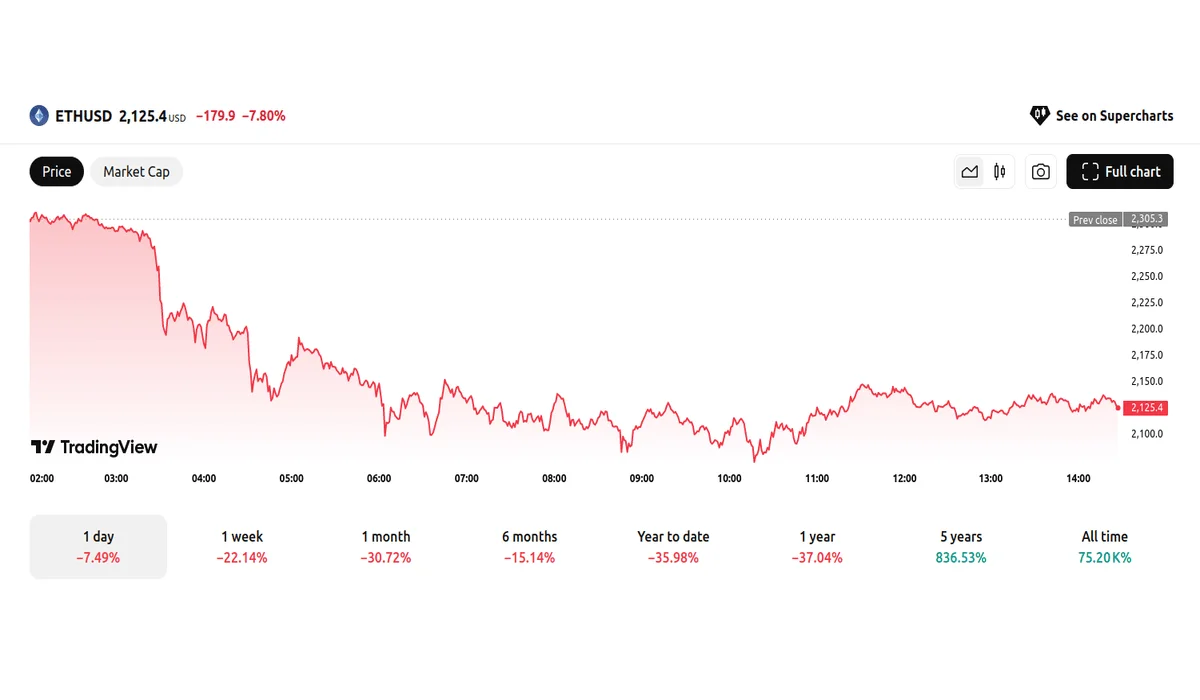

Ethereum’s Value Drops 7.80% to $2,125.4 as Bearish Trends Take Hold Ethereum's Value Drops 7.80% to $2,125.4 as Bearish Trends Take Hold

Key momentsEthereum fell 7.80% to $2,125.4, echoing a broader market slump and emphasizing the erratic nature of the cryptocurrency sector.This drop is part of a larger decline, with Ethereum losing a

Key moments

- Ethereum fell 7.80% to $2,125.4, echoing a broader market slump and emphasizing the erratic nature of the cryptocurrency sector.

- This drop is part of a larger decline, with Ethereum losing approximately 50% of its value since December.

- The market’s reaction to security breaches, trade tariffs, and macroeconomic uncertainties has led to a period of significant price correction, resulting in a heavy impact on Ethereum’s value and the overall cryptocurrency market.

Security Breaches and Macroeconomic Fears Drive Cryptocurrency Market Decline

On February 28th, the cryptocurrency market suffered a notable downturn, with Ethereum’s value dropping 7.80% to $2,125.4. Although this marked a significant decrease, it also represented a modest rebound from a previous low of $2,074, underscoring the extreme volatility that characterizes the digital asset market.

Ethereum has been steadily declining this past month, with the cryptocurrency having lost approximately 50% of its value since December. This substantial decrease indicates a major shift in market sentiment, moving away from the bullish trends observed following the recent U.S. elections. The decline can be attributed to a complex array of factors, including both internal and external influences.

One significant event contributing to Ethereum’s woes was a substantial security breach at the Bybit exchange, resulting in the theft of a large quantity of Ether tokens. This incident not only caused immediate price pressure but also sparked concerns about potential future sell-offs by the perpetrators, further undermining investor confidence. Additionally, technical analysis of Ethereum’s price movements revealed a descending channel, with key support levels being tested.

The overall cryptocurrency market mirrored Ethereum’s decline. Bitcoin, the leading cryptocurrency, fell below the $80,000 threshold, a significant drop that contributed to a market-wide sell-off. This downturn was exacerbated by large-scale liquidations, with substantial losses incurred by traders holding long positions. The market’s reaction to newly announced trade tariffs by the U.S. administration also played a pivotal role, creating uncertainty and volatility across various asset classes.

The collective impact of these factors, including security breaches, technical indicators, and macroeconomic uncertainties, has led to a period of significant price correction. The sentiment shift is clear, and the market is heavily affected by the current economic climate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.