Tough ahead! Google's first-quarter revenue exceeded expectations and announced a $70 billion buyback program.

On April 25, Google's parent company Alphabet released its first quarter earnings for the year ended March 31, 2023.。Alphabet's total first-quarter revenue was 697, according to earnings data..$8.7 billion, compared to 680.3% increase compared to $1.1 billion。

On April 25, Google's parent company Alphabet released its first quarter earnings for the year ended March 31, 2023.。Alphabet's total first-quarter revenue was 697, according to earnings data..$8.7 billion, compared to 680.$1.1 billion, up 3%; Alphabet's first-quarter net profit was 150% under U.S. GAAP..$5.1 billion, compared with 164.$3.6 billion down 8%; Alphabet's diluted EPS was 1 in the first quarter..$17, down about 4.9%。

The news comes after a website collected 28 analysts' forecasts for Alphabet's first-quarter financials.。According to the forecast, the average analyst forecast for Alphabet's first quarter revenue is 688.$800 million, with an average EPS expectation of 1.06 USD。According to earnings data, Alphabet's two data are better than expected。

In addition, according to data previously provided by Factset, in terms of net profit, the average estimate of market analysts is 139.$3.6 billion, and Alphabet's figures are better than that.。

Google Advertising Was "Encircled" by Microsoft's Department

By business, Alphabet's core division, Google Services, achieved first-quarter revenue of 619.600 million U.S. dollars, up about 8% year-on-year, with strong momentum。Among them, the largest proportion of Google advertising revenue of 545.$4.8 billion, down slightly from 546 in the same period last year.$6.1 billion, but still better than Wall Street analysts expected。

Google Ads, the top priority of Google's services business, has been growing steadily over the years, and since Alphabet went public in 2004, it has only seen a year-on-year decline in the second quarter of 2020, the first quarter of the epidemic, and the fourth quarter of last year.。In the first quarter of this year, Google's advertising revenue continued to decline, but the decline has slowed significantly。

Analysts pointed out that in the face of the current economic pressure in the market, advertisers have reduced spending, Facebook parent Meta and Snap advertising demand has declined sharply, but Google's performance is significantly better than competitors.。According to sources, Alphabet's leadership has been working hard to cut costs to maintain the company's profit margins.。

On the other hand, the ChatGPT AI robot is being integrated into Microsoft's Bing search engine, raising concerns about the long-term future threats to Google's own search engine.。Some analysts believe that if artificial intelligence search engines take the lead in occupying user habits, they may be diverted from Google's search engine, thus hitting Google's advertising revenue.。

Last month, Google released its own chatbot Bard, but received mixed reviews。Insiders say Google is planning to launch a new search engine to counter the menacing Microsoft line of products。

Breakdown, Google search and other revenue of 403.$5.9 billion, up from 39.6 billion in the same period last year.$1.8 billion; YouTube ad revenue was 66.$9.3 billion, down slightly from 68 in the same period last year..$6.9 billion; Google Web revenue was 74.$9.6 billion, down from 81.$7.4 billion。

Google Cloud's first-quarter revenue rose 28% year-over-year to $7.5 billion, down slightly from 32% in the fourth quarter of 2022.。It is worth noting that this quarterly report is the first time the division has achieved profitability since it began reporting results in 2020.。

It is reported that the service is mainly dedicated to providing enterprise customers with infrastructure and data analysis platform to help enterprises build and run home-grown applications, as well as subscriptions to Google productivity software, is considered to be Google's next growth engine.。

Sources pointed out that as more and more large companies and government agencies are trying to transform from traditional data centers to cloud data storage warehouses, Amazon, Microsoft, Google and other major technology vendors are struggling to compete for these potential businesses, and strive to take the lead in the field.。It can be expected that in the next few years, the business has a high growth space。

Regarding the outstanding performance of the cloud business, Alphabet and Google's chief financial officer Borat (Ruth Porat) said the company was satisfied with the profitability of the cloud business in the first quarter.。

Alphabet Announces US $70 Billion Repurchase Program Market Expects Annual l / 0 Conference

In its earnings report, Alphabet also announced that its board of directors authorized the company to repurchase up to $70 billion of Class A and Class C shares in the manner that best serves the interests of the company and its shareholders.。The company also said it will consider factors such as share price and market conditions when deciding when to buy back its own Class A and Class C shares.。

Alphabet announced a $70 billion share buyback in April 2022, after which it had to cut costs and lay off employees, citing "different economic realities" and employee redundancy.。

Some analysts have pointed out that Alphabet's share buybacks can reduce the number of shares outstanding and effectively increase the value of existing shares, thereby safeguarding the interests of stockholders.。In 2022, the total value of Alphabet's repurchased shares was the second highest in the market, behind Apple.。

Sundar Pichai, CEO of Alphabet, said: "We are pleased with our business performance in the first quarter, with the search business performing well and the cloud business developing strongly.。We've launched a major product update based on deep computer science and artificial intelligence。Our North Star is providing our users with the most helpful answers, and we see great opportunities ahead, continuing our long record of innovation.。"

On May 10, Google will host the 2023 L / 0 Conference, which is Google's annual developer event and a stage to showcase its latest technologies and products。According to rumors, Google will release new devices such as Pixel 7a, Pixel sub-board and Pixel folding screen phones at the conference。However, Pichai did not disclose specific details, but clearly hinted that the Pixel phone will have some functions related to artificial intelligence。

Perhaps Google's counterattack against Microsoft will begin that day..

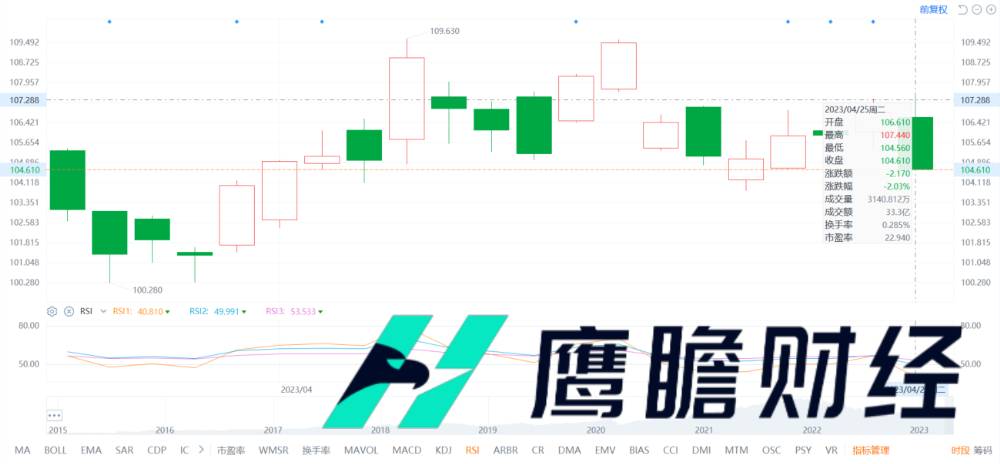

As of yesterday's close, Google edged down 2 in the day.03% at 104.610 USD。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.