Huawei Led China's Smartphone Shipments Increase 11% Year-on-Year in October Market or Reshuffle?

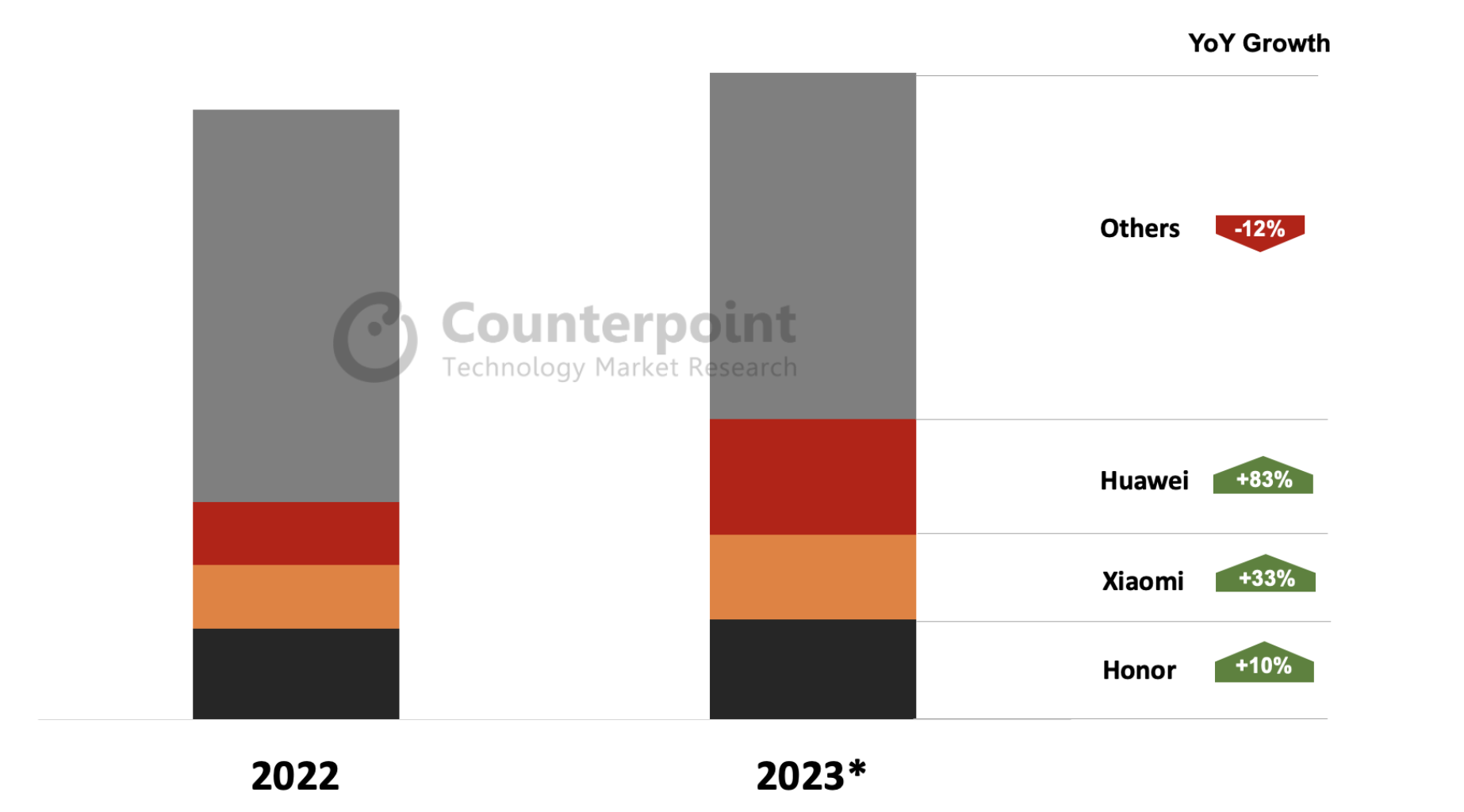

The latest data released by research firm Counterpoint shows that the Chinese smartphone market is showing signs of recovery, with total Chinese smartphone shipments up 11% in October。Huawei was the best performing mobile phone brand in October, with sales surging 83%。

