Kodi-B today's official offering: focus on skin disease treatment future market potential is huge

On May 31, Cody Group (listing name: Cody-B) announced its prospectus on the HKEx.。According to the announcement, the company will open the public offering in Hong Kong at 9: 00 a.m. on May 31, 2023 (Wednesday) and close the subscription on June 5, 2023 (Monday)。

On May 31, Cody Group (listing name: Cody-B) announced its prospectus on the HKEx.。According to the announcement, the company will open the public offering in Hong Kong at 9: 00 a.m. on May 31, 2023 (Wednesday) and close the subscription on June 5, 2023 (Monday)。

According to the documents, Cody Group intends to issue 2128.180,000 shares, of which 212 were publicly offered.840,000 shares (10%), international offering 1915.340,000 shares (90%), issue price per share 20.65-24.HK $75, 200 shares per lot, expected to list on June 12。

Company Profile

Founded in 2019, Cody Group is a dermatology-focused R & D biopharmaceutical company focused on a wide range of skin disease treatment and care treatments, including local fat accumulation management drugs, hair diseases and care, skin diseases and care, and epidermal anesthesia.。

The company has a core product and eight other pipeline candidates, and also distributes two commercialized products developed by overseas partners. Core product CU-20401 (a recombinant mutant collagenase that targets obesity, overweight or other metabolic diseases related to local fat accumulation) was developed as a local fat accumulation management drug for the treatment of skin diseases.。As of the Latest Practicable Date, the Company held a patent relating to a core product。

As of the Latest Practicable Date, the Cody Group R & D team had a total of 41 R & D personnel, all with diverse medical backgrounds and extensive experience.。Eleven of the members hold master's degrees and seven hold doctorates.。In addition, Cody Group has 24 patents and patent applications in Mainland China, Hong Kong and Japan, and two PCT patent applications.。

Cody Group is one of the few players with comprehensive capabilities in the broad dermatological treatment and care market in China, with a comprehensive product pipeline covering nine products and product candidates, including five clinical stages and four preclinical stage candidates, to meet market demand.。

The company's success is due to the company's comprehensive capabilities, customer-centric philosophy and continuous innovation driven by the proprietary CATAME ® technology platform, a comprehensive product pipeline and an experienced management team, which is expected to take advantage of the expected growth of the broad dermatological treatment and care market in China to continue to expand its business scale and increase its market share.。

Market size

According to Frost Sullivan, the size of China's extensive dermatological treatment and care market increased from RMB300.4 billion in 2017 to RMB471.8 billion in 2021, with a compound annual growth rate of 1.1 billion..9 per cent, which is expected to increase to RMB670.2 billion and RMB1,037.5 billion in 2025 and 2030, respectively, with a CAGR of 9 per cent from 2025 to 2030..1%。

Despite rapid growth, China's annual per capita expenditure on extensive dermatological treatment and care remains low due to the lack of comprehensive, effective and alternative solutions.。The Kodi Group is committed to providing comprehensive solutions for different therapeutic areas in China's rapidly growing broad dermatological treatment and care market.。

The market size of local fat accumulation management drugs for labeling purposes is expected to grow from 86.7 million yuan in 2023 to 5 yuan in 2025..1.4 billion yuan, with a CAGR of 143 from 2023 to 2025.6%。Market size expected to reach RMB 24 by 2030.4 billion yuan, with a compound annual growth rate of 36% from 2025 to 2030..5%。

According to Frost & Sullivan, in 2021, the number of female and male target patients with fat accumulation in China was 1.700 million people and 1.8.2 billion people, expected to reach 2 in 2030.1.1 billion people and 2.2.4 billion people。The target market for core products is only a tiny fraction of the overall broad dermatological treatment and care market in China。

In addition, in 2021, the per capita expenditure on extensive dermatological treatment and care in the United States, Japan and South Korea amounted to RMB1,828, respectively..0 yuan, RMB 1,417.3 yuan and RMB 1,406.9 yuan。By comparison, China's per capita expenditure on extensive dermatological treatment and care in 2021 is RMB 334.0 yuan, still far behind the above countries, which means that the future market potential of the industry is huge.。

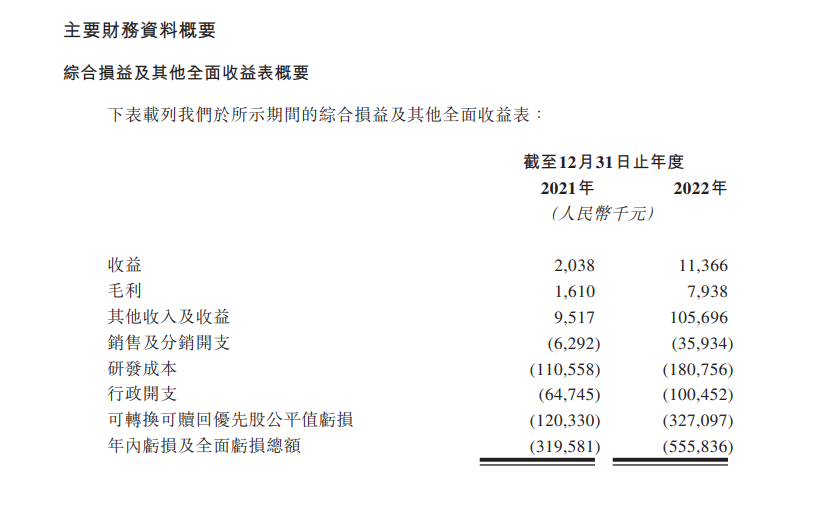

Financial Overview

According to Kodi Group's annual data for 2021 and 2022, the company achieved 203.80,000 yuan (RMB, the same below) and 1136.60,000 yuan of income; gross profit of 1.6 million yuan and 7.9 million yuan, respectively, gross profit margin reached 79..0% and 69.8%; due to high research and development costs, the company's total loss and overall loss for the year were 3.$1.9 billion and 5.5.5 billion yuan。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.