Ethereum Surges Above $2,250, $20M Spot Inflows Signal Investor Confidence Ethereum Surges Above $2,250, $20M Spot Inflows Signal Investor Confidence

Key momentsEthereum successfully remained above the $2,250 mark on ThursdayA key indicator of renewed confidence was the reversal of a ten-day outflow trend, with data showing $20 million in spot infl

Key moments

- Ethereum successfully remained above the $2,250 mark on Thursday

- A key indicator of renewed confidence was the reversal of a ten-day outflow trend, with data showing $20 million in spot inflows.

- Stability concerns surfaced when Ethereum faced technical challenges with its Pectra upgrade, but developers quickly resolved a bug on the Sepolia testnet.

Ethereum’s Price Climbs Past $2,250 on Renewed Demand

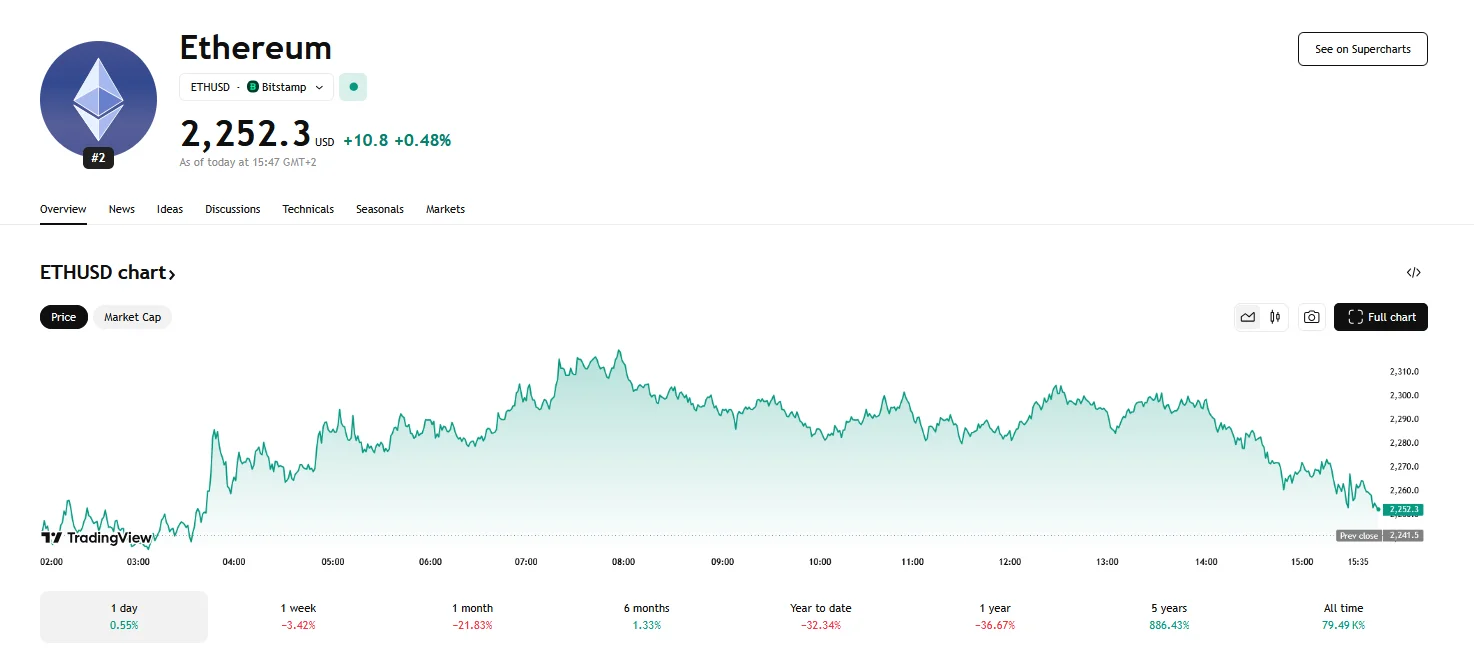

Ethereum has demonstrated a notable resurgence, trading comfortably above the $2,250 mark. This positive movement follows a period of significant outflows, suggesting a renewed interest among investors. The cryptocurrency’s price witnessed a robust increase on Thursday, briefly surpassing $2,300.

A key indicator of this renewed confidence is the reversal of a 10-day outflow trend. Data reveals that Ethereum experienced a $20 million spot inflow, a significant turnaround from the preceding period, where outflows exceeded $600 million. This shift in investor behavior is particularly noteworthy ahead of the anticipated White House Crypto Summit, which has stirred considerable market speculation.

The upward trajectory of Ethereum’s price is further supported by technical indicators. The coin’s open interest has been on the rise, reaching $20 billion, signifying increased trading activity and capital inflow into its futures market. Additionally, the Moving Average Convergence Divergence (MACD) readings suggest a potential bullish crossover, indicating strengthening upward momentum and a possible buy signal.

However, Ethereum’s journey has not been without its challenges. Recent technical issues surrounding the Pectra upgrade on the Sepolia testnet raised concerns about the network’s stability. A bug in the deposit contract led to a faulty execution layer, disrupting network operations. Tim Beiko, a prominent figure in the Ethereum development community, reassured users that the issue was specific to Sepolia’s configuration and would not affect the mainnet. Developers swiftly addressed the bug, restoring Sepolia to normal operations.

Despite these technical hurdles, developers remain optimistic about the Pectra upgrade’s mainnet launch. The swift resolution of the Sepolia bug has reinforced confidence in the upgrade’s progress, although the original April deployment timeline remains uncertain. The upgrade is expected to enhance network functionality and fee efficiency, potentially acting as a catalyst for increased demand.

While technical indicators and spot inflows point towards a bullish trend, some caution remains. The cryptocurrency is currently trading below the critical resistance level of $2,846, and a sustained break above this point would be necessary to confirm a strong bullish trend. Conversely, failure to hold current support levels could lead to a retest of the $2,200 support. The upcoming Crypto Summit has generated mixed sentiment, with some viewing it as a potential catalyst for further gains and others anticipating a “sell-the-news” event. As such, the market remains vigilant, closely monitoring both technical developments and regulatory signals.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.