BlackRock’s IBIT Sees $418.1 Million Outflow Amid Bitcoin ETF Market Correction BlackRock's IBIT Sees $418.1 Million Outflow Amid Bitcoin ETF Market Correction

Key momentsThe iShares Bitcoin Trust by BlackRock saw a single-day withdrawal of $418.1 million, the largest since its launch.Total daily outflows from U.S. spot Bitcoin ETFs reached $754.6 million on

Key moments

- The iShares Bitcoin Trust by BlackRock saw a single-day withdrawal of $418.1 million, the largest since its launch.

- Total daily outflows from U.S. spot Bitcoin ETFs reached $754.6 million on February 26.

- Bitcoin ETFs collectively experienced a $1 billion outflow on said day, ETF Store president claims.

$1 Billion Outflow and $82,000 Bitcoin Price Dip Signal Market Adjustment

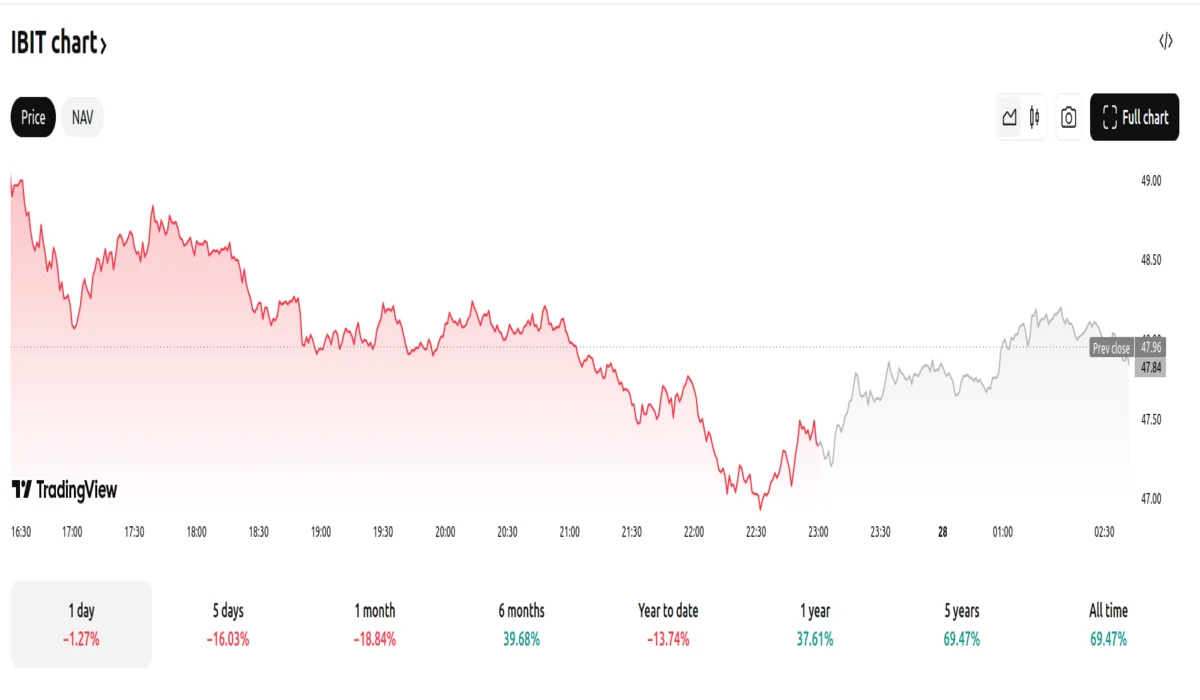

Recent market activity points to significant shifts in the cryptocurrency sector, with Bitcoin experiencing a notable decline. Data indicates there was a substantial outflow from U.S. spot Bitcoin ETFs, totaling $754.6 million on February 26. Specifically, BlackRock’s iShares Bitcoin Trust (IBIT) registered a record one-day withdrawal of $418.1 million, marking its largest single-day outflow since its inception in 2024. This sharp reduction in assets reflects a broader trend of investor caution within the digital currency space.

Furthermore, market analysts highlight a cumulative outflow of approximately $1 billion from Bitcoin ETFs on February 26, as reported by ETF Store President Nate Geraci, a figure described as a record-breaking event. The price of Bitcoin itself dropped to a low of approximately $82,000, representing a 25% correction from its peak. This movement coincides with a total outflow of over $3.6 billion from these ETFs since early February. Additionally, withdrawals occurred across multiple ETF providers, including Fidelity, Bitwise, ARK 21Shares, Invesco, Franklin, WisdomTree, and Grayscale. Grayscale, in particular, moved roughly $290 million worth of Bitcoin to Coinbase Prime.

Analysis of Bitcoin’s trading patterns suggests potential for further price adjustments. Market observers have noted a gap in Bitcoin futures prices, indicating the possibility of a decline towards the $78,000-$80,700 range. The current market liquidity of around $80,000 is considered weak, with a stronger sell wall near $90,000, suggesting continued downward pressure. Some analysts believe that the current sell-off is a temporary correction, while others anticipate further declines due to macroeconomic uncertainties and potential trade tariffs.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.