Management emphasized that the scale effect of AI infrastructure will gradually emerge.

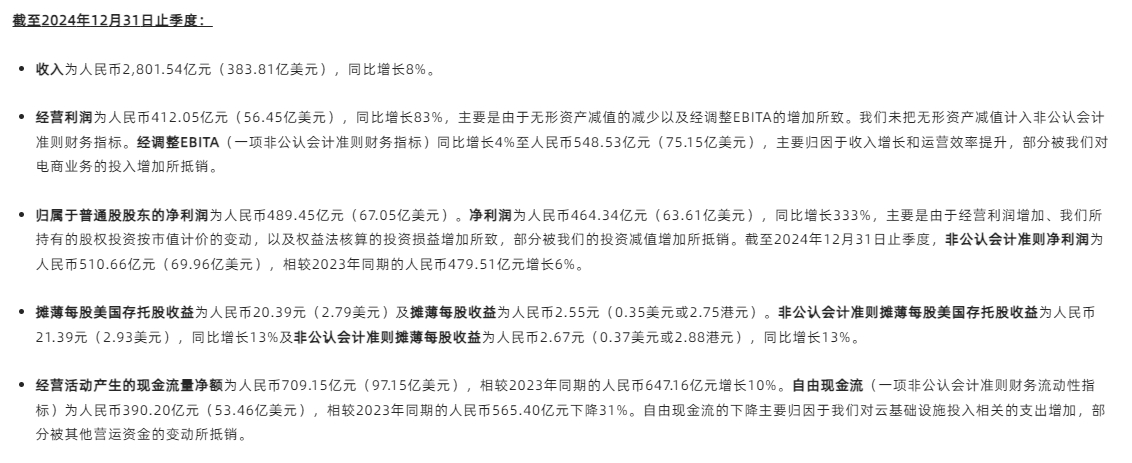

On February 20, Alibaba Group released its third-quarter financial report for the 2025 fiscal year.Data showed that during the quarter, Alibaba's revenue reached 280.15 billion yuan (RMB, the same below), a year-on-year increase of 8%; operating profit surged 83% year-on-year to 41.205 billion yuan; net profit attributable to ordinary shareholders reached 48.945 billion yuan, a year-on-year surge of 333%.

The "AI+ Cloud" strategy leverages double-digit growth, and the future will focus on the core of the AI strategy

From the perspective of business structure, the steady growth of the e-commerce sector has provided the Group with a foundation.Taotian Group's customer management revenue increased by 9% year-on-year to 100.79 billion yuan, and the number of 88VIP members exceeded 49 million, a year-on-year double-digit growth, showing the continued expansion of user stickiness and high-end consumer groups.The revenue of International Digital Business Group (AIDC) increased by 32% year-on-year to 37.756 billion yuan. The improvement in unit economic efficiency of AliExpress's Choice business confirmed the phased results of the global layout.However, what really excites the market is the performance of Alibaba Cloud Intelligent Group: revenue increased by 13% year-on-year to 31.742 billion yuan, of which revenue from AI-related products achieved triple-digit growth for six consecutive quarters, becoming the core engine of driving the cloud business back to double-digit growth.InvalidParameterValue

Behind the growth is the deep combination of Alibaba's systematic investment in AI technology and commercialization.

Group CEO Wu Yongming made it clear at the earnings call that in the next three years, we will focus on the core of the AI strategy and invest more in the three major areas of infrastructure, basic model platforms and AI native applications, and the scale is expected to exceed the total of the past ten years.This aggressive investment plan is based on a forward-looking judgment of technology trends: Alibaba defines AGI (General Artificial Intelligence) as a technology goal of "being able to achieve more than 80% of human capabilities" and believes that it may reshape 50% of the world's GDP. composition.This strategic positioning has upgraded Alibaba Cloud's positioning from a pure cloud computing service provider to an "AI smart grid"-through a global data center network, it carries 90% of the future AI model reasoning needs and becomes the output of AI capabilities. Core hub.InvalidParameterValue

