Collom Botai to be listed on HKEx as China's first pharmaceutical company to set up internal ADC

According to the Hong Kong Stock Exchange recently disclosed documents, Sichuan Colun Botai Biopharmaceutical Co., Ltd. issued an announcement (hereinafter referred to as Colun Botai) that the company will be in June 29, 2023 to July 4, the joint sponsors are Goldman Sachs and CITIC Securities.。

According to the Hong Kong Stock Exchange recently disclosed documents, Sichuan Colun Botai Biopharmaceutical Co., Ltd. issued an announcement (hereinafter referred to as Colun Botai) that the company will be in June 29, 2023 to July 4, the joint sponsors are Goldman Sachs and CITIC Securities.。

According to the report, the proposed issuance of 2244.610,000 shares, of which 224 were publicly offered.470,000 shares (10%), International Offering 2020.140,000 shares (90%) at an offer price of 60 per share..6-72.HK $8, 100 shares per lot, shares expected to be listed on 11 July 2023。

Company Profile

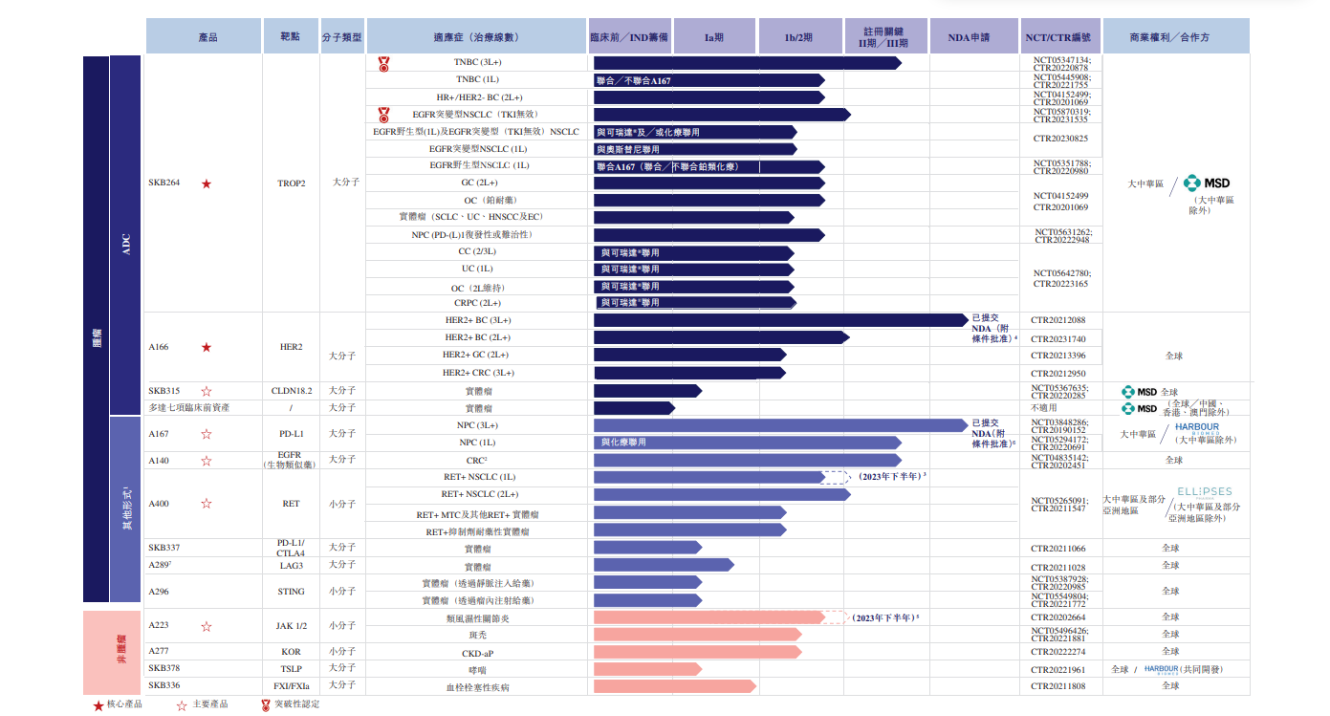

According to the disclosure documents, Colenbothai is a biomedical company that has been engaged in the development, manufacture and commercialization of innovative drugs in oncology, immunology and other therapeutic areas since its incorporation in 2016.。The company has two core ADC drugs, SKB264 and A166.。Among them, SKB264 is a new phase 3 TROP2 ADC, which is positioned as part of the early start combination therapy of advanced monotherapy for the treatment of various advanced solid tumors.。The A166, on the other hand, is a differentiated NDA registration phase HER2 ADC for the treatment of advanced HER2 + solid tumors, positioned as an advanced monotherapy therapy, and as of the Latest Practicable Date, the Company is also developing 12 non-core clinical phase assets。

Collomatte is one of the first biopharmaceutical companies in China and one of the few in the world to establish OptiDC, an in-house ADC platform.。The company's end-to-end manufacturing capabilities and comprehensive quality control system in line with current Good Manufacturing Practices (cGMP) further support our drug development capabilities.。In addition, by virtue of the decades of experience, industry relationships and extensive network of the controlling shareholder of the Company, the Company is well positioned to expand its commercial infrastructure and market channels.。

