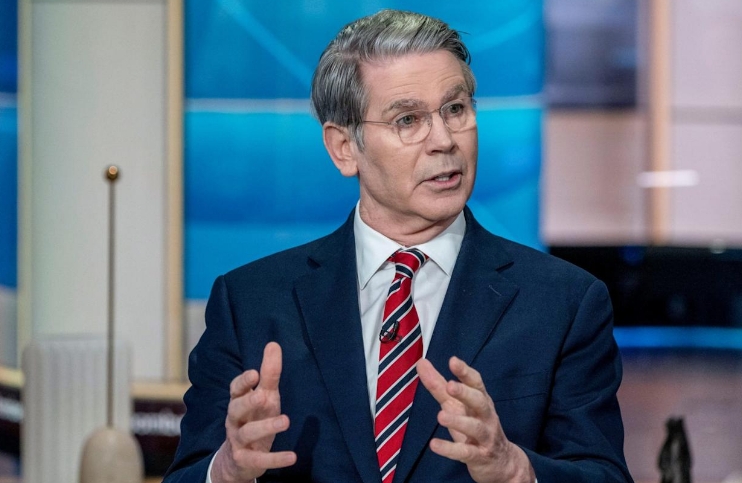

Bessent Dismisses Bond Market Fears, Signals Steady U.S. Financial Outlook

In a recent interview during his visit to Argentina, U.S. Treasury Secretary Scott Bessent addressed several key economic concerns. He downplayed the recent selloff in the bond market, dismissed specu

In a recent interview during his visit to Argentina, U.S. Treasury Secretary Scott Bessent addressed several key economic concerns.

He downplayed the recent selloff in the bond market, dismissed speculation about foreign investors dumping U.S. Treasuries, and reaffirmed the U.S.'s status as a global safe haven. Bessent also discussed his recent meeting with Federal Reserve Chair Jerome Powell, emphasizing there are no concerns about the bond market from Powell, and outlined the timeline for selecting Powell's successor, offering a calm and confident perspective on the U.S. financial landscape.

Bond Market Selloff and U.S. Haven Status

Bessent downplayed the recent selloff in the bond market, dismissing speculation that foreign investors were dumping U.S. Treasuries. "I don't think there's a dumping" by foreign investors, Bessent stated, pointing to increased foreign demand at last week's auctions for 10-year and 30-year Treasury securities as evidence of sustained interest in U.S. debt. He attributed the market decline primarily to deleveraging—a process where investors sell assets like Treasuries to reduce debt levels—rather than sovereign actions. "I have no evidence that it's sovereigns" behind the drop, he emphasized.

Bessent also reassured markets that the Treasury is well-equipped to handle any disruptions, stating, "We have a big toolkit that we can roll out" if necessary. This toolkit includes a buyback program for older securities, launched last year to enhance liquidity in less-traded Treasuries, which could be scaled up if conditions worsen.

Addressing the simultaneous decline in Treasuries and the dollar last week—described by some as the biggest weekly slide since 2001—Bessent rejected concerns that this signaled the U.S. losing its safe-haven status. He affirmed, "We are still a global reserve currency," and underscored the administration's "strong dollar policy." This safe-haven status reflects the U.S.'s reputation as a stable investment destination during global uncertainty, a position Bessent believes remains intact.

Meeting with Powell and Timeline for Successor

In his latest weekly meeting with Fed Chair Jerome Powell, Bessent reported no discussions about emergency measures for the Treasury market. "Specifically, did we discuss some kind of a break the glass? I think we're a long way from that," he said. When asked if Powell expressed concern, Bessent noted, "I think we would have heard from the Fed chair" if there were any worries, suggesting the Federal Reserve views the current market conditions as manageable.

Bessent expressed strong respect for the Fed's independence in shaping monetary policy—which governs interest rates and money supply—calling it a "jewel box that has got to be preserved." However, he indicated openness to dialogue on regulatory policies, where the Fed collaborates with other bank regulators, highlighting a nuanced approach to coordination .

On the succession front, Bessent outlined plans to interview candidates to succeed Powell, whose term ends in May next year. He specified that this process would begin "sometime in the fall," signaling proactive planning for a smooth transition at the Fed .

Bessent's remarks throughout the interview radiated a deliberate blend of confidence and pragmatism, reflecting his commitment to steering both markets and the U.S. financial architecture through a period of heightened volatility.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.