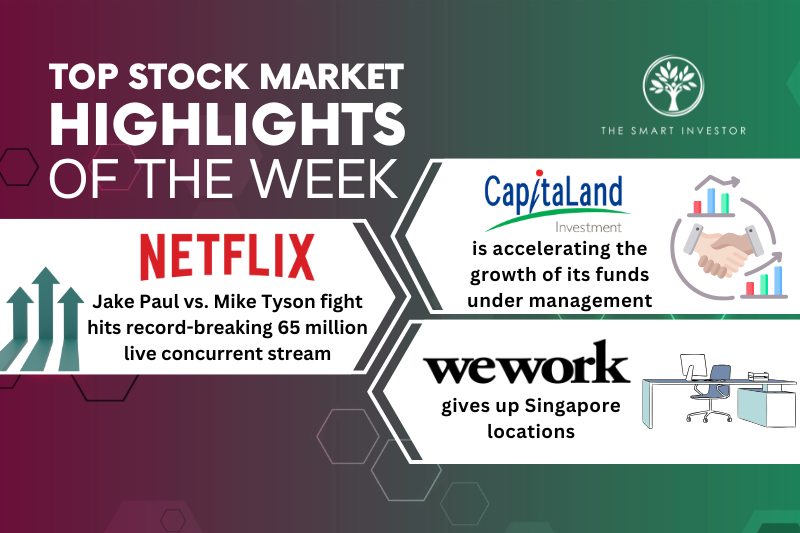

Top Stock Market Highlights of the Week: CapitaLand Investment, Netflix and WeWork

Singapore Stock

2024-11-25 09:46:37

2.46W

A property giant acquires to raise its funds under management while a co-working business is falling on hard times.

CapitaLand Investment Limited (SGX: 9CI)

CapitaLand Investment Limited, or CLI, is accelerating the growth of its funds under management (FUM). The blue-chip group is acquiring a 40% stake in SC Capital Partners (SCCP) for S$280 million, with the remaining 60% stake to be acquired in phases over the next five years. As part of the agreement, CLI will also invest a minimum of S$524 million strategic capital into SCCP’s fund strategies to help to grow the latter’s platform. SCCP is an Asian-Pacific real estate investment manager (REIM) with a presence across eight locations in Asia, with total FUM of S$11 billion. The REIM has a 20-year track record and employs 56 personnel. SCCP’s fund management platform consists of a listed Japanese REIT – Japan Hotel REIT (TYO: 8985), and eight private funds. The REIM’s FUM breakdown has 76% of its assets in Japan with the same proportion belonging to lodging. The addition of SCCP’s FUM will boost CLI’s combined FUM to S$113 billion. This acquisition will also significantly increase CLI’s exposure to Japan, which will help in geographic diversification. CLI’s FUM in Japan will more than triple from S$2.9 billion to around S$11 billion post-acquisition. This purchase will also grow CLI’s listed funds’ FUM to S$69 billion from S$63 billion and will mark the real estate investment manager’s first entry into the lucrative Japanese REIT sector. This deal should result in synergies for CLI with opportunities for joint value creation in product development, deal sourcing, and access to new sources of capital.Netflix (NASDAQ: NFLX)

Netflix is responsible for the most-streamed global sporting event ever. The streaming TV giant achieved this with the iconic Jake Paul vs Mike Tyson fight, which hit a record-breaking 65 million live concurrent streams. The US alone made up for more than half of this number at 38 million concurrent streams. According to TVision, more than half (56%) of US TV viewing between 12 midnight and one a.m. was for the Paul vs Tyson fight. In yet another first, the Katie Taylor vs Amanda Serrano fight became the most-watched professional women’s sports event in US history, averaging an estimated 74 million live viewers globally. This mega-event was the #1 title for Netflix for the week, with 46.6 million views through Sunday night. The event was also the most-watched in 78 countries including Australia, Brazil, Germany, India, and Italy. The fight also generated more than 1.4 billion owned impressions across Netflix’s global social media channels, attesting to the power of social media to broadcast and spread the news of this event.WeWork Inc

WeWork is once again facing challenges as the co-working company agreed to give up space in two prime locations in Singapore. The first is co-working space spanning the 17th to 20th floors at Manulife Tower while the other is a three-floor space in an office building at 83 Clemenceau Avenue. Although a WeWork spokesperson said that Singapore remains a “priority market” for the company, it had to pull out of these two locations. However, WeWork is still leasing space at 12 remaining buildings in Singapore. The owner of Manulife Tower is Manulife (Singapore) Pte Ltd while the office building at Clemenceau Avenue is owned by United Engineers, a subsidiary of Yanlord Land Group (SGX: Z25). WeWork is still trying to recover from its sharp fall from grace even as it exited bankruptcy in May this year. The co-working outfit’s woes are continuing with prime office vacancies spiking to a two-year high in the third quarter of 2024, according to data from Jones Lang LaSelle. Some office tenants are also consolidating space to save costs, such as Tencent’s (SGX: HTCD) decision to give up a WeWork space at 30 Raffles Place as it chose to bring employees together at a new office at another location. Our FREE report, ‘7 Singapore Blue-Chip Stocks That Can Pay You for Life,’ reveals stable, dividend-paying stocks with a history of strong returns—even in uncertain markets. Get insights on Singapore’s most dependable blue-chips and see how they can offer you steady income. Download it today to start building your portfolio with confidence. Follow us on Facebook and Telegram for the latest investing news and analyses! Disclosure: Royston Yang does not own shares in any of the companies mentioned.Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.