Why Only China Hits Back Fully on Tariffs? The Charts Explain

Why Is China the Only One Daring Full Retaliation? These Charts Explain It AllIn response to U.S. tariffs, most countries are opting for negotiations. Only China and Canada have imposed retaliatory ta

Why Is China the Only One Daring Full Retaliation? These Charts Explain It All

In response to U.S. tariffs, most countries are opting for negotiations. Only China and Canada have imposed retaliatory tariffs — and China's response has been by far the strongest. Why does China have such confidence?

Just look at what each country trades.

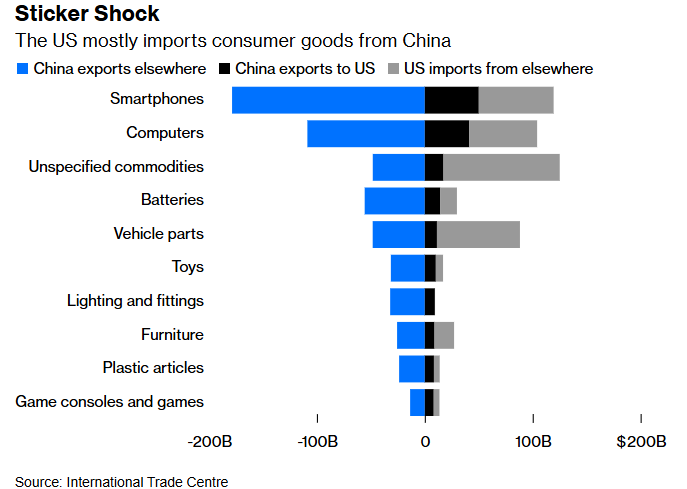

America imports a vast range of consumer goods from China — the kind you'd find at walmart, in shopping malls, or on amazon.com: smartphones, computers, gaming consoles, furniture, toys, and clothing.

Imposing steep tariffs on these products would quickly trigger a spike in consumer prices, which American shoppers would feel almost immediately. The U.S. public has already endured four years of high inflation. Democrats were punished in the 2024 election for failing to control inflation. If Trump also fails, voters may severely punish Republicans in the midterm elections next year.

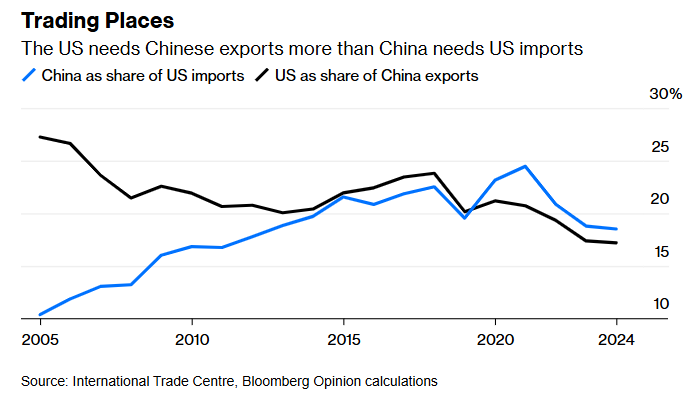

China's Exports Aren't Dominated by the U.S.

While the U.S. is one of China's largest export markets, it's far from dominant. Losing access to the U.S. would hurt — but alternative markets do exist. This is clearly shown in the charts, where the relatively large blue bars represent China's diversified export destinations.

At the same time, China dominates many segments of the U.S. import market, meaning American consumers can't easily switch to alternative suppliers. China's massive capacity and low costs are globally unmatched, and shifting the supply chain would take time — while price hikes would be immediate.

What China Imports from the U.S.

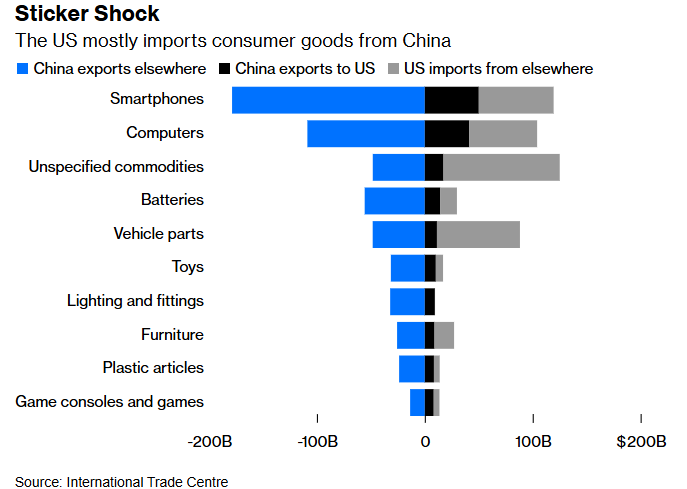

China's imports from the U.S. are mostly intermediate goods used in manufacturing — not items regular consumers ever see. This includes energy products, semiconductors, chipmaking equipment, and aircraft engines.

China has long pursued import diversification, reducing reliance on the U.S. One notable exception is soybeans, but China has already begun sourcing soybeans from countries like Brazil and Argentina, and has ramped up domestic farming.

A Key Difference: Political Pressure

One factor should not be overlooked: U.S. voters punish leaders for rising prices and plunging stock markets. Trump and the Republican Party face real political risk.

China's leader Xi, by contrast, faces no such electoral concerns.

Decoupling — But Who Did It Better?

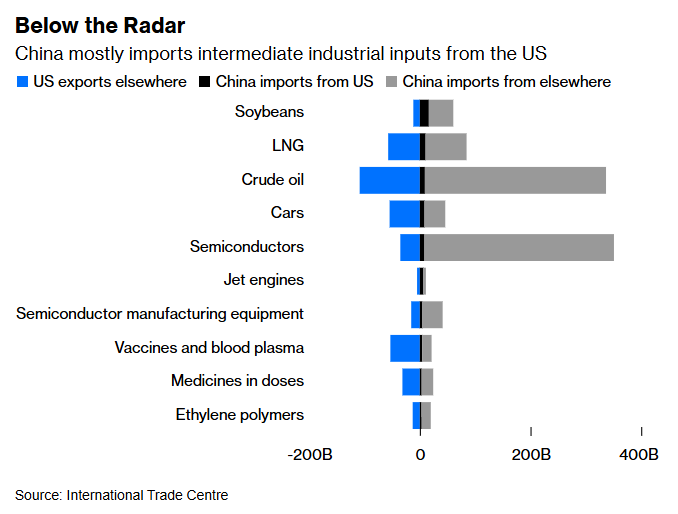

Since Trump first launched the trade war in 2018, both nations have been moving toward decoupling — but China has done it more effectively.

The U.S. share of Chinese exports has fallen by 6.6 percentage points, down to 17.2%. Meanwhile, China's share of U.S. imports has only declined 4 points to 18.5%.

China's Strategic Pivot

China is also using this opportunity to strengthen ties with other nations, forming what some call an emerging anti-U.S bloc. The European Union is increasing contact with China, especially as Trump's tariffs on allies are nearly as harsh as those on China.

Yes, China is facing economic challenges — but international trade isn't one of them. If the world heads into a prolonged trade war, China has already done the hard work of reinforcing its position.

Trump may be stepping into a battle with a more resilient and prepared rival than before.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.