Nexo 7RCC Files for World’s First Bitcoin and Carbon Credit Futures ETF

Nexo and 7RCC Global have proposed a unique Bitcoin ETF blending 80% spot Bitcoin exposure with 20% carbon credit futures.

- Nexo and 7RCC Global have introduced an innovative Bitcoin ETF that integrates ESG principles.

- The fund aims to combine cryptocurrency growth with environmentally sustainable investment.

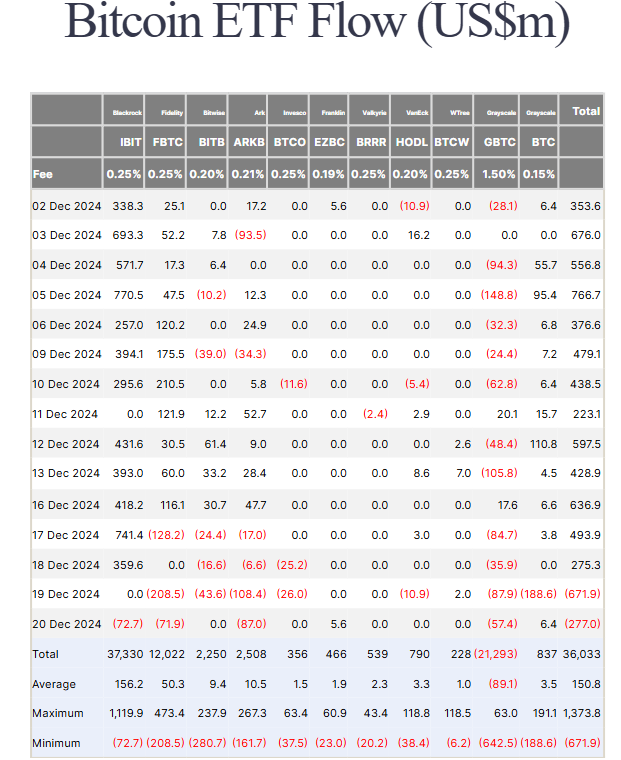

- The fund would enter the competitive spot Bitcoin ETF market that has seen $36 billion in inflows this year.

Nexo and 7RCC Global are pioneering a novel approach in the investment sphere by introducing an ESG-centric Bitcoin exchange-traded fund (ETF).

This venture aligns with the impressive market trajectory observed in spot Bitcoin ETFs since their January debut.

Nexo and 7RCC Present an ESG Twist on Bitcoin Investment

On December 20, Nate Geraci, president of the ETF Store, announced that Nexo and 7RCC Global had submitted an S-1 amendment to the US Securities and Exchange Commission (SEC) for a new fund — the Nexo 7RCC Spot Bitcoin and Carbon Credit Futures ETF.

Geraci revealed that this ETF would diversify its portfolio by allocating 80% to Bitcoin and the remaining 20% to Carbon Credit Futures. He highlighted that the ETF would focus on emissions allowances from established cap-and-trade systems, including those in the European Union, California, and under the Regional Greenhouse Gas Initiative.

Carbon credit futures are financial instruments traded based on the projected value of carbon credits. They provide a mechanism to handle regulatory uncertainties while fostering environmentally sustainable investment practices. Geraci described the ETF as an “ESG version of a spot BTC ETF” and expressed optimism about its regulatory approval.

“Expect this to launch soon. Basically an ‘ESG’ version of spot BTC ETF,” Geraci said.

This initiative is not just a significant advancement in embedding ESG principles within cryptocurrency investment but also sets a new benchmark for financial instruments designed to marry profitability with environmental and social responsibility.

If approved, this ETF will enter a robust market currently led by heavyweights like BlackRock and Fidelity. Spot Bitcoin ETFs have already attracted about $36 billion in net inflows since the start of the year, underscoring the dynamic investment landscape.

Beyond the ETF, Nexo’s collaboration with 7RCC Global also promises broader societal benefits, aligning with the World Economic Forum’s Safeguarding the Planet initiative. Indeed, this partnership underscores a mutual commitment to fostering progress that respects and nurtures the environment for future generations.

Kalin Metodiev, CFA, Co-founder and Managing Partner at Nexo, emphasized the partnership’s dedication to lasting impact.

“Unlike 20 years ago, today’s generation is not just about making money; it’s about making a difference. This strategic alliance highlights our commitment to sustainable solutions that will benefit future generations,” Metodiev stated.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.