Collomatte has established three core platforms focused on ADC, macromolecule and small molecule technologies, respectively. Its pipeline targets the world's prevalent or difficult-to-treat cancers, such as breast cancer (BC), non-small cell lung cancer (NSCLC), gastrointestinal (GI) cancer (including gastric cancer (GC) and colorectal cancer (CRC)), and non-tumor diseases and conditions with large numbers of patients and unmet medical needs.。The Company is advancing a pipeline of 33 differentiated and clinically valuable assets, of which 14 are in the clinical phase (5 are in the critical trial or NDA registration phase) as of the Latest Practicable Date.。

Colenbotech's clinical value and drug development capabilities are recognized by global partners。To date, the Company has signed nine external licensing agreements, including three licensing and collaboration agreements with Merck Sharp & Dohme LLC (together with its affiliate, "Merck") to develop up to nine ADC assets for cancer treatment, with upfront and milestone payments totaling $11.8 billion.。

According to Frost & Sullivan, Collomatech is the first Chinese company to license internally discovered and developed ADC drug candidates to the top ten biopharmaceutical multinationals。According to Frost & Sullivan, the company's recent partnership with Merck to develop up to seven preclinical ADC assets is by far the largest biopharmaceutical external licensing transaction by a Chinese company, and according to Nature Reviews Drug Discovery, the company is also the world's largest biopharmaceutical partnership by 2022 transaction value.。

Industry Overview

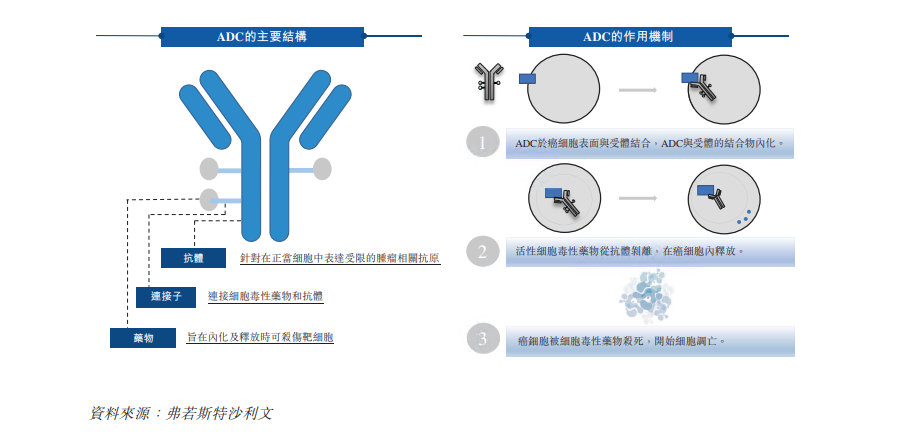

According to the disclosure documents, there will be 10% in the world and 10% in China in 2022..5 million people and 2.9 million people die from cancer, and the burden of disease is expected to rise due to population growth and aging。The number of cancer cases worldwide will be 20 in 2022.2 million cases, expected to reach 24 in 2030.5 million cases。The total number of cancer cases in China in 2022 was 4.8 million cases, expected to reach 5 by 2030.8 million cases。The pattern of cancer treatment has evolved from surgery and undifferentiated cytotoxic therapy (such as radiotherapy and chemotherapy) to essence therapy, with antibody drugs (including monoclonal antibodies, dual antibodies, and ADCs) as the main category.。ADC is one of the fastest growing treatment modalities in recent years, evolving from posterior line therapy for specific blood cancers to a promising front-line treatment modality for a wider range of solid tumors and other indications。

In 2022, targeted therapy and immunotherapy will be the two largest cancer drug categories in the world, accounting for 61% of the total..3% and 24.5% market share, followed by chemotherapy (14.2%)。In China, the development of targeted therapy and immunotherapy lags behind other major markets such as the United States.。In 2022, the Chinese oncology drug market will be dominated by chemotherapy, accounting for 54.3% market share, while targeted therapy and immunotherapy account for only 37.0% and 8.7% market share。

The global oncology drug market grew from $110.6 billion in 2017 to $205.1 billion in 2022, with a compound annual growth rate of 13.1% and is expected to grow at a CAGR of 10% from 2022 onwards..6% growth to reach $458.6 billion in 2030。China's oncology drug market increased from RMB139.4 billion in 2017 to RMB233.6 billion in 2022, with a compound annual growth rate of 10.9%, which is expected to continue to grow strongly, at a compound annual growth rate of 12% from 2022 onwards..2% growth, will reach RMB 586.6 billion in 2030。

