HHLR first-quarter position data released: the concept of the stock is favored to fight more than a large increase in holdings rose to heavy position second!

On May 15, HHLR ADVISORS, LTD.disclosed its 13F position report as of March 31, 2023。Among the top ten positions, the proportion of positions increased by Chinese stocks.。Pinduoduo, Shell and Alibaba are all in the top five positions, ranking 2-4 respectively.。

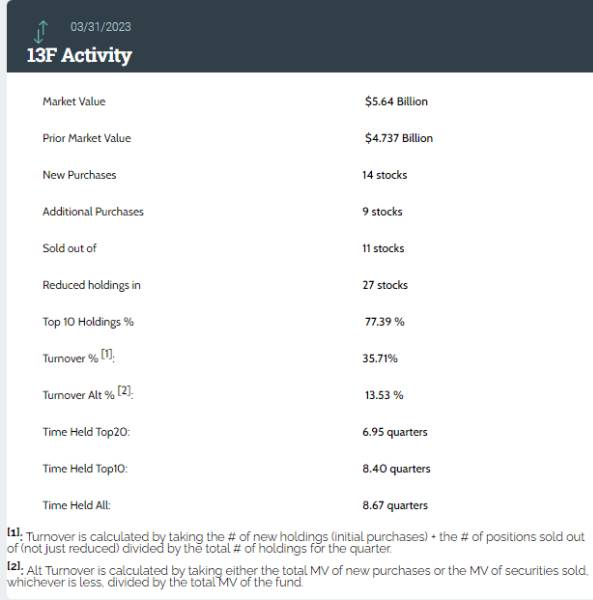

On May 15, HHLR ADVISORS, LTD.(Hillhouse) disclosed its institutional position report as of March 31, 2023 (13F)。Report data show that the total market value of high-end positions in the first quarter was 56..$400 million, 14 new stocks bought, 9 positions added, 27 positions reduced, 11 positions cleared。The total market capitalization of the top ten stocks is 77..39%。

The general stock changes in the transfer are very conspicuous, "some people are happy and some are sad."

After adjusting its position in the first quarter, non-essential consumer goods and medical services stocks accounted for a similar proportion, both around 30%.。Followed by information technology and communications stocks, with positions of about 24% and 9%.。In terms of changes in positions, the proportion of positions in non-essential consumer goods and information technology stocks increased, while medical services suffered a large decline.。

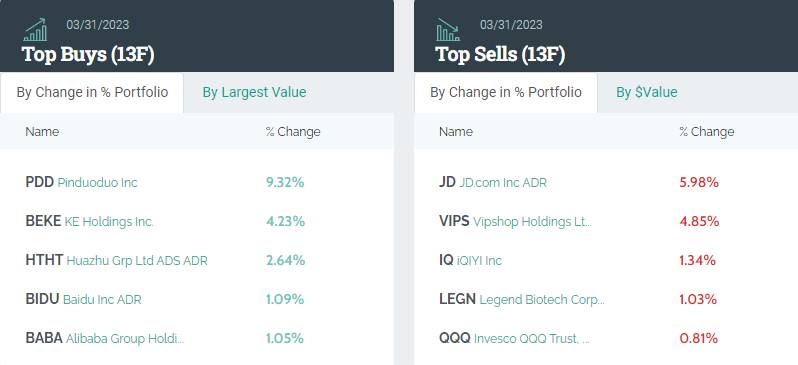

After the Q1 position adjustment, three of the top ten positions were unchanged, namely, Baekje Shenzhou, Safetime and Freeport McMoran.。Among the top ten positions, the proportion of positions increased by Chinese stocks.。Pinduoduo, Shell and Alibaba are all in the top five positions, ranking 2-4 respectively, with 14 positions respectively..32%, 10.43% and 6.86%。Huazhu is in 9th place, with a position ratio of 2.92%.

A number of Chinese stocks in the top ten heavy positions, naturally inseparable from the Hillhouse Capital "buy buy buy"。According to the data, the top five buying targets are all Chinese stocks, namely, Pinduoduo, Shell, Huazhu, Alibaba and Baidu.。

However, some of the Chinese stocks were also abandoned miserably in this change of high capital.。

Among the top five selling targets, Jingdong, Vipshop and iQiyi ranked in the top three.。In terms of position reduction changes, iQiyi changed by as much as 98%, followed by Boss Direct Hire, Proview and Jingdong, which were reduced by 87%, 85% and 63%, respectively.。In addition, TSMC and JinkoSolar were directly liquidated by Hillhouse Capital.。

Biotech stocks were the most newly bought, and financial stocks suffered a decline in their positions.

Biotech stocks accounted for the majority of the new purchases, with a total of nine。Including Bymarin Pharmaceuticals, Regeneron Pharmaceuticals and Yisheng.。There are three Chinese stocks, namely Baidu, Ideal Auto and Zhongtong Express.。The remaining 2 are semiconductor-related companies, for Chaowei Semiconductor and Wolfspeed Inc..

Since Q3 2021, financial stocks have suffered a significant reduction in their positions in Hillhouse Capital, and Q2 2021 still has 5.2% of the position, and by 2022 Q3 will be only 0.19%。In 2022, Q4 rose slightly to 1.44%。But this Q1 data show that financial stocks have once again been "abandoned," now accounting for only 0.56%。In this liquidation, there are two financial stocks, namely Invesco QQQ Trust and ProShares UltraPro QQQ.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.