The coupling of technological breakthroughs and business scenarios has shown results in specific businesses.The open source ecosystem of the Tongyi Thousand Questions Model family continues to expand. As of January 2025, the number of derivative models developed on the Hugging Face platform based on this model exceeds 90,000, covering 290,000 enterprise developers. This ecological advantage not only consolidates technical barriers, but also forms a stable commercialization path through API calls.The upcoming Qwen2.5-Max deep reasoning model targets the high-performance requirements of enterprise-level AI applications and attempts to seize the lead in the commercialization competition of generative AI.At the application level, Taobao's AI shopping assistant, Gaode's life service entrance transformation, and Dinghao's intelligent collaboration upgrade all show the potential of AI technology to reconstruct the value of existing businesses.InvalidParameterValue

Although capital expenditure surged 80% month-on-month to 31.775 billion yuan in the quarter, and free cash flow fell 31% year-on-year, management emphasized that the scale effect of AI infrastructure will gradually emerge: the adjusted EBITA profit margin of the cloud computing business remains at around 10%, and long-term profitability is expected to strengthen as the proportion of public cloud revenue increases and customer demand expands.This logic of "investment for space" has precedents in the development of Amazon AWS and Microsoft Azure, and Alibaba's unique advantage lies in the collaboration between its huge e-commerce ecosystem and AI scenarios-for example, AI tools in Taobao Station can be directly transformed into customer needs for cloud services, forming a business closed loop of internal circulation.InvalidParameterValue

However, this big technological gamble is not without hidden concerns.The current global AI competition has entered a white-hot stage. Meta's Llama series, Google's Gemini, and OpenAI's GPT-5 are all competing for the developer ecosystem, while domestic companies such as ByteDance and Baidu are also accelerating their deployment.Although Alibaba occupies the open source ecosystem with its first-mover advantage, how to transform its technological advantages into a sustainable business model remains a key challenge.In addition, although the international e-commerce business is growing rapidly, it has not yet achieved overall profit in a single quarter. Geopolitical risks and the complexity of localized operations may affect its globalization process.InvalidParameterValue

Judging from the reaction of the capital market, this financial report has initially won investor recognition: after the financial report was released, Alibaba's pre-market gain in U.S. stocks once expanded to 10%, indicating the market's cautious optimism about its strategic shift.If it can fulfill its promise of "investing more than ten years in AI" in the next three years and maintain a leading position in AGI technology iterations, Alibaba may have the opportunity to break the traditional e-commerce valuation framework and restructure it as an "infrastructure operator in the AI era." imagination.

Goldman Sachs quickly upgrades its rating

After the financial report was announced, well-known investment bank Goldman Sachs pointed out that Alibaba's cloud business revenue growth accelerated to 13% year-on-year, up from 7% in the previous quarter and 3% in the same period last year.AI revenue achieved triple-digit year-on-year growth for six consecutive quarters, and public cloud revenue also achieved double-digit year-on-year growth.Alibaba Cloud's adjusted EBITA profit margin reached 9.9%, up from 9.0% in the previous quarter and 8.4% in the same period last year, indicating continued improvement in its profitability.In terms of capital expenditure, Alibaba's capital expenditure reached 31.8 billion yuan (approximately US$4.35 billion), a year-on-year increase of approximately 260% and a month-on-month increase of 80%, mainly due to the increase in cloud infrastructure expenditure.

Goldman Sachs expects that Alibaba's strategy will have a significant boost to China's data center operators, especially companies such as International Data and 21 Internet.Alibaba is IWC's largest customer, accounting for 33.5%/30.1% of IWC China's total committed area/net income in the third quarter of 2024.Accelerating Alibaba Cloud's revenue growth may mean stronger occupancy demand among outstanding orders, and data center operators may receive larger data center orders, which may lead to increased capital expenditures among data center operators.

From a valuation perspective, Goldman Sachs believes that improving market sentiment towards the data center industry will lead investors to be more inclined to value these stocks based on "normalized/contracted EBITDA", resulting in a higher multiple of corporate value to EBITDA (EV/EBITDA) in the 12-month forward.For example, if the "normalized EBITDA" forecast by IWC Data China in 2026 is valued at 15 times EV/EBITDA, the final valuation is 19 times, which means that the value of each depositary receipt (ADS) of IWC Data China is US$54.7; For Century Vianet, if we use 11 times EV/EBITDA based on "normalized EBITDA", the final valuation is 15.8 times, which means that the value of each depositary receipt (ADS) per share of Century Vianet's data center business is US$17.8.

Based on this, Goldman Sachs said it significantly raised Alibaba Group's 12-month target price to US$160/HK$156, an increase of more than 36% from the previous US$117/HK$114.