The Next Silicon Valley Bank?First Republic Bank Staged Deposit "Great Escape" of US $30 Billion in First Quarter

First Republic Bank announces its first-quarter financial results after U.S. stock market on April 24。It's worth noting that at the end of the first quarter, the bank's deposits were just $104.5 billion, down about $72 billion from $176.5 billion at the end of last year, or nearly 41 percent.。

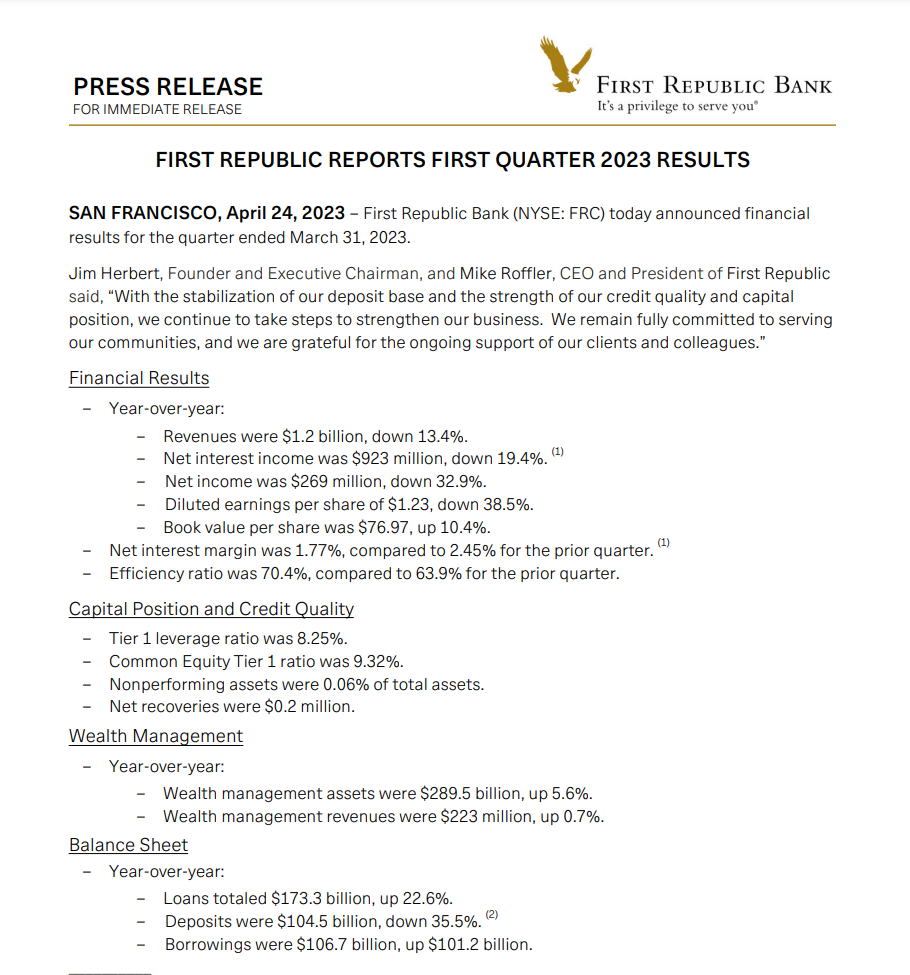

First Republic Bank announces its first-quarter financial results after U.S. stock market on April 24。Data show that the bank's first quarter revenue fell 13.4% to $1.2 billion, still above market expectations of 11.$200 million; EPS 1.$23, also above expectations of 0.$72, net interest income decreased by 19.4% to 9.$2.3 billion, expected 8.$89.9 billion。

Yellen couldn't save First Republic Bank. The actual outflow of deposits in the first quarter exceeded 100 billion yuan.

It's worth noting that at the end of the first quarter, the bank's deposits were just $104.5 billion, down about $72 billion from $176.5 billion at the end of last year, or nearly 41 percent.。Previously, in response to the spread of the banking crisis, after JPMorgan CEO Jamie Dimon and U.S. Treasury Secretary Janet L..Yellen), 11 major banks, including Bank of America, Citigroup and Wells Fargo, reached an agreement with First Republic Bank to inject $30 billion in deposits into the bank to help ease its crisis, and if this is excluded, the actual loss of deposits at First Republic Bank in the first quarter will exceed $100 billion.。

To add insult to injury, First Republic Bank's lending business also declined significantly due to market fears of an impending recession, directly resulting in a one-third year-on-year drop in its net profit, which recorded only 2.$6.9 billion。

During the earnings call, First Republic executives read a pre-prepared 12-minute manuscript, essentially repeating the bank's public disclosures and refusing to answer any questions, which overwhelmed Wall Street analysts who were also at the earnings meeting and deepened concerns about its prospects.。

