U.S. prices continue to cool, big investment banks and investors are starting to make a group bet.

Faced with successive declines in inflation data and weak economic activity, major banks have begun to step up their efforts to explore the possibility of a soft landing for the Fed's economy。

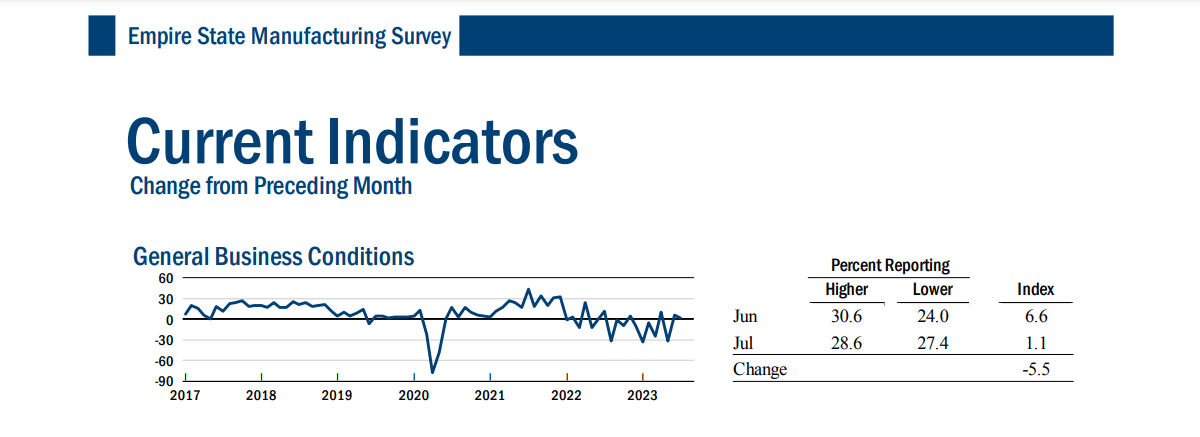

On July 17, local time, the Federal Reserve Bank of New York released the July New York Fed Manufacturing Index (NY Empire State Index).。As the Fed's meeting at the end of the month approaches, the market needs to race against time to grasp the valid information released each time.。

Manufacturing activity continues to expand but to a limited extent

Data show that the U.S. July New York Fed manufacturing index published a value of 1.1, compared with the previous month's 6.6 down 5..5, a better-than-expected -4.3, and remained above the 0 demarcation line, indicating that there is still expansion in manufacturing activity in the region, but the magnitude is limited。Although the manufacturing data is only for New York State, the state is the economic and financial heart of the United States, and the New York Fed is the No. 2 financial institution after the Federal Reserve, and the release of the data is representative.。

According to the report, manufacturing activity in New York State remained generally stable this month: manufacturing new orders and shipments expanded, delivery times shortened, and inventories continued to fall; employment levels rose slightly, but average weekly hours worked were little changed; increases in input and sales prices continued to be moderate; and capital spending growth plans remained weak.。Looking ahead, companies have begun to expect industry conditions to gradually improve, but remain mildly optimistic.。

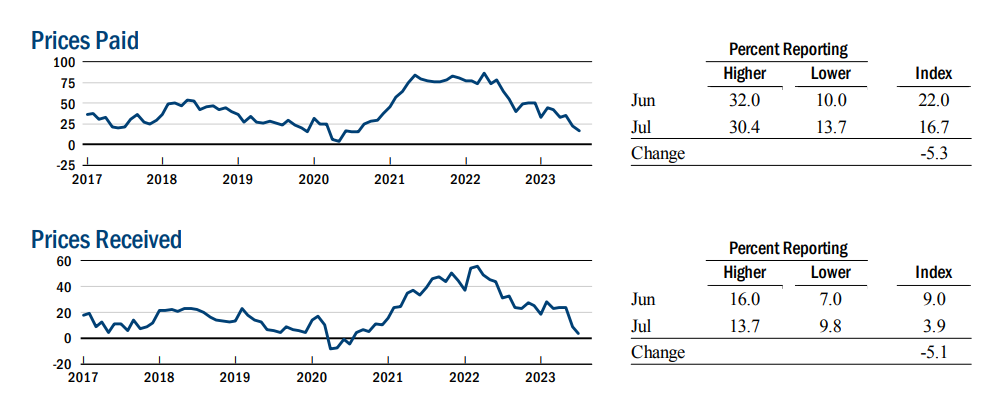

Remarkably, the state has maintained a cooling of prices while maintaining a modest increase in employment。This month, the number of workers in New York State climbed to a positive figure for the first time since January, at 4..7, indicating a small increase in employment。Meanwhile, the state's price-paid and received indices both fell another five points, falling back to their lowest level since mid-2020.。Over the past year, the New York State Price Payments Index has fallen nearly 50 points, while the Price Receipts Index has fallen a cumulative 27 points, and price pressures have slowed sharply.。

