Net profit tripled in the first half of the year! BYD's gross margin surpasses Tesla's sales and breaks into the world's top 10 for the first time

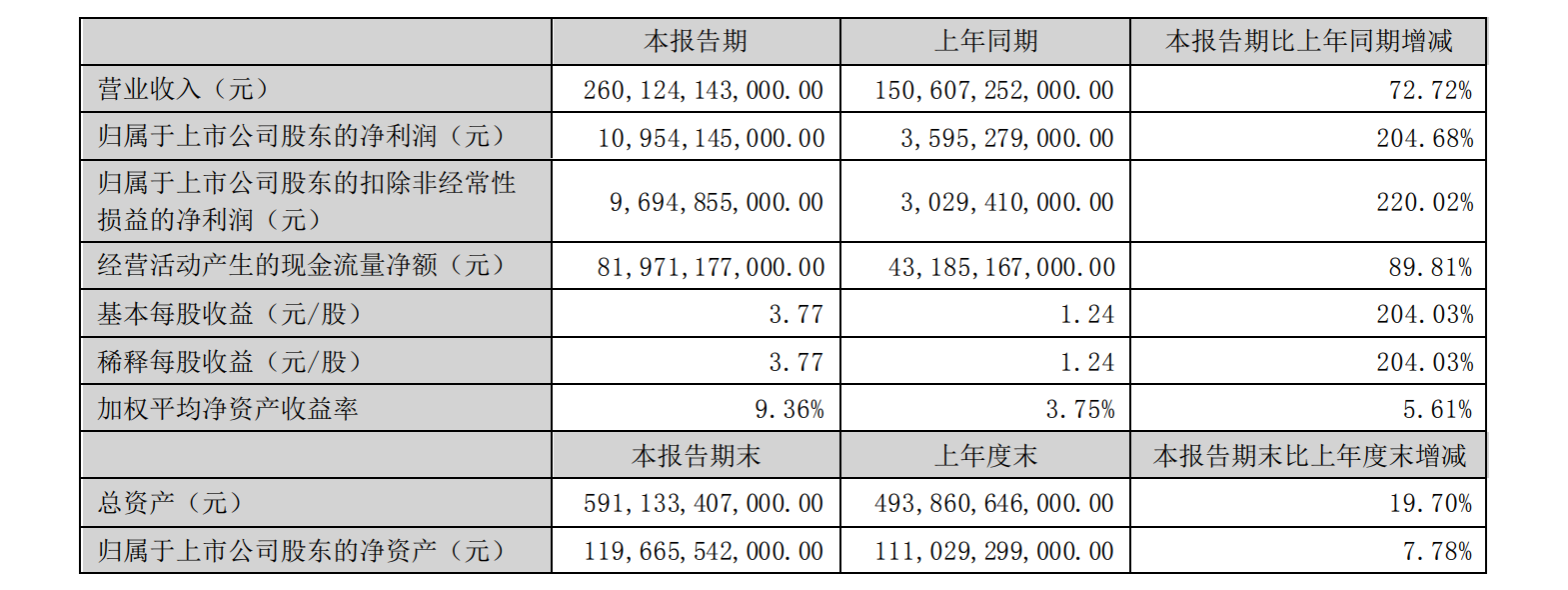

On the evening of August 28, BYD released its 2023 semi-annual report.。BYD achieved operating income of 2,601 in the first half of the year, data show.RMB 2.4 billion, up 72% YoY.72%; net profit attributable to parent 109.5.4 billion yuan, up 204.68%。

This month, the United States "Fortune" magazine released the "world's top 500" 2023 list of enterprises。China's NEV giant BYD records new high。BYD, which entered the Top 500 for the first time last year at 436th, has jumped to 212th this year, a significant increase of 224 places.。From the top 500 "last stream" to "middle stream," BYD relies on its outstanding performance.。

On the evening of August 28, BYD released its 2023 semi-annual report.。BYD achieved operating income of 2,601 in the first half of the year, performance data show.2.4 billion yuan (RMB, the same below), up 72.72%; net profit attributable to parent 109.5.4 billion yuan, a sharp increase of 204.68%; basic EPS 3.77 yuan。According to the company's Q1 earnings data, Q1 net profit of 41.300 million yuan, from which the net profit of Q2 68.2.4 billion yuan, up 65% month on month。

Car sales burst into the world's top 10 for the first time, with gross margins exceeding Tesla's

In the first half of the year, BYD's share of revenue from auto business further increased。BYD's business scope covers new energy vehicles, mobile phone parts and assembly business, secondary rechargeable batteries and photovoltaic business, etc.。Of which, revenue from automotive and automotive-related businesses in the first half of the year was 2,088.2.4 billion yuan, up 91.11%, accounting for 80% of the group's total revenue.28%。In 2021, by contrast, the proportion was 59.66%, 76 in 2022.57%。

