Yen Surges to 5-Month High, Breaching 147 Per Dollar Amid U.S. Economic Tensions Yen Surges to 5-Month High, Breaching 147 Per Dollar Amid U.S. Economic Tensions

Key momentsThe yen strengthened considerably on Tuesday, exceeding 147 per dollar to achieve its highest point since early October.Earlier fluctuations saw the yen reaching 146.570 before climbing bac

Key moments

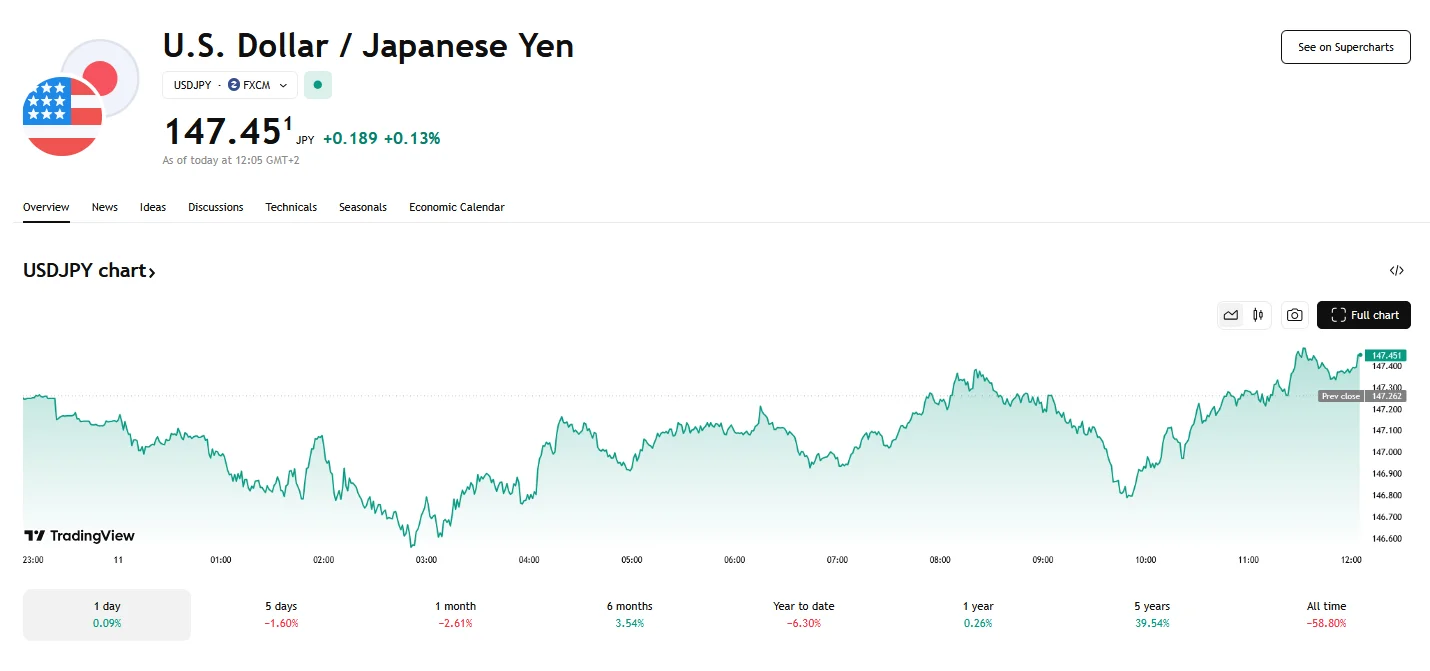

- The yen strengthened considerably on Tuesday, exceeding 147 per dollar to achieve its highest point since early October.

- Earlier fluctuations saw the yen reaching 146.570 before climbing back up, and this volatility drew official attention. Japan’s Finance Minister emphasized the tangible effects of exchange rate swings on daily life.

- The Bank of Japan is projected to hold current interest rates in the short term. However, analysts predict rate adjustments to be undertaken later this year.

Yen Strengthens Amid U.S. Rate Cut Expectations

The Japanese yen strengthened notably against the United States dollar on Tuesday. Trading reached a five-month peak, breaching the 147 yen per dollar mark, a level not seen since early October. Contributing to the yen’s appreciation is the weakening of the dollar, which has been impacted by concerns surrounding a potential U.S. economic downturn. Such anxieties have been amplified by recent policy decisions and pronouncements from U.S. leadership, including trade tariffs and government policy shifts.

Adding to the complexity of the economic landscape, Japan’s Cabinet Office revised its initial report of 2.8% annualized growth, with the new figures indicating a slower pace of 2.2% This revision primarily stemmed from weaker-than-anticipated consumer spending, a crucial component of Japan’s economic activity.

Despite this deceleration in growth, the Bank of Japan (BOJ) is expected to maintain its current interest rate policy in the immediate term. However, market analysts anticipate that the central bank will likely implement further rate adjustments later in the year as part of its ongoing efforts to normalize monetary policy. This expectation has further bolstered the yen’s position, as investors perceive a potential for increased returns on yen-denominated assets.

It is important to note that the Yen was volatile on Tuesday, briefly touching 146.570. The fluctuations in the yen’s value have not gone unnoticed by Japanese officials. Finance Minister Shunichi Kato issued a cautionary statement regarding the potential consequences of excessive foreign exchange volatility. He emphasized that rapid changes in currency values can have tangible effects on the daily lives of citizens. Similarly, concerns have been voiced regarding the effect of higher long-term interest rates on the broader Japanese economy.

Meanwhile, trade discussions between Japan and the United States remain a focal point. Uncertainty persists regarding Japan’s exemption from these tariffs, adding another layer of complexity to the economic relationship between the two nations. The U.S. Dollar index, which measures the greenback against a basket of major currencies, has seen a decrease. This decrease has been contributed to by the acceptance of the US Federal reserve beginning a rate cutting cycle.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.