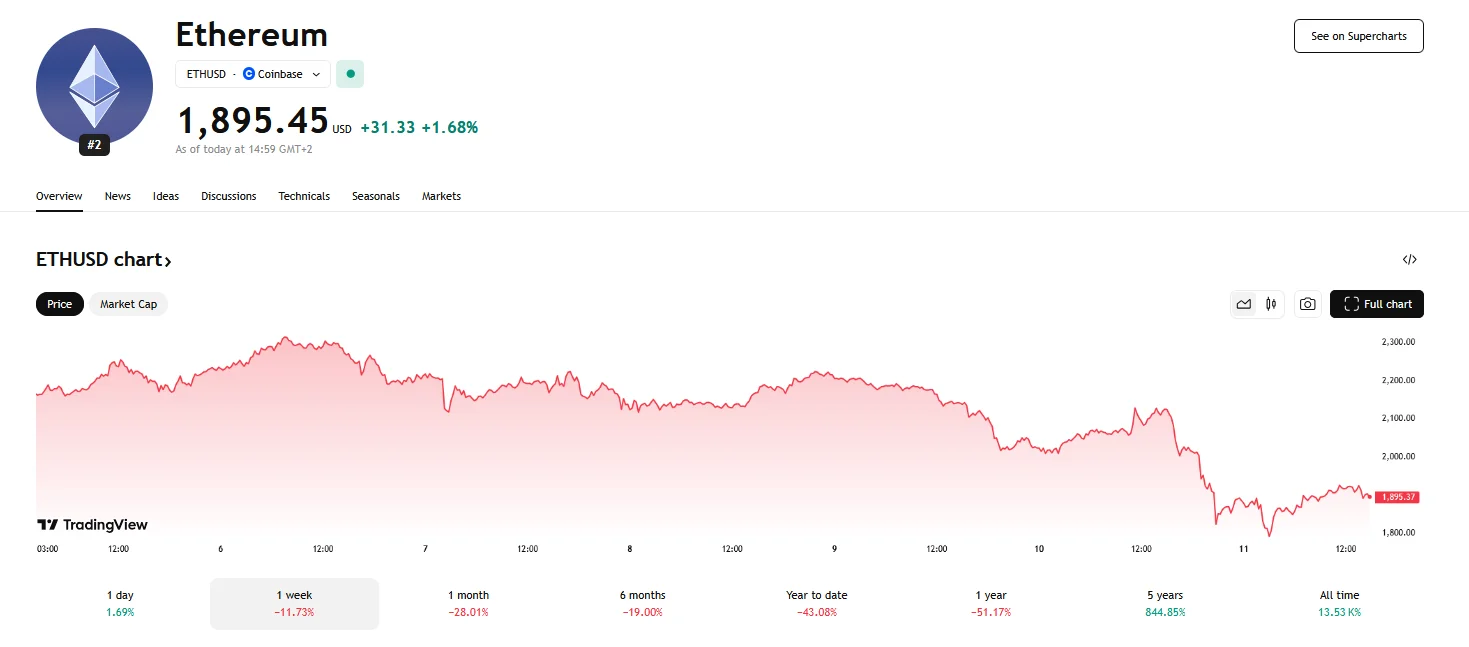

Ethereum Struggles to Regain Momentum, Price Slips Below $1,900 Ethereum Struggles to Regain Momentum, Price Slips Below $1,900

Key momentsA rapid 12% drop sent Ethereums price plummeting to $1,755 on Tuesday.Though it has since climbed back to around $1,890 and $1,900, Ethereum could not reach the $2,000 threshold.Heavy liqui

Key moments

- A rapid 12% drop sent Ethereum’s price plummeting to $1,755 on Tuesday.

- Though it has since climbed back to around $1,890 and $1,900, Ethereum could not reach the $2,000 threshold.

- Heavy liquidations, exceeding $240 million in a single day, intensified Ethereum’s price decline.

Concerns Over U.S. Recession Have Compounded Ethereum’s Recent Challenges

A notable drop in Ethereum’s valuation occurred at the week’s outset, with prices breaching the $2,000 mark on Monday and failing to fully rebound. The digital currency’s value plunged by nearly 12% in a short period, reaching a low of $1,755 on Tuesday, a level not seen since October 2023. While it managed to recover slightly, hovering around $1,890 at the time of writing, the volatility has left investors concerned.

Several factors contributed to this sharp decline. One prominent concern is the growing apprehension about a potential recession in the United States. This economic uncertainty has rippled through various markets, including the cryptocurrency sector, which is often perceived as a high-risk asset class.

Additionally, the significant amount of long liquidations, where traders who had bet on Ethereum’s price increase were forced to sell their holdings, exacerbated the downward pressure. Over $240 million worth of Ethereum positions were liquidated in a single day, with the majority being long positions. One notable instance involved a substantial loan on the Sky protocol, where the borrower had to take emergency measures to avoid liquidation.

The correlation between the crypto market and traditional financial markets, particularly the U.S. stock market, also plays a role. As fears of a U.S. recession grow and trade tensions rise, the stock market has been facing declines, which have been mirrored in the crypto market. The uncertainty surrounding potential interest rate cuts further contributes to the risk-averse sentiment among investors.

Despite the current bearish trend, there are some signs of potential stabilization. The movement of large amounts of Ethereum from exchanges to private wallets suggests that some investors are accumulating the cryptocurrency for long-term holding. However, the near-term outlook remains uncertain, with market sentiment largely driven by economic concerns and technical indicators.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.