The direct factor driving the growth of BYD's auto business revenue is auto sales.。According to cumulative data, BYD delivered a total of 125 in the first half of this year..560,000 vehicles, up 95.78%。Thanks to a steady climb in delivery data, BYD overtook Mercedes-Benz and BMW in the first half of the year to break into the top 10 global sales for the first time。

Although it is a new member of the Top10, BYD's potential has put pressure on other competitors, as BYD is a well-deserved "sales crown" among new energy vehicle companies.。In China's new energy vehicle market, BYD's market share further expanded to 33 in the first half of the year..5%, up 6% from 2022.5 percentage points, continue to consolidate its leading position in the industry。On August 9 this year, BYD rolled off the production line of its 5 million new energy vehicles, becoming the first car company in the world to reach this milestone.。

The scale effect of rising sales has driven up gross margins.。In the first half of this year, the gross profit margin of BYD Auto and related products reached 20.67%, more than Tesla in the first half of 17.Gross margin of 9%。

Although BYD's "home" is in China, it has been pushing for overseas expansion.。BYD's overseas sales reach 7 in 1H20.430,000, more than 5 for the whole of 2022.590,000 sales。At present, BYD car has entered Japan, Germany, France, Australia, Brazil, the United Arab Emirates and other more than 50 countries and regions。Among them, Yuan PLUS (also known as "BYD ATTO 3") has gained both sales and market reputation in the international market, and has repeatedly won the monthly sales champion of pure electric vehicles in Thailand, Israel, New Zealand and Singapore, and won the first half of 2023 in Thailand.。

In order to reduce costs and expand scale, BYD is also actively promoting "overseas plant construction."。In March, BYD's first overseas passenger car production base was laid in Thailand。It is understood that the production base cost 17.9 billion baht (about 5.100 million U.S. dollars), which is expected to start production from 2024, when 150,000 passenger cars can be produced each year。In July, BYD announced that its second overseas production base would land in Brazil.。The company will build a large complex of three factories in the northeastern Brazilian city of Camasari.。The plant is expected to start production in the second half of 2024, mainly producing electric vehicles and processing lithium iron phosphate batteries.。

BYD's two locations are worth pondering.。The proportion of new energy vehicles in the automobile market in both places is relatively low, and more importantly, BYD hopes to use these two "points" to drive the two "sides" of Southeast Asia and South America.。In addition, in May this year, there was news that BYD was looking for a new site in Europe, with France, Germany and Spain all under consideration.。In response, the relevant person in charge of BYD said that BYD is evaluating the feasibility of building a plant in Europe and is looking for a suitable location.。Europe as Mercedes-Benz, Volkswagen and many other established car companies "base camp," BYD will face more intense competition。How BYD will penetrate the "hinterland" of Europe, let us wait and see。

BYD R & D expenses are higher than net profit, and batteries are under pressure from "Ning Wang."

In addition to record highs in revenue and profit, BYD also disclosed its ridiculously high R & D expenses。According to the financial report, in the first half of the year, BYD's R & D expenses 138.3.5 billion yuan, up 155% year-on-year。This is more than the net profit in the first half of the year and is close to three-quarters of last year's full-year R & D expenses.。

With continued investment, BYD has achieved impressive results in a number of product technologies。In the first half of the year, BYD released the world's first new energy-exclusive intelligent body control system "Yunxuan," and the power system "Easy Sifang" with four-motor independent drive as the core, and based on this, the company released its high-end brand "Look up."。In April, BYD's million-level new energy hardcore off-road "Looking up to U8" and million-level pure electric performance supercar "Looking up to U9" appeared at the Shanghai Auto Show, causing widespread concern.。In addition to the reporting period, the high-level intelligent driving assistance system was released in July, and the "DMO" super hybrid off-road platform was released in August.。

In terms of power batteries, BYD's high-safety lithium iron phosphate battery - "blade battery" is still BYD's killer.。But in terms of batteries, BYD is facing the pressure of the Ningde era。Because from the Ningde era "take goods" car companies cover a number of Chinese and foreign car companies, not only BMW, Volkswagen, GM, Toyota and other old car companies, but also Tesla, ideal, Weilai and other car-building "upstarts," so the Ningde era is known as the "King of Ning."。

On August 16, Ningde Times released the world's first lithium iron phosphate 4C overcharged battery - Shenxing overcharged battery。According to the official introduction, the battery can achieve "charging for 10 minutes, driving 800 miles (battery life of about 400 kilometers)"。The battery will be mass-produced by the end of 2023 and will be available in the first quarter of 2024.。It is reported that Changan Automobile, GAC Group, Geely Automobile, Great Wall Motor and other car company executives have expressed their intention to cooperate。

Since the launch of "blade battery," BYD has been advancing all the way, relying on its own vehicle sales scale to continuously improve the market share, while the Ningde era has many "friends" at home and abroad to help it improve the market share.。Nowadays, in terms of lithium iron phosphate batteries, BYD and Ningde era have appeared in court.。Now in order to break this situation, Ningde era has launched overcharged batteries, so it is also considered by the outside world as a new measure to declare its status as "King of Ning."。