Separately, the Fed's forward-looking measures of demand and capital spending also deteriorated, with the state's capital spending index falling 5 points to 2 for the month..9, indicating weakness in its capital spending plans。

Big banks join forces with investors to bet on a "soft landing" for the U.S. economy

Faced with successive declines in inflation data and weak economic activity, major banks have begun to step up their efforts to explore the possibility of a soft landing for the Fed's economy。

On Monday, according to a report to clients by Marko Kolanovic, chief global market strategist at JPMorgan Chase, his thoughts on a possible recession in the U.S. economy have softened considerably。The analyst believes that the better-than-expected performance of the US CPI data in June slightly increased the possibility of the Fed achieving a "soft landing" - that is, to curb inflation without triggering a recession.。

After last week's U.S. CPI data, Goldman Sachs also lowered the likelihood of a U.S. recession further, from the previous 25 percent to 20 percent.。Jan Hatzius, the bank's chief economist, said that while the sharp inversion of the U.S. Treasury yield curve has triggered anxiety about the outlook for a recession, "we do not share the general concerns about the inversion of the yield curve."。

The reason given by Hazus is that while the yield curve inversion is almost "a hundred times" in predicting a recession, this time the situation is different: in this inversion, the term premium is "well below" its long-term average, so only less expected rate cuts are needed to make the curve inverted.。

The Goldman Sachs report also expects economic growth to decelerate somewhat faster in the coming quarters.。The bank said the main reason for the future slowdown in economic growth was the slower growth in real disposable income for consumers, especially after student loan repayments resumed from October.。In addition, reduced bank lending will also drag down the economy。Goldman Sachs also noted that the easing of financial conditions, a rebound in the housing market, and continued hot factory construction all indicate that the U.S. economy will continue to grow, but at a slower rate than trend.。

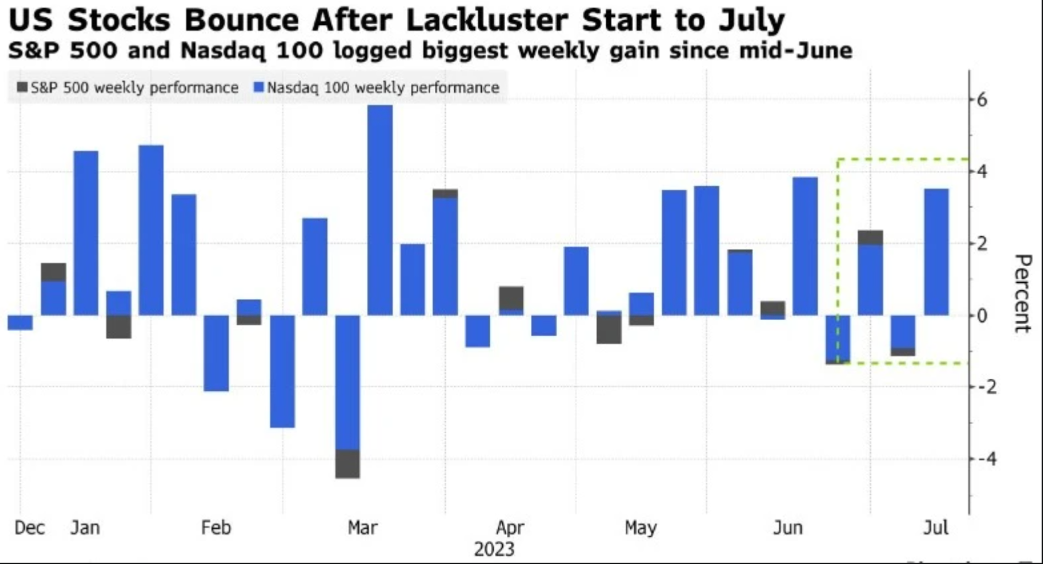

Citi, on the other hand, perceives a shift in market sentiment through the movement of capital flows.。A few days ago, Citi strategists led by Chris Montagu (Chris Montagu) said that after a quiet trading in early July, the past week's favorable data on the U.S. economy triggered an increase in new long positions in the S & P 500 index.。The team noted that investors appear to be preparing for a soft landing for the U.S. economy, as evidenced by the reaction triggered by recent economic data.。

In addition, according to the HSNSI Index, a measure of bullish sentiment among short-term timing traders, the HSNSI is now higher than in the past 99.99% of the daily readings are high, which means that bullish sentiment among short-term timing traders in the U.S. stock market is now close to record levels。

As of press time, according to CME Fed Watch, the probability of a 25 basis point rate hike by the Fed in July has exceeded 97%, a result that is consistent with the Fed's previous argument.。

However, by the end of this year, according to the interest rate futures trading market pricing, the probability of the Fed's total of at least two 25 basis points rate hikes totaled less than 23%, which is quite different from the Fed's previous attitude, indicating that traders are still confident that the continued slowdown in prices and weak economic activity will prompt the Fed to dispel the idea of a second rate hike during the year, so that the U.S. economy in the week period of a smooth。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.