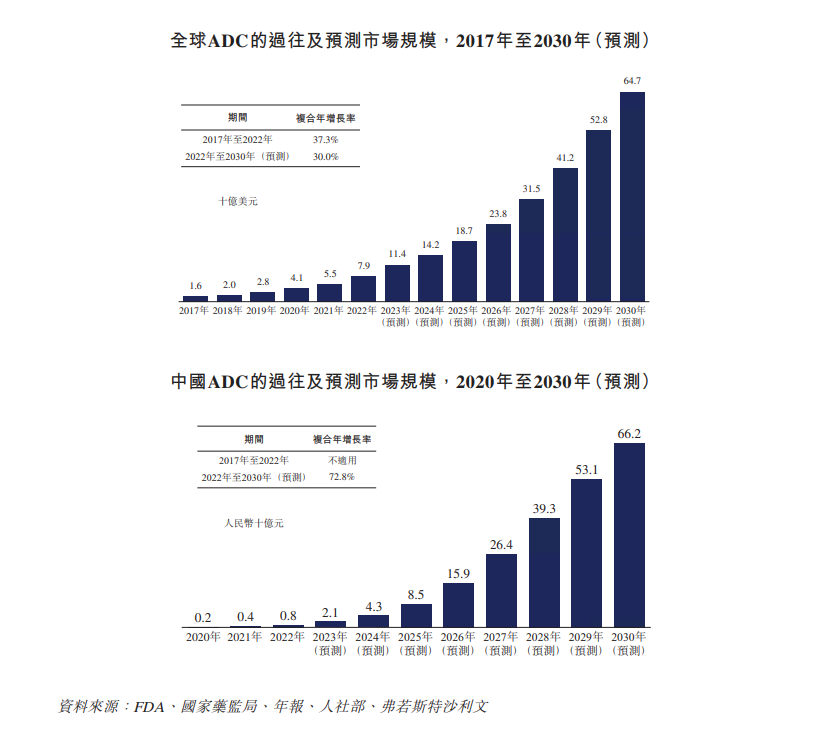

ADCThe global market size grew rapidly from $1.6 billion in 2017 to $7.9 billion in 2022, with a compound annual growth rate of 37.3%, and is expected to remain at 30% between 2022 and 2030..0% CAGR continues to grow rapidly。After the State Food and Drug Administration approved the first ADC drug Herceilene in 2020, China's ADC drug market began to grow and is expected to grow from RMB 800 million in 2022 to RMB 66.2 billion, a compound annual growth rate of 72.8%。

FINANCIAL SITUATION

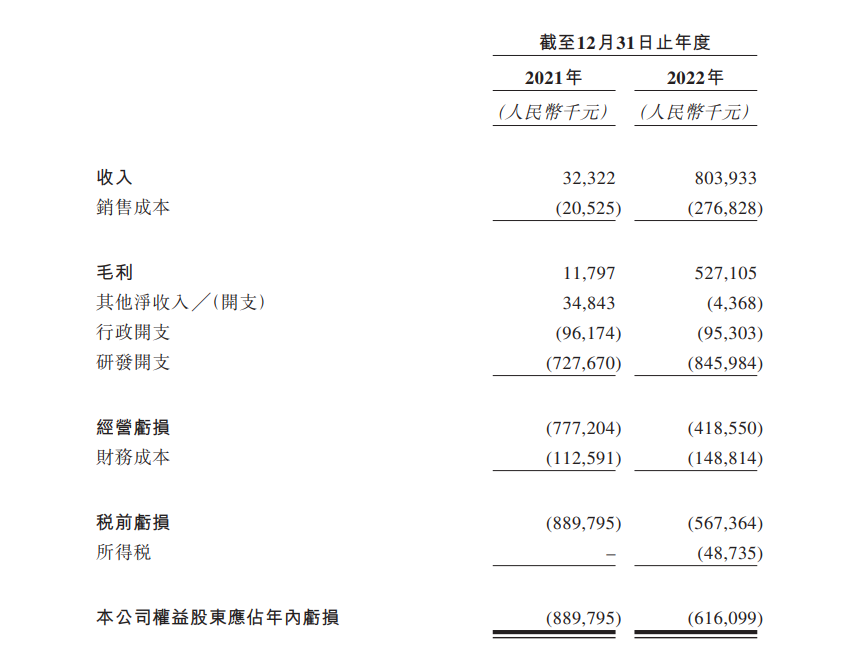

In terms of financial position, the total revenue for 2021-22 was $32.3 million and $8 million, respectively..The significant increase in revenue in 2021-22 was primarily due to the increase in revenue generated by the Company's two licensing and cooperation agreements with Merck to develop SKB264 and SKB315.。Net losses for the same period were 8.8.9 billion yuan, 6.$1.6 billion, mainly from R & D and administrative expenses。

Funding purposes

Colombotay expects net proceeds of approximately 13.HK $7.5 billion (assuming the over-allotment option is not exercised to indicate the median range of the offer price 66.calculated at HK $70)。

The announcement stated that the Company intends to use the net proceeds from the share offering for the following purposes: approximately 45.0% will be used to develop and commercialize its core products SKB264 and A166; about 30.0% will be used for the development and commercialization of other major products; approximately 12.0% will be used to fund the continued development of technology platforms, advance other existing pipeline assets, and explore and develop new drug candidates; approximately 8.0% will be used to expand capacity and quality control systems to support the expected commercialization of assets at a later stage; approximately 5.0% to be used for working capital and other general corporate purposes。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.