In a limited statement, the bank's chief executive, Mike Roffler, said that we are taking steps to deliberately reduce expenses to match our focus on reducing the size of our balance sheet.。Faced with a serious deposit drain problem, the bank is also aware of the seriousness of the problem, said finance director Neal Holland (Neal Holland), with several banks failing in March, we have experienced unprecedented deposit outflows。But the bank also said that by the end of March, the problem of deposit losses had eased relatively。From March 31 to April 21, the loss of deposits has been controlled at 1.7%, and most of the withdrawals during the period were used by depositors for tax-related purposes.。

Janney Montgomery Scott Bank analyst Timothy Coffey said the decision by the bank's top brass to abandon question-and-answer sessions with analysts was reminiscent of a conference call during the 2008 financial crisis.。

Since March, the stock price has fallen by nearly 90%, and the First Republic Bank has started a "self-help mode."

In fact, since the U.S. banking crisis, markets have been worried about whether First Republic Bank will also fall in this crisis and become the next Silicon Valley bank.。It is also because of this, investors on the first Republic of the quarterly report announced to give full attention, the so-called "the greater the expectation, the greater the disappointment," in its performance "thunder" after the first Republic Bank in the U.S. stock market fell more than 22%。And since March 2023, the stock has fallen a staggering 88.63%。

In addition, in the middle of last month, S & P Global Ratings downgraded the bank's issuer credit rating from "A-" to "BB +," classified as speculative, or "junk," indicating that the market has lost confidence in its profitability.。

The market is so concerned, in part, because there are some similarities between First Republic and the Silicon Valley and Signature banks that triggered the crisis.。For one, many of First Republic's customers are also from start-ups.。Second, many of the deposit accounts of First Republic Bank have also exceeded the $250,000 federal deposit insurance limit, and in the event of a crisis, depositors will be at risk of losing their deposits, which could trigger a run on depositors, exacerbate the bank's liquidity crisis and eventually lead to its bankruptcy.。

In the face of operational difficulties, First Republic Bank is also actively looking for ways to help itself.。

Recently, it has been reported that First Republic Bank is actively seeking the advice of financial advisors and is actively negotiating with government officials in the hope of partially or fully selling the bank or raising new capital.。

In addition, the First Republic Bank has made progress in throttling。According to the financial report, the bank's non-interest expenses fell 1 year-on-year in the first quarter..6% to 8.$5.2 billion, lower than expected by 8.$98.1 billion。The bank said it would continue to take action to cut costs, including significantly reducing the pay of senior officials, compressing office space, and reducing non-essential projects and activities.。The bank expects to cut about 20 to 25 percent of its workforce in the second quarter.。

Finally, the bank has also vigorously developed its wealth management business, seeking to increase intermediate income and mitigate the crisis while maintaining asset size.。First Republic Bank's total wealth management assets at the end of the first quarter totaled $289.5 billion, up 6.7%。Income from the bank's wealth management business covers investment management, brokerage and investment, insurance, trust and foreign exchange expenses, accounting for 18% of the bank's total revenue..5%。

"Battle" is staged every day. The big bank has "targeted" its strong customer chain.

According to foreign media reports, even today's crisis, the First Republic Bank is not short of favorites。In fact, when the banking crisis occurred, a number of big banks said they wanted to buy First Republic Bank, but the two sides were slow to agree on the acquisition, which led to the subsequent $30 billion capital injection.。

First Republic Bank was founded in 1985 and has been providing huge loans to the wealthy for years.。Its founder, Jim Herbert, has always believed that the strength of First Republic Bank lies in the robustness of its business model, as its borrower customers have a "good credit history."。Since 2008, First Republic Bank has been opening up in wealthy areas of the United States and has been praised by customers for its good service attitude and efficient business completion.。It can be said that the real wealth of the First Republic Bank, in addition to the funds on the books, but also its mouth-watering customer chain composed of commercial giants, if the First Republic Bank really to the point of illness, I believe that other big banks will not let this wealth slip away in vain。

But there are also concerns.。Earlier, there were media reports that First Republic Bank had offered relatively low interest rates on loans in recent years to attract high net worth customers, which had put pressure on the profitability of the business line.。Robert Conzo, CEO of the Wealth Alliance, an investment advisory firm, also said that First Republic's mortgage portfolio is large, but the revenue generated is small, which could dissuade potential buyers.。

Separately, he also noted that the wealth management business is one of the bank's only remaining trump cards and believes it will sell cautiously。

All in all, the future of First Republic Bank is still unknown, but it is foreseeable that 2023 will be a difficult year for this prestigious bank.。Speaking on the earnings call, Roffler said: "I would like to take the event specifically to thank my colleagues for their dedication to First Republic Bank and their uninterrupted service to our customers and communities during this challenging time.。"

Coffey, on the other hand, said that every day, every week from now on, it will be a battle for them.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.