U.S. to December 2 week's preliminary data release: labor market loose but not derailed

If the current situation holds, the Fed's hand is better played - the labor market is loose but not derailed, recession expectations are fading, and inflation is steadily falling.。If nothing else, the Fed will announce a continued pause in rate hikes next Wednesday。

As the final meeting in 2023 approaches, every report currently published will have an impact on the outcome of the meeting。

U.S. Initial Request Data Slightly Increased Last Week Continues to Request Data to Continue "Distortion"

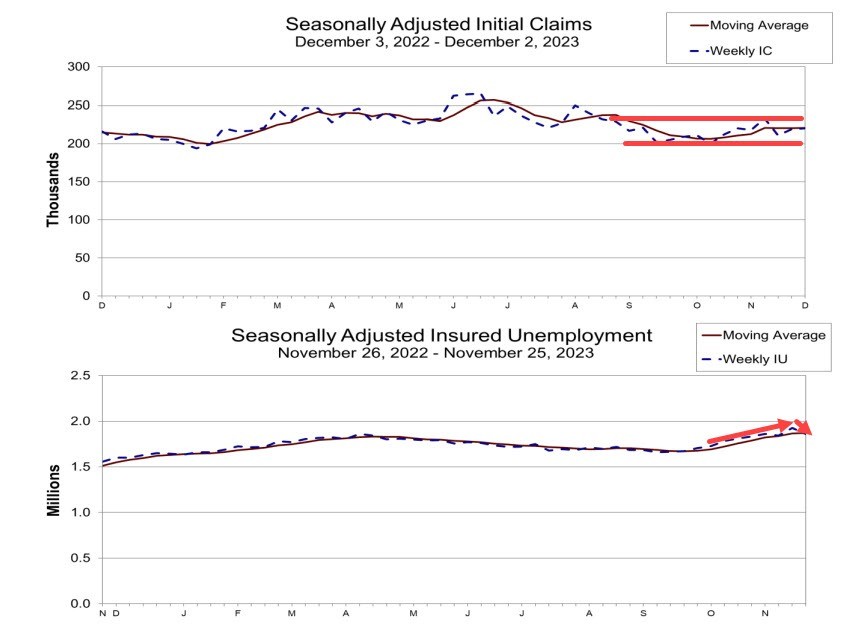

On December 7, the United States released the initial request data last week。Data show that for the week ending December 2, the number of initial jobless claims in the United States was 220,000, with an expected 22.20,000, previous value from 21.80,000 revised to 21.90,000; four-week average of 22.075 million, with the previous value revised from 220,000 to 22.0250,000; jobless claims renewed for week ending Nov. 25 186.10,000, expected 1.91 million, previous value from 192.70,000 revised to 192.50,000 people。

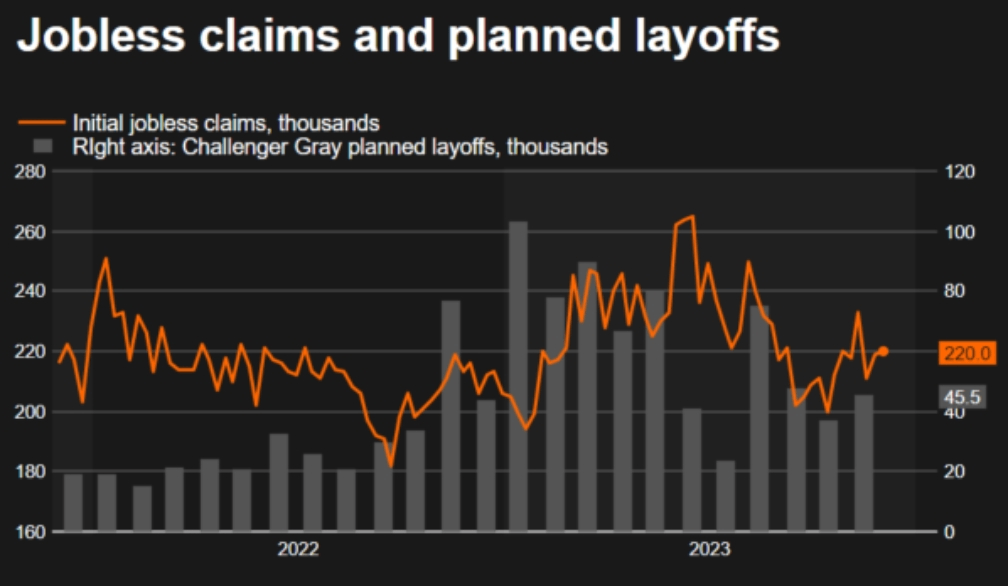

Overall, the number of new U.S. claims for unemployment benefits rose slightly last week, suggesting that rising borrowing costs are dampening demand in the broader economy and that the labor market is losing steam.。The mixed preliminary report supports economists' view that the Fed is likely to be nearing the end of its current cycle of rate hikes, but comments also point out that financial markets are premature to speculate that the Fed will be in the first quarter of next year.。

