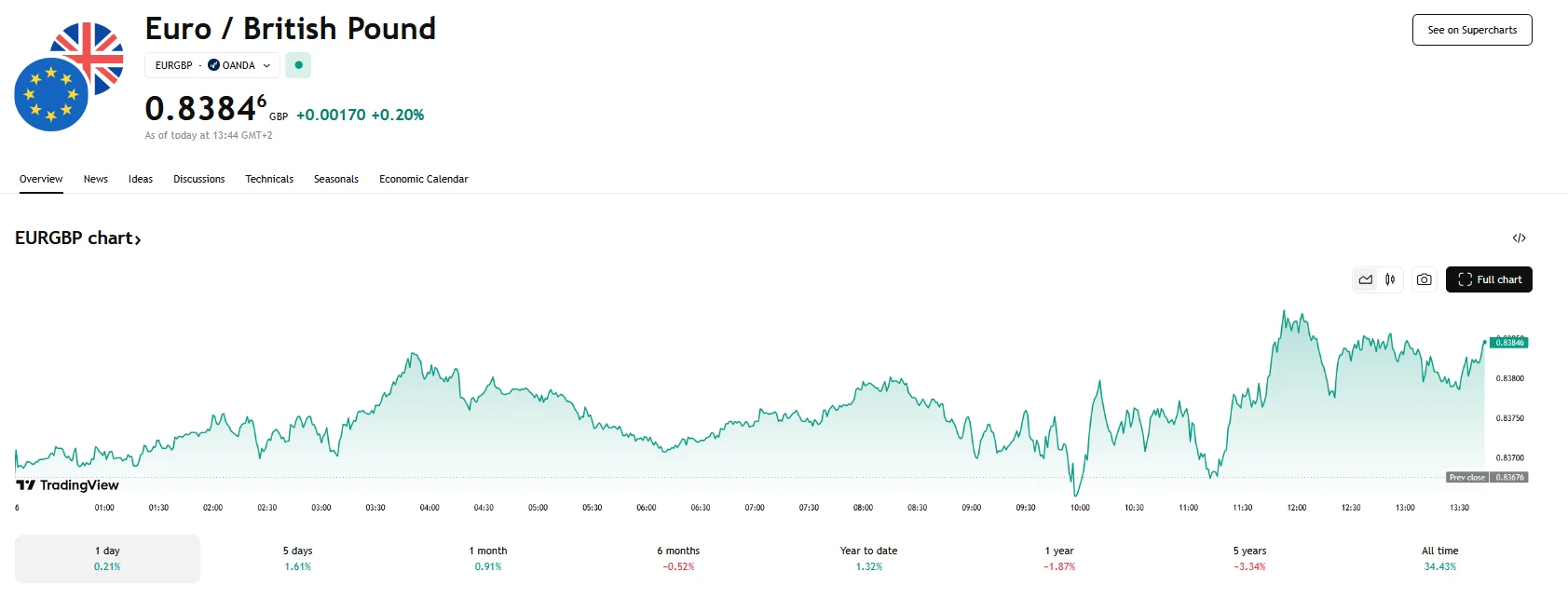

Euro Strength Drives EUR/GBP Above 0.8380 Euro Strength Drives EUR/GBP Above 0.8380

Key momentsA significant upward movement characterized the EUR/GBP pair’s trading on Thursday, with a decisive breach of the 0.8380 level and a brief approach to 0.8390.The announcement of a 500 billi

Key moments

- A significant upward movement characterized the EUR/GBP pair’s trading on Thursday, with a decisive breach of the 0.8380 level and a brief approach to 0.8390.

- The announcement of a 500 billion euro infrastructure fund, combined with the relaxation of fiscal constraints, effectively ignited widespread optimism about the Eurozone’s growth potential and helped strengthen the Euro.

- In contrast to the Euro’s strength, the Pound Sterling faced considerable pressure due to the Bank of England’s (BoE) cautious approach to monetary policy.

EUR/GBP Climbs on Eurozone Growth Expectations

On Thursday, the EUR/GBP currency pairing experienced a significant surge, decisively surpassing the 0.8380 mark and briefly approaching 0.8390. The day’s trading saw some volatility, however, with the pair dipping to around 0.8360 before its substantial climb.

The primary driver behind this movement was the strengthening of the Euro, fueled by a surge of optimism stemming from Germany’s bold fiscal policy initiatives. The announcement of a massive 500 billion euro infrastructure fund, coupled with the relaxation of fiscal constraints, ignited expectations of robust economic growth within the Eurozone. This fiscal stimulus, perceived by many as a decisive move to bolster the economy, triggered a wave of buying interest in the Euro, pushing its value higher against the Pound.

Simultaneously, the uncertainty surrounding US trade tariffs, while somewhat mitigated, continued to cast a shadow over market sentiment. Although immediate fears of sweeping tariffs had subsided, the potential for renewed trade tensions remained a persistent concern. Any resurgence of trade disputes could disrupt global economic activity, impacting currency valuations.

The European Central Bank’s (ECB) highly anticipated interest rate decision was a central focal point of the day’s trading. The market widely anticipated a quarter-point rate cut, which was ultimately implemented. However, the focus extended beyond the immediate rate adjustment, with market participants keenly observing the ECB’s forward guidance. The combination of the German fiscal stimulus and the ECB’s monetary policy outlook contributed to the Euro’s robust performance.

In contrast, the Pound Sterling faced considerable pressure. The Bank of England’s (BoE) cautious approach to monetary policy, characterized by a “careful and gradual” stance, reflected concerns about labor market uncertainties and the broader global trade environment. Elevated UK wage growth, potentially sustaining inflationary pressures, also weighed on the Pound. Furthermore, a sharp contraction in the UK’s construction sector, as highlighted by the S&P Global/CIPS UK Construction Purchasing Managers’ Index, added to the Pound’s woes.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.