Ali FY24Q3 earnings highlights frequently: AliExpress exceeds expectations by 60%

On the evening of February 7, Alibaba Group released its third-quarter results for fiscal 2024 and revealed that it had expanded its share repurchase program by $25 billion.。

On the evening of February 7, Beijing time, Alibaba Group (hereinafter referred to as "Ali") released its third-quarter results report for the fiscal year 2024 ended December 31, 2023, and revealed that it had expanded its share repurchase program by $25 billion.。

Financial Data Summary

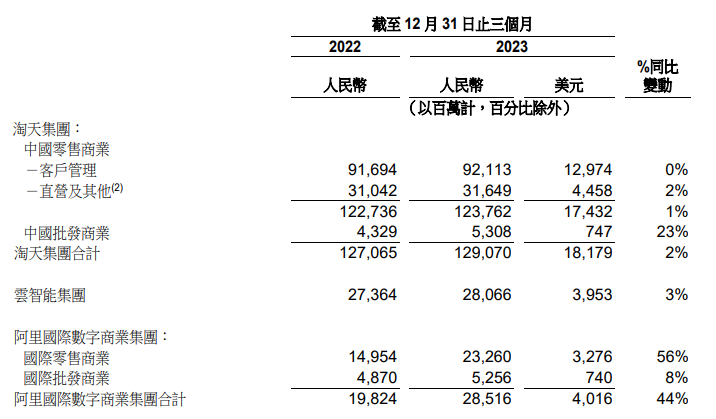

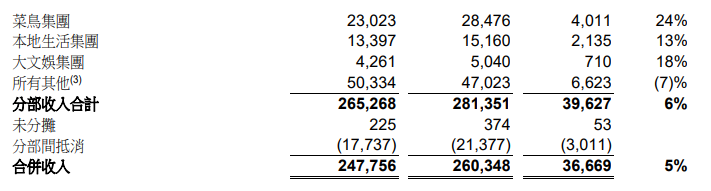

According to earnings data, Ali achieved revenue of 2,603 in the quarter..500 million yuan, up 5% year-on-year; operating profit was 225.1.1 billion, down 36% YoY; net profit 107.1.7 billion, down 77% YoY; Adjusted EBITA up 2% YoY to Rmb528.$4.3 billion; diluted EPS 0.71 yuan。

According to Ali, the significant decline in operating profit was mainly due to the impairment of intangible assets of its Gaoxin Retail and the impairment of Youku's goodwill.。Excluding equity incentive expenses, impairment of intangible assets and goodwill, and certain other items, adjusted EBITA operating profit is 528.4.3 billion yuan, a year-on-year growth of 2%。

According to Xu Hong, Ali's chief financial officer, Ali's healthy performance this quarter, relying on a strong balance sheet and cash flow, the group has increased its investment in strategic priority areas and improved shareholder returns, reflecting its confidence in the business and cash flow prospects.。

Progress of each business and strategy

Since 2023, Ali has undergone a number of major changes - in September 2023, the group changed command, Cai Chongxin took over as chairman of the board of directors, Wu Yongming took over as CEO, FY24Q3 performance is also Ali's first answer after the new official took office.。

"E-commerce + cloud computing" is the highest priority

In terms of business and strategic progress, Ali's two core businesses - Amoy Group and cloud computing - saw the smallest year-on-year increase in revenue, but despite this, Ali executives said: e-commerce and cloud computing remain Ali's focus in the coming year.。

- Amoy Group

In the quarter, Amoy Group's business revenue was 1,290.700 million, up 2% YoY, adjusted EBITA to 599.3 billion yuan, up 1% year-on-year。Among them, China's retail business revenue was 1237.6.2 billion yuan, up 1% year-on-year; while China's wholesale business revenue was 53.08 billion yuan, up 23% year-on-year。

