Don't Chase the S&P 500 Rebound! History Warns

Trump's announcement of a 90-day suspension on tariffs for countries other than China triggered a sharp rebound in U.S. stocks. But what comes next?According to data compiled by Bloomberg, since 1928,

Trump's announcement of a 90-day suspension on tariffs for countries other than China triggered a sharp rebound in U.S. stocks. But what comes next?

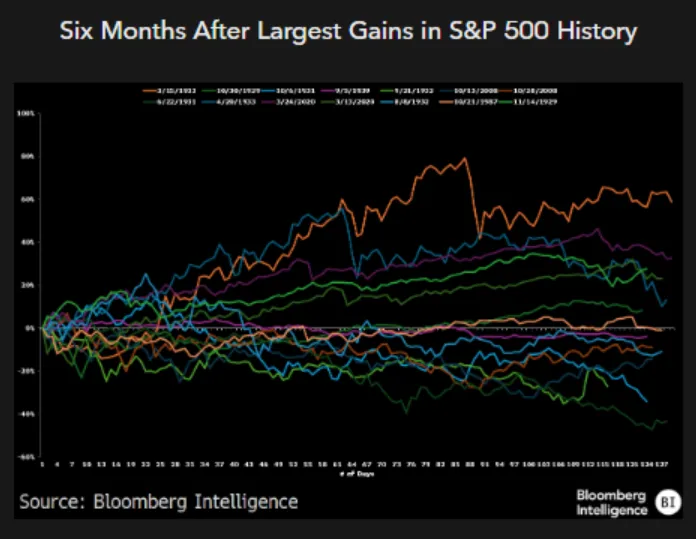

According to data compiled by Bloomberg, since 1928, after the S&P 500 Index recorded its 15 largest single-day gains in history, there was only a 43% chance of achieving positive returns over the following six months. This means that buying stocks after a major single-day surge and holding for half a year results in losses more than half the time.

Indeed, such sharp moves have historically only occurred during periods of economic crisis. Among the S&P 500's 15 best-performing days, two occurred during the COVID-19 pandemic in 2020, two during the 2008 global financial crisis, one amid the Black Monday crash in 1987, and nine during the Great Depression between 1929 and 1933.

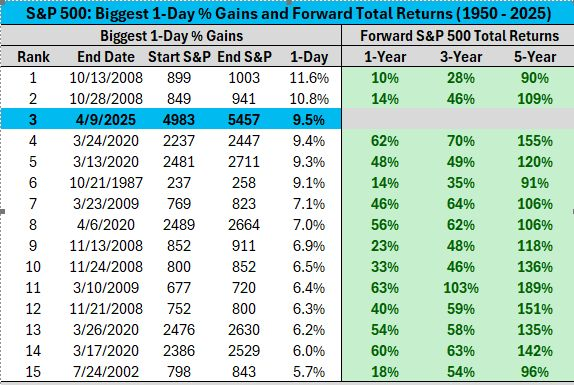

According to an analysis led by Bloomberg Intelligence strategists Gina Martin Adams and Michael Casper, the S&P 500 jumped 9.5% on April 9—its eighth-largest daily gain in history. However, the future trajectory of the U.S. equity market remains heavily dependent on Trump's trade policy decisions. The market's next major focus is the Q1 earnings season, and Wall Street's largest investment banks—among the first to report—have already issued warnings that the U.S. economy is on shaky ground.

As for the April 9 rally, Wall Street traders largely dismissed it, viewing it as the result of algorithmic short covering and rapid position unwinding, rather than bullish investors actively buying in. Stuart kaiser, head of equity trading strategy at citigroup, said the rally was not driven by a positive shift in investor sentiment. He added, "The persistence of tariffs and the risk of renewed retaliation from China make further gains difficult. Unless the market fully prices in these risks, bulls may soon take profits en masse."

Bank of America's Chief Investment Strategist Michael Hartnett advised investors to take profits on S&P 500 gains and stay cautious until the Federal Reserve steps in or the U.S. and China ease trade tensions. He warned that the 90-day tariff delay would cast a new macroeconomic cloud over the markets for another three months.

Long-Term Holding Ultimately Wins

However, looking over a longer time frame, the bulls ultimately prevail. Since 1950, buying into the S&P 500 following historic one-day surges and holding for at least a year has always resulted in positive returns.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.