Another giant was reduced. Softbank's stake in Alibaba fell to 3.8%, almost clearance!

According to reports, SoftBank Group Corp (SoftBank Group Corp.) is planning to sell its shares in Chinese Internet giant Alibaba Group Holding Ltd (Alibaba Group Holding Ltd..) majority stake, the latest sign that Chinese long-term investors have reduced their exposure to the company。

Recently, as discussed, foreign investors have reduced their holdings of larger domestic listed companies.。

First, the stock god Buffett's Berkshire Hathaway (Berkshire Hathaway) for the tenth time to reduce its stake in BYD, and then the domestic Internet giant also by the major shareholder Prosus to sell Tencent nearly 100 million shares。At present, another Internet giant to be reduced。

According to reports, SoftBank Group Corp (SoftBank Group Corp.) is planning to sell its shares in Chinese Internet giant Alibaba Group Holding Ltd (Alibaba Group Holding Ltd..) majority stake, the latest sign that Chinese long-term investors have reduced their exposure to the company。

SoftBank reportedly sold more than $7 billion of Alibaba shares this year through prepaid forward contracts。The contracts gave SoftBank an option to buy back shares, but the group has settled previous deals by handing over shares.。

According to regulatory documents, the sale will reduce the Japanese conglomerate's stake in Alibaba to 3.8%, almost close to clearance。Last year, SoftBank had already taken its stake in Alibaba from 23.7% to 14.6%, earning $34 billion。

SoftBank is understood to have held about a third of Alibaba's shares, which came from a $20 million investment in one of the most famous bets on venture capital in the early days.。

Affected by the news, overnight Alibaba U.S. stocks fell all the way down, and finally closed down nearly 6%。Alibaba Hong Kong stocks also opened nearly 5 points lower today, but have narrowed to nearly 2% in late trading。

SoftBank, once one of Silicon Valley's biggest investors, has taken billions of dollars in losses from its Vision Fund, which has boosted the valuations of startups around the world by betting heavily on hundreds of them.。

But with losses at venture capital, SoftBank said it would prioritize financial discipline before seeking the right time to invest.。Investors are also speculating whether the company will launch another buyback program.。

Last year, as it was no longer actively seeking new investments, the company cut staff in the Vision Fund division.。This week, SoftBank said it plans to sell its early-stage venture capital arm, SoftBank Ventures Asia, as part of its path to finding promising startups.。

In a note to investors, Citibank analyst Mitsunobu Tsuruo said: "We believe that progress in monetizing asset holdings will increase the chances of announcing a buyback.。"。

Alibaba and other tech companies have been stymied by various pressures in recent years, and their shares have fallen sharply.。Last month, Alibaba said it planned to split its $240 billion empire into six units, each raising capital and exploring an initial public offering.。

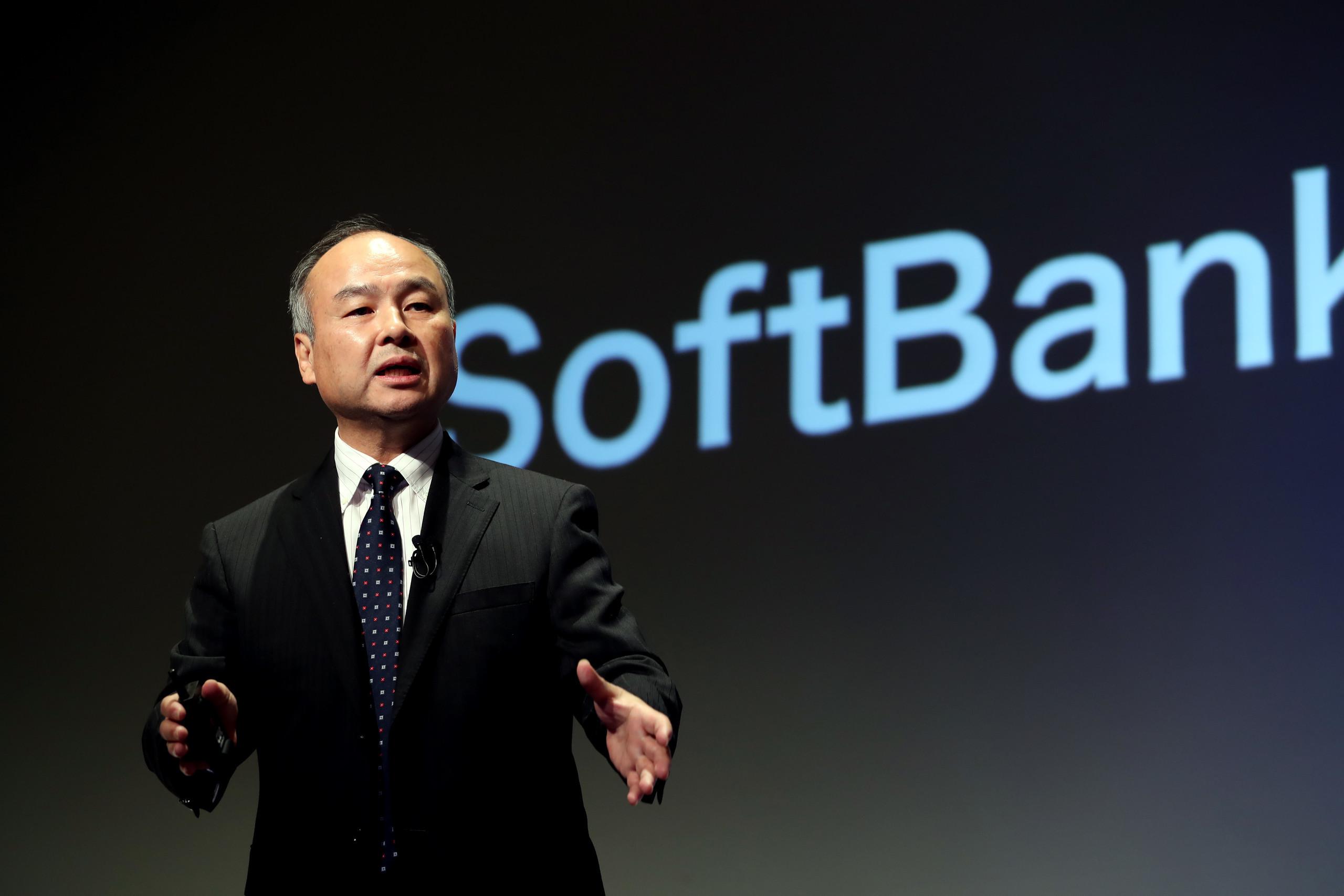

In addition, SoftBank founder Masayoshi Son said he hopes to focus on his chip design unit Arm Ltd later this year..The company plans to go public and launch the "largest" product in the history of the semiconductor industry for the first time.。Arm, which was traded on the London exchange before SoftBank's $32 billion takeover in 2016, is expected to be a windfall for the world's largest tech investor.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.