Ali rose sharply: Ma Yun, Cai Chongxin significantly increased their holdings by about $200 million!

On January 23, US Eastern Time, Alibaba Group founder Jack Ma and Chairman Cai Chongxin significantly increased their holdings of Ali shares, causing market concern.。After the news, Alibaba's U.S. stocks pulled up before the day, up more than 7% at one point.。

On January 23, US Eastern time, Alibaba Group founder Jack Ma and Chairman Cai Chongxin's significant increase in Ali shares caused market concern, which to some extent boosted market confidence and provided support for Ali's share price.。After the news, Alibaba's U.S. stocks pulled up before the day, up more than 7% at one point.。

Ali Shuangxiong Joins Hands to Increase Holdings

In 2019, Jack Ma officially resigned as chairman of Alibaba Group; in 2023, he continued to release control of Ant Group, seemingly gradually moving away from the "country" he had laid down.。

However, according to relevant personnel, Ma has been buying Ali's shares in recent months, as has Cai Chongxin.。In the fourth quarter of last year, Tsai purchased a value of 1 through his Blue Pool Management family investment vehicle..$5.1 billion in Ali U.S. stocks, while Ma also increased his holdings significantly during the same period, buying about $50 million worth of group Hong Kong stocks。

Industry insiders see, the move is also in response to the news that Ma Yun reduced his holdings of Alibaba some time ago.。

On November 16, 2023, 144 documents disclosed on the official website of the Securities and Exchange Commission (SEC) showed that Jack Ma's family trust JC Properties Limited and JSP Investment Limited intend to sell Ali founder shares on November 21, reducing their holdings of 5 million American depositary shares (ADS), respectively, involving a total stock market value of 8..$70.7 billion。

In response to the "reduction" of the matter, Ma Yun's office lawyer has replied: "The sale is a forward plan, did not occur actual reduction."。Ma Yun is still very optimistic about Ali, the current share price is far below Ali's actual value, will still firmly hold Ali shares.。However, the news has been released has caused a "retreat" of a large number of followers, the stock all the way down to $68, a nearly one-year low.。

Ali has had a hard time in recent years, with the company and Ant Group bearing the brunt of the tech industry's huge epicenter。At the time, the technology industry's market capitalization evaporated by about 1.1 trillion dollars。

In 2020, Ant Group had to cancel a potentially record listing due to regulatory changes to the status of private companies, and Ali was subsequently fined $2.8 billion in antitrust fines.。In 2022, Ali gave up its plan to spin off its cloud computing business, which led to a massive sell-off of its shares, and industry experts believe that the market share of Ali's cloud business is constantly suffering and has to choose to stagnate in the midst of hardship.。

Transparency and decentralization of share voting rights

Not long ago, Ant Group completed the restructuring of its shareholder structure, and Jack Ma stepped down as the de facto controller of Ant Group.。

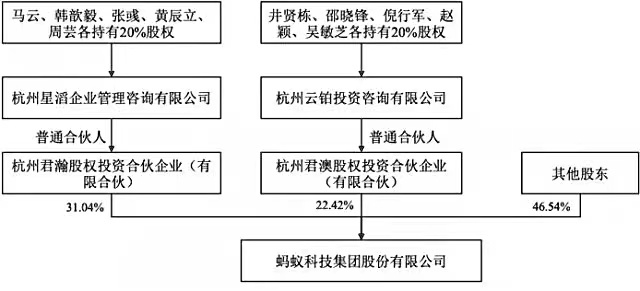

Before the adjustment, Ant Group's shareholding structure was.

According to the information disclosed by Tianyan Zha, Hangzhou Junhan Equity Investment Partnership (Limited Partnership), the largest shareholder of Ant Technology Group Co.。

At present, the partnership is jointly funded by Hangzhou Junjie Equity Investment Partnership (Limited Partnership), Hangzhou Xingtao Enterprise Management Consulting Co.。

After adjustment, the equity structure of Ant Group is:

It is reported that the adjustment is aimed at adapting to the requirements of the modern corporate governance system, with the voting rights of major shareholders as the core of the adjustment, so that it matches the relevant economic interests, and does not involve changes in the economic interests of the Group's shareholders and related beneficiaries, nor will it affect the daily operations of Ant Group and its subsidiaries.。

After the completion of the adjustment, the major shareholders of Ant Group exercise their voting rights in their shares independently of each other, and have no concerted action relationship, nor have they individually or jointly formed control at the level of the Group's general meeting of shareholders, let alone "the number of directors nominated by shareholders exceeds half of all directors."。Since then, Ant Group has eliminated any single or joint control by direct or indirect shareholders.。

"Repurchase + Investment"

In 2023, against the backdrop of strong domestic economic recovery and lack of investor confidence, Ali's full-year market capitalization fell by more than 40%, and was once overtaken by its e-commerce rival Pinduoduo.。

At this time, however, Alibaba repurchased a total of $9.5 billion ($68 billion) for a total of $8.97.9 billion shares of common stock (equivalent to 1.12.2 billion American depository shares), becoming the largest Chinese Internet company to buy back.。

And at the Q3 earnings call, Ali executives noted that the group plans to raise its return on capital (ROIC) to double-digit levels in the next few years.。As a result, significant investments will be made in core businesses to increase the degree of conversion of return on capital; for non-core businesses, evolution will translate their investments into profitability。

Xu Hong, CFO of Alibaba Group, said: "For some of our investments, we still have the opportunity to liquidate them, and by monetizing them, we can return value to the group's shareholders in the future, thus helping the group to improve its return on capital; for equity securities and some affiliate investments, they can also add color to our goals.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.