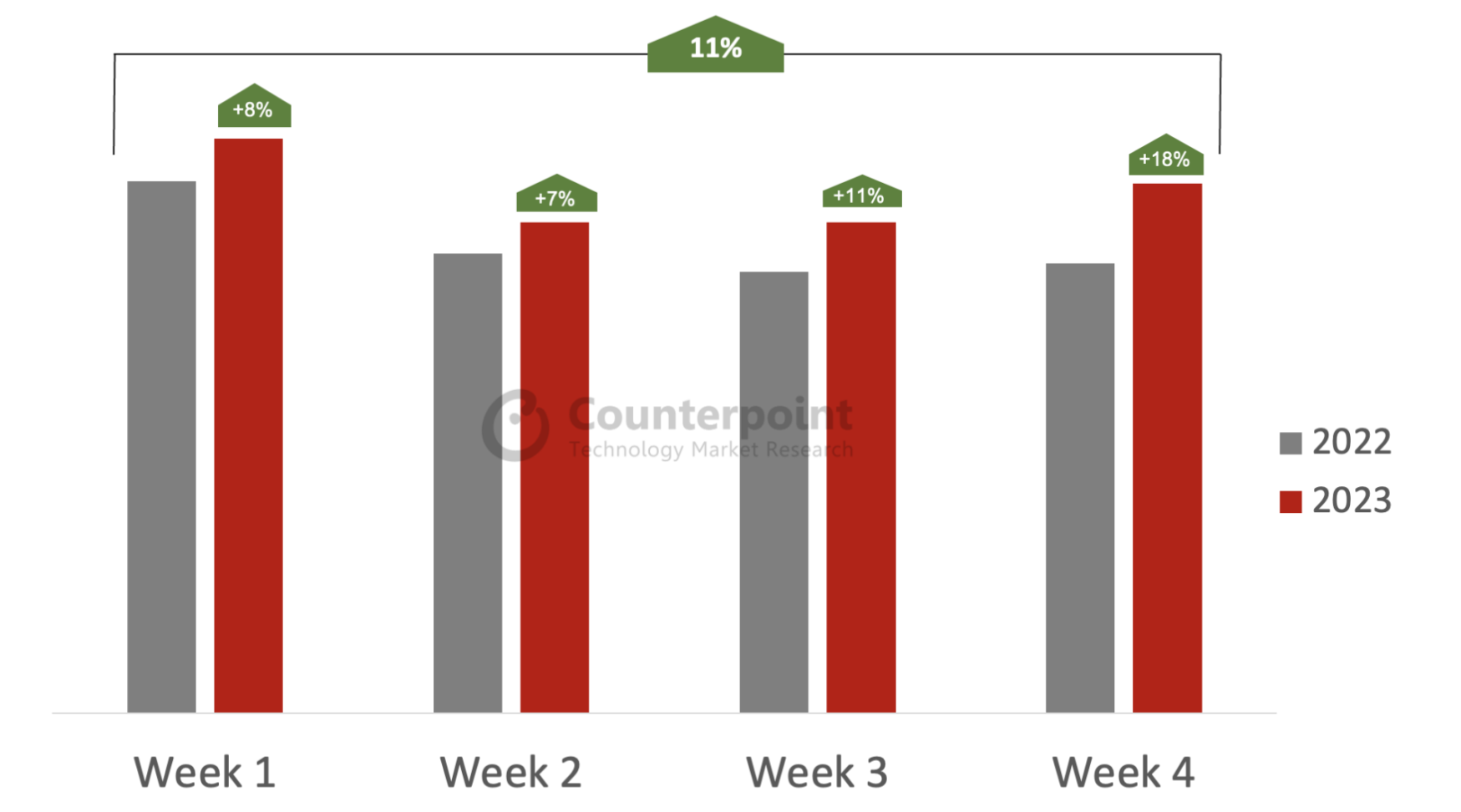

On November 14, the latest data released by research firm Counterpoint showed that the Chinese smartphone market is showing signs of recovery, with total smartphone shipments in China increasing by 11% in October.。

