Singapore Depository Receipts (SDRs) Explained in Simple Terms - ProsperUs

Singapore Depository Receipts (SDRs) on the Singapore Exchange (SGX) allow investors to buy shares of companies listed overseas — currently limited to blue-chip stocks in Thailand and Hong Kong — through SGX, providing a convenient way to diversify your investment portfolio.While it's true that you can also buy overseas stocks via brokerage accounts, SDRs simplify"

How Do SDRs Work?

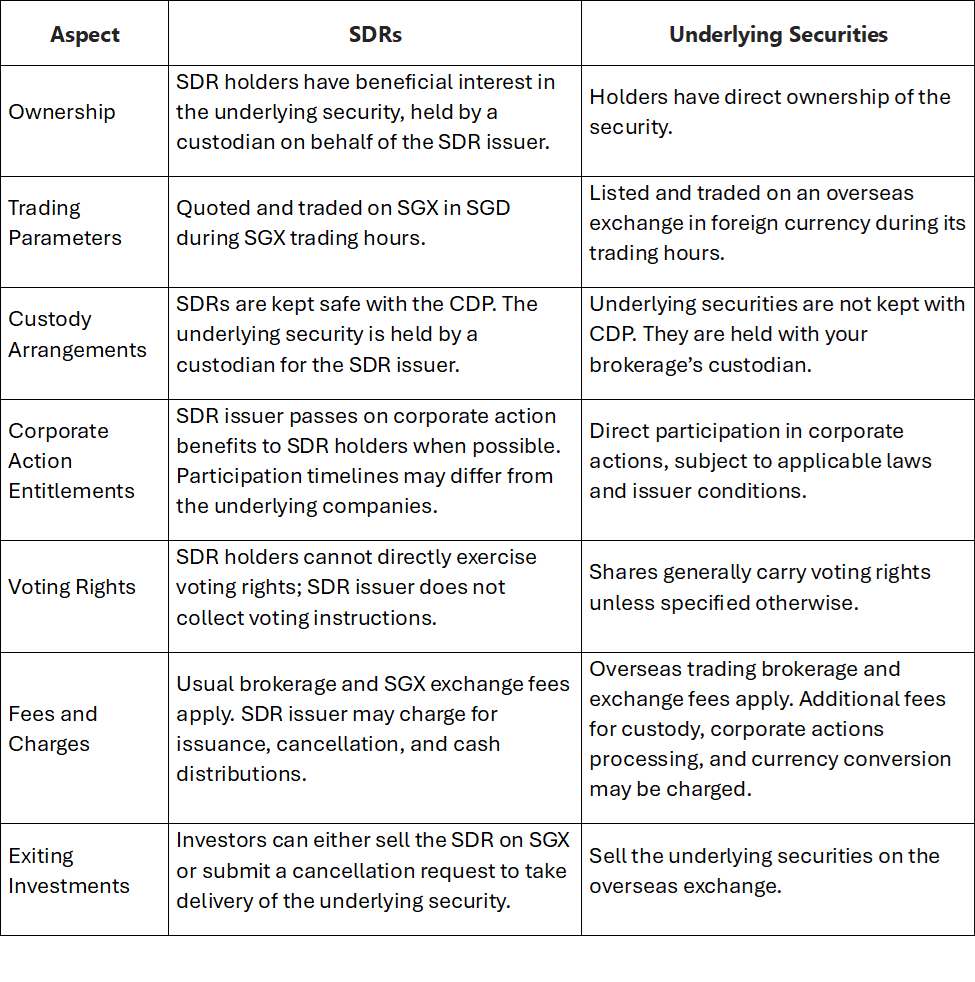

Imagine you love a particular brand of snacks that’s only available in Thailand. The local store in Singapore gives you a ticket that represents a box of those Thai snacks and keeps the actual snacks in a safe place. Instead of direct ownership of the security, each SDR represents a beneficial interest in an underlying security listed on an overseas exchange. Beneficial interest means you have the right to benefit from the underlying security, like receiving dividends, even though you don’t directly own the shares. An SDR issuer buys shares of a company listed in the overseas exchange and issues SDRs that represent those shares. Your SDRs are safely kept with the Central Depository (CDP), ensuring your investments are secure. These SDRs are then traded on the SGX, just like local stocks. For instance, if you want to own a piece of CP All Public Company Ltd (SET:CPALL) a Thai convenience store business, you can buy the CP ALL TH SDR (SGX:TCPD) on SGX. This SDR acts like your ticket, giving you a share in the company without having to deal with the Thai stock exchange directly. You can convert SDRs into the underlying foreign shares through a process of issuance and cancellation if you prefer to hold the actual shares. If you hold the underlying securities, you may request to convert them into SDRs for trading on the SGX.Differences Between Holding SDRs vs. Underlying Securities

Current SDR Offerings on SGX

Thailand SDRs

| No. | SDR Trading Name | SGX Trading Code | SDR: Underlying Securities Ratio | SDR Programme Disclosure Documents |

| 1 | CP ALL TH SDR 1to1 | TCPD | 1:1 | CP ALL Programme Disclosure |

| 2 | Airports TH TH SDR 1to1 | TATD | 1:1 | AOT Programme Disclosure |

| 3 | PTTEP TH SDR 1to1 | TPED | 1:1 | PTTEP Programme Disclosure |

| 4 | AIS TH SDR 10to1 | TADD | 10:1 | AIS Programme Disclosure |

| 5 | Siam Cement TH SDR 10to1 | TSCD | 10:1 | SIAM CEMENT Programme Disclosure |

| 6 | Kasikorn BK TH SDR 1to1 | TKKD | 1:1 | KASIKORN BANK Programme Disclosure |

| 7 | GULF TH SDR 1to1 | TGED | 1:1 | GULF Programme Disclosure |

| 8 | Delta TH SDR 1to1 | TDED | 1:1 | DELTA Programme Disclosure |

Hong Kong SDRs

| No. | SDR Trading Name | SGX Trading Code | SDR: Underlying Securities Ratio | SDR Programme Disclosure Documents |

| 1 | Tencent HK SDR 10to1 | HTCD | 10:1 | TENCENT Programme Disclosure |

| 2 | BYD HK SDR 10to1 | HYDD | 10:1 | BYD Programme Disclosure |

| 3 | Alibaba HK SDR 5to1 | HBBD | 5:1 | ALIBABA Programme Disclosure |

| 4 | HSBC HK SDR 5to1 | HSHD | 5:1 | HSBC Programme Disclosure |

| 5 | Bank of CN HK SDR 1to1 | HBND | 1:1 | BANK OF CHINA Programme Disclosure |

Securities Products – Singapore Exchange (SGX)

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.