Counterpoint: Global smartphone market shrinks to lowest in 10 years Samsung remains industry leader

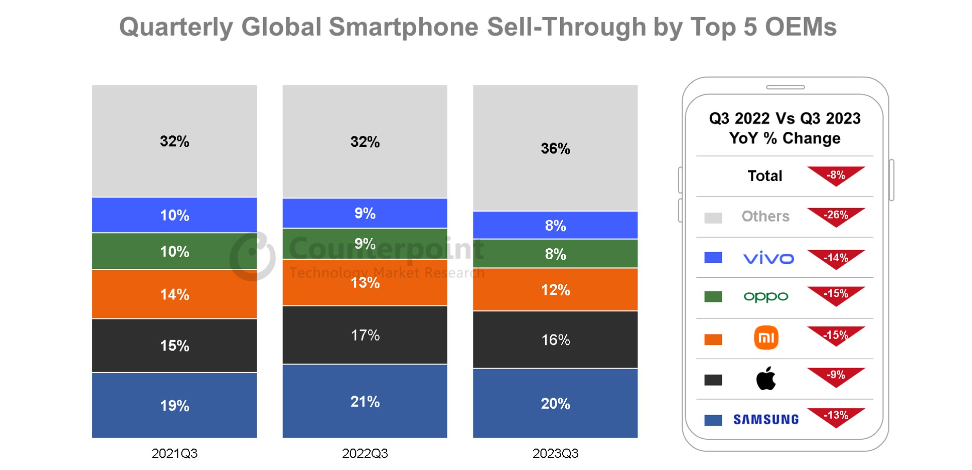

On October 17, according to the latest report from research firm Counterpoint, the global smartphone market shrank by 8% year-on-year in the third quarter of this year, the lowest level in a decade.。

On October 17, according to the latest report from research firm Counterpoint, the global smartphone market shrank by 8% year-on-year in the third quarter of this year, the lowest level in a decade.。

According to the report, global smartphone sales continued to shrink in the third quarter of this year, falling for the ninth consecutive quarter, mainly due to a slower-than-expected recovery in consumer demand.。But on a quarter-on-quarter basis, it grew by 2% in the third quarter, showing a recovery.。

The top five brands in the global smartphone market declined to varying degrees in the third quarter, but the ranking remained unchanged。

Samsung continues to lead the global market, accounting for one-fifth of total sales in the third quarter。Its new generation of foldable products has had mixed reactions, with Flip 5 sales almost double that of similar products。In addition, Samsung's A-Series models remain the mid-priced market leader。

Apple remains second on the list, with a market share of 16%, down one percentage point from the same period last year.。After the release of the iPhone 15 series, the response so far has been good。But Apple's performance in China is weaker due to competition from Huawei phones。

Counterpoint, in unreported data provided to the media, estimated that iPhone 15 sales fell 4 percent in the first 17 days after launch compared to the iPhone 14..5%。Separately, Jefferies analysts, led by Edison Lee, estimated that Huawei's overall sales in the Chinese market surpassed Apple's after the unexpected debut of the Huawei Mate 60 Pro, and iPhone 15 sales fell by double digits from the previous generation.。And Jefferies expects this "Huawei pressure Apple" situation will continue until 2024, Apple's dominant position in China's high-end market may be "not guaranteed."。

However, Counterpoint Director Jeff Fieldhack believes that the new iPhone has been selling well in the U.S. and has performed well for several consecutive weekends.。Positive signals from the United States as the world's largest iPhone market can mitigate some of the impact of the Chinese market。

Xiaomi, Oppo and Vivo ranked third, fourth and fifth on the global smartphone list, all of which fell year-on-year in the third quarter。In the third quarter, the brands focused on strengthening their positions in key markets such as China and India, while continuing to slow expansion in overseas markets.。

It is worth noting that brands such as Glory, Huawei and Transonic all increased their smartphone market share, making them one of the few brands to achieve year-over-year growth in the third quarter.。The report mentioned that Huawei's growth was driven by the launch of the Mate 60 series in China, while Glory's growth was driven by strong overseas performance.。Transmit brand continues to expand in the Middle East and Africa, while also benefiting from the recovery of the local market.。

Global smartphones showed a strong recovery in September, and Counterpoint expects this momentum to continue until the end of the year。One driving factor is the launch of new models, such as the iPhone 15 series。The iPhone 15 had a shorter time to market in the third quarter, causing demand to shift to the next quarter.。On the other hand, the holiday effect should also boost smartphone growth。Such as the arrival of the Indian holiday season, the "Double Eleven" sales activities of Chinese e-commerce platforms, and the global Christmas and year-end promotions。As a result, the year-on-year downward trend in the global smartphone market is likely to stop in the fourth quarter of 2023。However, for the full year 2023, Counterpoint expects the smartphone market to decline year-over-year throughout the year, reaching its lowest level in a decade.。

The Middle East and Africa region was the only region to achieve year-on-year growth in the third quarter due to improved macroeconomic indicators, with most developed markets such as North America, Western Europe and South Korea experiencing significant declines, which also indicates a faster recovery in markets such as emerging markets。Counterpoint said most developed markets will see growth in the fourth quarter, mainly due to the delayed effect of the iPhone launch.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.