According to unadjusted data, the number of initial jobless claims rose by 3,761 month-on-month to 293,511 last week.。Among them, applications surged 14,057 in California; 9,343 in New York; 7,698 in Texas; and 6,481 in Georgia.。

For holiday reasons, the accuracy of initial request data at this time of the year will decline to varying degrees, so it is difficult to obtain a clear signal from the labor market. This situation is expected to continue until early January。

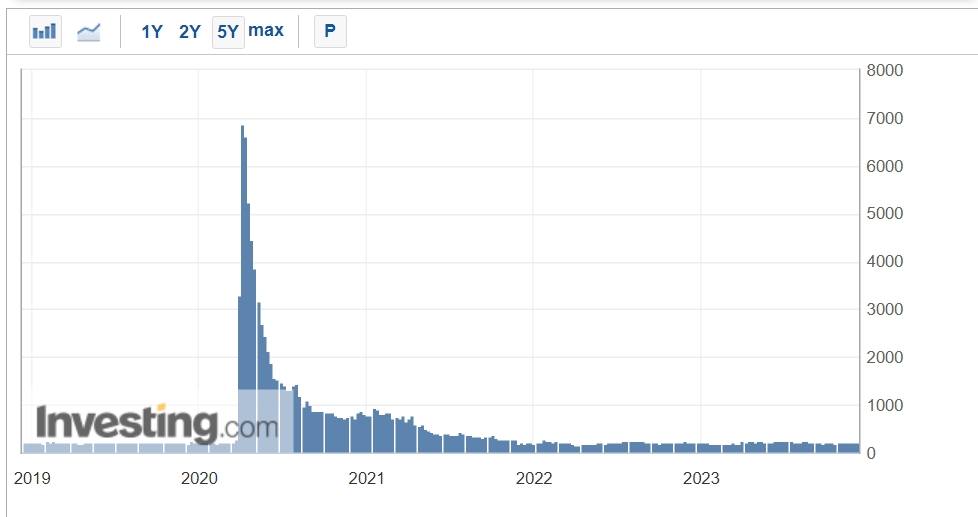

The data also showed that the number of people renewing benefits fell by 6 in the week ending November 25..40,000, down to 186.10,000, a week after the figure jumped to a two-year high.。Most of these figures have increased since mid-September, mainly due to an unprecedented surge in jobless claims in the early days of the epidemic, making it difficult for statisticians to adjust the figures to seasonal fluctuations, the commentary said.。

Lou Crandall, chief economist at Wrightson ICAP in New York, said: "While the job market is slightly weaker than recent initial requests suggest, the surge in renewals since Labor Day has also greatly exaggerated the extent of the deterioration in the job market.。"

Fed expected to remain on hold

On the one hand, the U.S. labor market is gradually cooling, the job market supply and demand is gradually balancing, the number of initial requests rose slightly, which is what the Fed wants to see;。

According to a U.S. government report released this week, the number of job openings per unemployed person in October was 1.34, the lowest number since August 2021。In addition, according to a report released by the Census Bureau of the U.S. Department of Commerce, U.S. wholesale inventories fell by 0 in October..4%, worse than expected, with a gradual slowdown in economic activity。

However, according to another report released on Thursday by Challenger, Gray & Christmas, a global employment agency, U.S. employers announced 45,510 job cuts in November, up 24% from October, but the number of planned layoffs by employers fell 41% compared to a year ago, and the employment environment has improved.。

If the current situation holds, the Fed's hand is better played - the labor market is loose but not derailed, recession expectations are fading, and inflation is steadily falling.。If nothing else, the Fed will announce a continued pause in rate hikes next Wednesday。

As of press time, according to CME Fed Watch, the Fed kept interest rates at 5 in December..25% -5.The probability of a constant 50% interval is as high as 97.5%, the probability of a 25 basis point rate hike is only 2.5%; the probability of keeping interest rates unchanged by February next year is 83.8%, with a cumulative probability of a 25 basis point cut of 14.1%。

Christopher Rupkey, chief economist at FWDBONDS in New York, said: "In the current labor market, there has not been a sharp deterioration in the event that the Fed has to move quickly from raising interest rates to cutting interest rates to boost a potentially dangerous economy.。The current data will at best keep the Fed cautious, with the risk of authorities doing too much or too little roughly balanced.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.