Ali said that Amoy Group is in the process of revitalization, and focus on future growth。Losses in several of the Group's businesses narrowed, focusing on user experience optimization and price competitiveness strategies, with a surge in the number of buyers and orders driving healthy year-on-year growth in online GMV, partially offset by a decline in average order size; on the other hand, the number of platform merchants also recorded double-digit year-on-year growth, which has been maintained over the past four quarters。

After the "Double Eleven" shopping carnival, thanks to the price competitiveness strategy, consumers' enthusiasm for buying did not stop, so that the second half of the quarter's order volume also achieved double-digit growth year-on-year.。Moreover, in terms of retention and conversion of high-end consumers, the number of 88VIP members has exceeded 32 million, contributing to an increase in revenue from value-added services and continuing to achieve double-digit year-on-year growth.。

- Cloud Intelligence Group

During the financial reporting period, Alibaba Cloud's revenue grew strongly, accounting for 11% of the group's total revenue, up 3% from the previous year to 280.6.6 BILLION, ADJUSTED EBITA PROFIT JUMPS 86% TO 23.6.4 billion yuan, a new high for the fiscal year。

According to the report, the growth was driven by Alibaba Cloud's continued efforts to improve revenue quality by reducing lower-margin project-based contract revenue, while the healthy growth in revenue from public cloud products and services also led to improved profitability.。

A few days ago, Alibaba Cloud put forward the "AI-driven, public cloud priority" strategy, set up three core business units (public cloud business division, government and enterprise division, overseas business division), and as a basis, increase investment in public cloud technology, accelerate the penetration of public cloud in the domestic market, with more standardized, more competitive products and services, and further expand the various markets。

In the future, Alibaba Cloud will rely on the full-stack technology system of "cloud + AI" to support more customers to "go to the cloud for big data" and "go to the cloud for storage," and work with partners to promote the landing of big models in more customers' specific business scenarios.。

- International Digital Business Group (AIDC)

As for the e-commerce business, Ali's performance is bright.。It is reported that the growth rate of GMV of Ali International Station in 2023 will be around 20%, and the growth volume of overseas users will exceed 10%.。

Data show that Ali International Station revenue increased 44% year-on-year to 285.At $1.6 billion, AliExpress achieved over 60% year-on-year order growth, mainly driven by its cross-border business Choice, exceeding market expectations for six consecutive quarters。Ali international wholesale business revenue of 52.5.6 billion yuan, up 8 percentage points year-on-year, mainly due to the positive trend of value-added service revenue under cross-border business.。

Trendyol continued to record strong double-digit order growth during the quarter。While maintaining Turkey's leading e-commerce position, Trendyol further expands its business to the Middle East through its rich supply of goods and fast and reliable logistics experience; Lazada continues to focus on improving operational efficiency。Lazada's loss per order continued to narrow year-on-year in the quarter as the realization rate further improved and logistics costs decreased.。

However, under the high growth of Ali's overseas e-commerce, profitability is still an issue that it has no time to take into account at the moment.。Adjusted EBITA loss due to increased investment in the Group's expanded AliExpress Choice and Trendyol international operations, etc. 31.4.6 billion yuan, a significant increase year-on-year.。

Ali CEO Wu Yongming said: "Re-igniting the growth momentum of the two core businesses of e-commerce and cloud computing is the Group's highest priority.。In the coming year, we will increase investment in improving the core user experience to support Amoy Group to regain growth and strengthen its market leadership, focus resources on developing public cloud products, and maintain the strong growth momentum of international commercial business.。"

According to people familiar with the matter, Wu Yongming's next step will continue to integrate Ali Group, Taotian and Aliyun, thoroughly open up the two core businesses of Taotian and Aliyun, return them to the Group in essence, and complete Taotian's technology upgrade and the layout of key directions such as AI as soon as possible.。

Other businesses are pleased to see an increase in revenue and a decrease in losses.