However, BYD did not "sit still"。In June of this year, there were media reports that BYD's procurement office was recruiting "large cylindrical battery automatic baking line equipment suppliers," indicating that the company is likely to have begun to develop large cylindrical batteries.。At present, the more famous large cylindrical battery on the market is Tesla's 4680 battery。According to the report, BYD applied for a patent for a hexagonal prism cell in August last year, which is presumed to be a large cylindrical battery case developed by BYD。However, BYD has not yet officially announced the relevant information.。

Acquisition of Jabil Drives BYD Electronics Expansion

Although BYD is now known for its electric car business, the company actually started out selling electronic components。Now the mobile phone parts and assembly business has become the company's second business.。In the first half of the year, BYD's mobile phone components, assembly and other products business generated revenue of $51.1 billion, up 24.40%, accounting for 19% of the group's total revenue.64%。

Although retreating to the "second line," BYD is still actively developing the business。

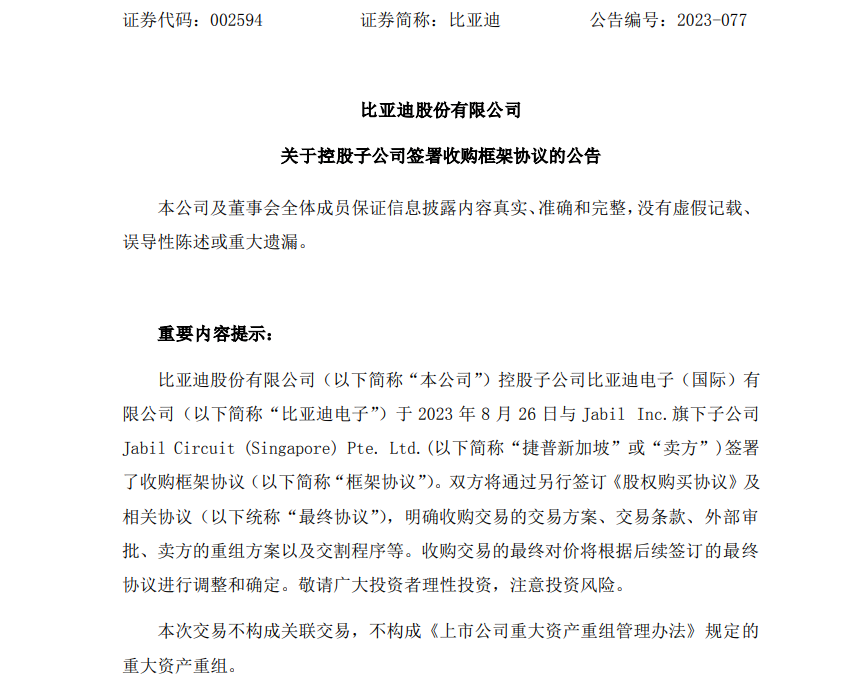

On August 28, BYD announced that its holding subsidiary BYD Electronics (International) Co., Ltd. (hereinafter referred to as "BYD Electronics") had a meeting with American manufacturer Jabil Inc on August 26..Jabil Circuit (Singapore) Pte.Ltd.("Jabil Singapore") entered into a framework agreement for acquisition。Under the agreement, BYD will acquire Jabil Singapore's product manufacturing operations in Chengdu and Wuxi for $15.8 billion, including parts manufacturing operations for existing customers.。

According to the announcement, Jabil Singapore has established a new legal entity in Singapore, Juno Newco Target Holdco Singapore Pte..Ltd.BYD Electronics and its subsidiaries will acquire 100% of the target company.。

Currently, BYD Electronics' main business is selling electronic components for consumer electronics such as smartphones and laptops, which account for more than 70% of the company's total revenue.。Upon completion of the transaction, BYD Electronics' customer base, product portfolio and its smartphone components business will be further expanded.。

BYD said the acquisition will expand the group's customer and product boundaries, broaden the smartphone parts business, and significantly improve the group's customer and product mix.。While increasing the market share of the Group's products, it effectively collaborates with the Company's existing products to enhance the Group's overall competitiveness, maintain long-term sustainable development and create value for customers and shareholders.。But the company did not disclose any further details about the acquisition.。

Jabil said the deal, if completed, would allow it to further invest in "electric vehicles, renewable energy, healthcare, AI cloud data centers and other end markets."。It is reported that Jabil's board of directors has been facing the problem of "weak growth" in the mobile parts business in recent years.。

Analysts at UBS said Jabil's main customer, Apple, has been steadily declining as a share of the company's business, from 28 percent of fiscal 2018 revenue to 19 percent of fiscal 2022 revenue, and the deal could refine Jabil's portfolio.。

BYD Electronics has a high position in the mobile supply chain and is a supplier to Apple。Tu Le, founder of Sino Auto Insights, said: "I think this is a reminder from BYD that they are doing more than just dominating the electric car space.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.