It is said that Ant Group is planning to reorganize or divest some of its businesses to "reload"

July 26, according to media reports, Ant Group is planning a reorganization。The restructuring plan will divest some non-core businesses of its China finance-related businesses, paving the way for the company to subsequently seek an initial public offering (IPO) on the Hong Kong Stock Exchange of China.。

July 26, according to media reports, Ant Group is planning a reorganization。The restructuring plan will divest some non-core businesses of its China finance-related businesses, paving the way for the company to subsequently seek an initial public offering (IPO) on the Hong Kong Stock Exchange of China.。

Ant Group is considering spinning off its blockchain, database management services and international operations from a major entity that will be used to apply for a financial company license in China, according to people familiar with the matter.。At present, the company has conveyed this plan to some shareholders.。Once Ant Financial gets its financial company license, the company can prepare for an initial public offering in Hong Kong, China。But people familiar with the matter also said the plan has yet to be finalized and could eventually change.。

On the evening of July 7, the People's Bank of China, the State Administration of Financial Supervision and Administration and the China Securities Regulatory Commission jointly issued a message saying that the financial management department imposed fines (including confiscation of illegal income) on Ant Group and its institutions for past years in corporate governance, financial consumer protection, participation in the business activities of banking and insurance institutions, engaging in payment and settlement business, fulfilling anti-money laundering obligations and carrying out fund sales business..2.3 billion yuan。At the same time, Ant Group was required to shut down its "mutual treasure" business and compensate consumers in accordance with the law.。

The ticket was issued, announcing the end of the regulator's three-year-long investigation machine rectification of Ant Group.。

During the regulatory investigation and rectification, Ant Group first adjusted its positioning, and Ant Group now positions itself as a financial holding company rather than a technology company.。And then made a change to the actual controller of the company.。Alibaba founder Jack Ma previously owned more than 50% of Ant Group's voting rights, but in January this year, Ant Group announced management changes。After the adjustment was completed, the voting rights of Ma and his co-actors increased from 53.46% down to 6.208%, no longer the actual controller of the company.。

Due to the long period of investigation and rectification, Ant Group's consumer loans, asset management and other businesses have been affected.。It is reported that the restructuring may give Ant Group's shareholders "compensation"。Shareholders will likely receive shares in entities outside the main business at a nominal price, but they have also been told that these businesses will take years to develop.。

Two weeks after receiving a huge fine, Ant Group announced its share buyback program。

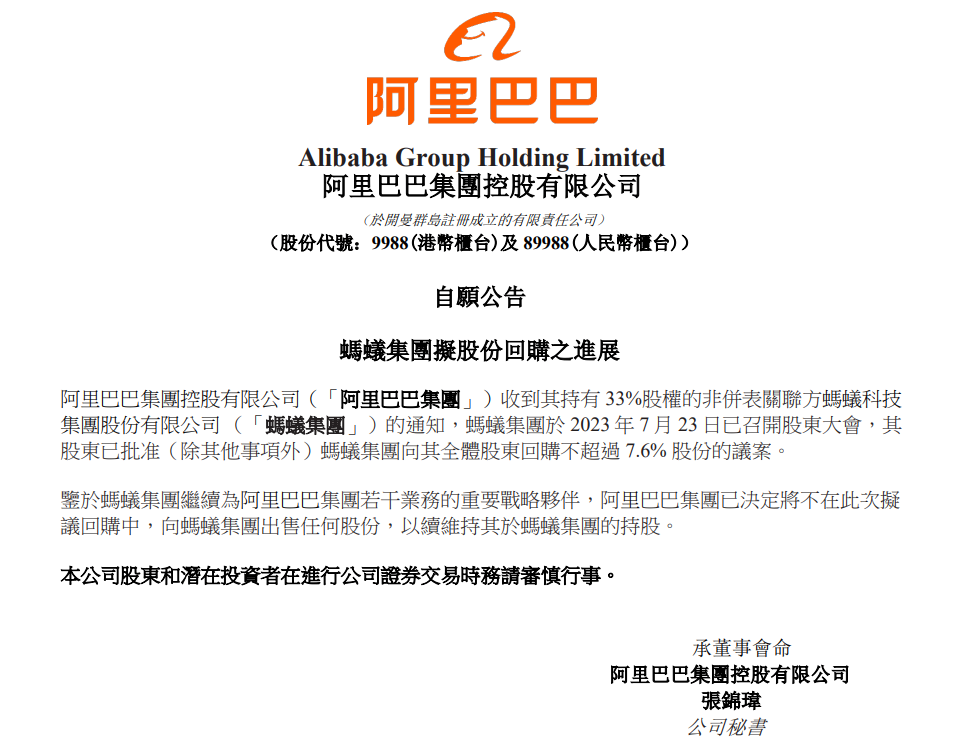

On July 23, Alibaba announced that Ant Group had held a general meeting of shareholders on July 23, and its shareholders had approved Ant Group to buy back no more than 7.Bill for 6% shares。Notably, Alibaba did not participate in the buyback, and the company explained that Ant Group continues to be an important strategic partner for several of Alibaba Group's businesses and therefore will not sell any Ant Group shares.。Alibaba currently holds about a third of Ant Group。

According to the July 8 announcement, the price of the repurchase corresponds to a company valuation of approximately RMB567 billion, or approximately $79 billion.。It can be seen that Ant Group's valuation has shrunk significantly, which is well below its $280 billion valuation before the cancellation of the IPO in 2020 and below Temasek Holdings Pte and Carlyle Group Inc..) and other global funds at a valuation of $150 billion when they took a stake five years ago.。

It is reported that Ant Group's repurchase is mainly to attract talent and meet the liquidity needs of shareholders, all shareholders can voluntarily choose whether to participate within the repurchase ratio.。Some of the Chinese state-owned companies involved in Ant Group's early financing are planning to participate in the buyback, although shareholders must make a decision by early August, according to people familiar with the matter.。

After the share repurchase and want to restructure the company, Ant Group's purpose is not difficult to guess, is to meet the interruption of three years ago, "listing dream."。

Ant Group's IPO shouldn't be that fast, though。According to the provisions of China's A-share IPO, the declaration of listing on the main board of the Shanghai and Shenzhen exchanges requires that the company has not changed its actual controller in the last 3 years;。In Hong Kong, China, under the listing rules, ownership and control are required to remain unchanged for at least the most recent audited fiscal year.。

From a time perspective, Ant Group is much more likely to choose to list in Hong Kong, China than in Shanghai and Shenzhen, China。In addition, Ant Group's overseas layout also makes it look more "international," and listing in Hong Kong, China can also attract more overseas investors for the company.。

Ant Group's current international operations include a trading network called "Alipay +," which facilitates cross-border payments between multiple digital wallets in multiple countries.。According to public information, since its launch in 2020, digital wallets in many countries, including Hong Kong, Malaysia, the Philippines, Thailand, and South Korea, have been connected to Ant's Alipay + service.。The company also operates WorldFirst, a one-stop digital payments and financial services platform for small businesses doing cross-border trade.。In addition, Ant Group has an ANEXT Bank。It is understood that the bank is a digital bank established by Ant Group in Singapore in June 2022 after obtaining a digital wholesale banking license from the Monetary Authority of Singapore (MAS), and is one of the first digital banks in Singapore.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.