- Cainiao Group

Cainiao Group's quarterly revenue increased 24% year-over-year to 284.$700 million; adjusted EBITA to earnings 9.600 million yuan, the same period last year is still in a state of loss, the period recorded a loss of 12 million yuan.。

It is reported that cross-border logistics has always been a strong growth driver for Cainiao, with its "global 5-day" capacity covering 10 countries (2 new countries) and soaring business orders, with triple-digit growth from the previous year.。As a result, Cainiao's cross-border business "end-to-end" capability has been greatly upgraded, truly realizing the transformation of cross-border logistics fulfillment solutions.。

Moreover, thanks to the economies of scale and the cost optimization brought about by the refined operation of the trunk line, the last mile distribution and other links, the profitability of the rookie has been continuously enhanced.。

- Local Living Group

Local Living Group's in-quarter revenue rose 13% YoY to 151.600 million, adjusted EBITA for a loss of 20.600 million, but narrowed from the loss in 2022, with a 29% year-on-year decrease in losses.2%。

In the third fiscal quarter, orders from local life groups increased by more than 20% year-on-year, driven by Hungry Noodles and Golder's growth, with active consumers exceeding 3% in 2023..900 million。

Earlier, there were market rumors that "Ali intends to sell hungry," Ali said hungry is a very important asset near the field, the company has no plans to sell.。On January 24, Yu Yongfu, chairman and CEO of the local life group, explicitly refuted the rumor on the intranet, saying: "Fake can only be fake after all."。

- Big Entertainment Group

Big Entertainment Group seems to have become Ali's "short board" in this performance statistics.。During the quarter, the Group's adjusted EBITA loss was 5.100 million yuan, compared with 3 in the same period last year..900 million yuan, loss increased by 31% year-on-year。But in fact, Big Entertainment's revenue grew 18% year-over-year to 50.400 million yuan。However, there is still much room for improvement in its operating efficiency and cost reduction efforts。

Alibaba Pictures' offline entertainment business is growing rapidly。Ali Pictures is involved in the production and promotion of the total box office of the film, accounting for more than half of the total box office in China, while its subsidiary Barley provides services for almost all major concerts in China, which led to the rapid growth of GMV year-on-year.。

Share repurchase plan size raised again

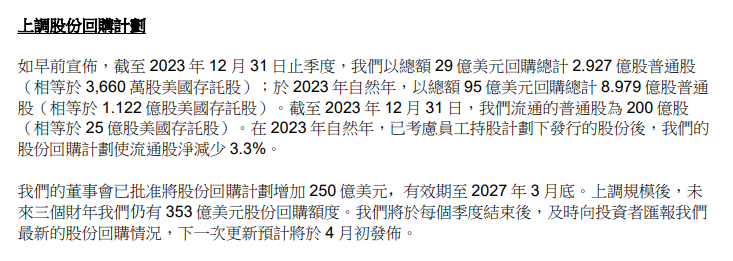

The results coincided with Ali's announcement that it would increase its share repurchase program by $25 billion and increase the total size of share repurchases to $65 billion, which will be extended until the end of March 2027.。It is estimated that the Group will still have $35.3 billion in share buybacks over the next three fiscal years, with the latest buybacks likely to be announced again in early April。

Statistics show that in the third quarter ended December 2023, Ali repurchased a total of $2.9 billion for a total of 2.92.7 billion shares of common stock (approximately 36.6 million ADRs); for all of 2023, 8.97.9 billion shares of common stock (approximately 1.12.2 billion ADRs); at the end of the year, the number of common shares outstanding in the Group was 20 billion (approximately 2.5 billion ADRs)。

In fact, Ali has launched share buybacks for many years in a row, raising the amount of buybacks several times.。In November 2022, Ali announced an additional $15 billion increase in its share repurchase program, expanding the total size to $40 billion;。

Xu Hong said, "Continued share buybacks also help reduce the total number of shares outstanding, thereby enhancing earnings per share and cash flow per share.。"

On the conference call, Ali said, "The size of the repurchase takes into account a number of different factors, including cash generation capacity, financial leverage, and the level of borrowing.。Taken together, about $12 billion a fiscal year on such a scale should be very appropriate.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.