployment rate is expected to gradually rise to 4.5% or so, a more modest increase than previously forecast。While wage growth has picked up over the past year, it remains in line with the inflation target as long as productivity growth accelerates。The RBA went on to say that returning inflation to target levels within a reasonable time remains the committee's top priority。

It is worth noting that the RBA adjusted the wording in the last paragraph of the statement, softening from "may need to tighten monetary policy further" to "whether further tightening of monetary policy is needed."。That sounds like a desire to hold on as long as possible, analysts said, with the RBA likely to send a spokesman to deliver the message in the coming weeks。

RBC: A dovish hike

On the institutional side, Tim Lawless, research director at real estate research firm CoreLogic, believes the RBA's decision to raise the official cash rate to 4.35 per cent, which clearly shows that the RBA is willing to raise interest rates if inflation exceeds the 2-3 per cent target range.。Tim Lawless also said continued tight labor market conditions and a pick-up in the volume and value of retail spending could be additional factors supporting the move to raise interest rates.。

Saxo Markets said the RBA statement failed to confirm the hawkish stance expected by some market participants。Market strategist Charu Chanana wrote in a report that the Australian dollar's reaction after the RBA announced a 25 basis point rate hike was typical of "buying news, selling facts."。Interest rate hike expectations have been heating up over the past few weeks, making the Australian dollar one of the biggest gainers among the G10 currencies.。But the market is pricing in not just a rate hike today, but another rate hike in the current cycle。The RBA statement failed to confirm this hawkish stance and instead used a data-dependent approach to assess the need for further tightening.。

Royal Bank of Canada Capital Markets interest rate strategist Rob Thompson believes that the RBA in this rate hike is a "dovish rate hike."。He said the RBA will not take immediate follow-up action after this rate hike: "The market may think that this rate hike marks the RBA reopening the door to rate hikes, but in fact their intention is to intervene in the market as little as possible, and the barriers to continuing to raise rates are actually very high.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.