Q4 recovery is expected

The performance of the smartphone market in October will lay the foundation for the fourth quarter。Previously, according to China's smartphone market sales have been declining for several consecutive quarters。

However, the downward trend is gradually slowing down。By the third quarter of this year, the decline in China's smartphone sales narrowed to 3% year-on-year, according to Counterpoint.。Counterpoint believes that this or the Chinese smartphone market is close to the bottom of the signal。

Counterpoint's senior analysts said that both year-on-year and shorter-term weekly ring data suggest that only the mobile phone market is recovering。"There is some (return to growth) momentum that is certain.。Analyst Mengmeng Zhang said, "This is a good sign because we are about to enter the double eleven sales period of the reporting season."。"

Huawei was the best performing mobile phone brand in October and the main driver of monthly smartphone market growth。

Huawei's sales surge 83% in October, report shows。Analyst Archie Zhang said: "The most notable in October was Huawei, which achieved a turnaround with the Mate 60 series of devices.。The growth rate is amazing。The analyst added: "[Huawei's] demand continues to remain high in the double digits and we also see a halo effect, with other models from suppliers performing well."。"

However, Counterpoint also said that Huawei is under pressure to deliver new machines.。Since the launch of Huawei's Mate 60 series, the supply of its online and offline official channels has been tight, often facing the phenomenon of a machine difficult to find.。According to reports, in some unofficial channels, Huawei's Mate 60 series full-line premium is around RMB 1,000。

Counterpoint believes that Huawei's inventory shortage is due to much higher than expected demand and pressure on its parts supply chain and EMS (electronic manufacturing services) suppliers.。Ivan Lam, senior manufacturing analyst, said: "Huawei's ability to adapt to this new normal will be an important factor in determining its own growth and the wider market.。Lam further said that how to deal with the double eleven is the first real test facing Huawei.。It currently shows that overall only handset sales have risen, but how much Huawei has contributed will be known for the rest of the quarter。

In addition to Huawei, another outstanding mobile phone brand is Xiaomi。Xiaomi smartphone sales up 33% in October, according to Counterpoint。

Xiaomi's growth is mainly driven by new models。Xiaomi released the Xiaomi 14 series on October 26, which was hit by the market as soon as it was launched。Third-party data show that by November 10th, the total sales volume of the Xiaomi 14 series has reached 144.740,000 units, setting a record for Xiaomi's high-end flagship sales。

Market landscape or change

With Huawei, Xiaomi and other brands releasing new models to detonate the market, China's smartphone market is likely to usher in a major reshuffle in the fourth quarter。

According to Counterpoint, the top five smartphone market shares in China in the third quarter were Glory (18.3%), VIVO (17.8%), OPPO (16%), Apple (14.2%) and Xiaomi (14%)。

According to the data learned by the media from the supply chain, in the 44th week of this year (that is, the week ending November 5), in terms of sales, Xiaomi accounted for 21.9% market share, ranking first in China's Android phone market。At the same time, Xiaomi was the only mobile phone supplier to achieve positive month-on-month growth during the week, with a month-on-month increase of 8.9 percentage points。In terms of Android phones, Xiaomi was followed by Huawei and Honor, with 13% and 12% respectively..8% market share。

Earlier, some institutions predicted that the growth momentum of Xiaomi smartphones will continue into the fourth quarter of this year, driven by strong sales of the Xiaomi 14 series, and the upcoming Redmi K70 may also become the next growth catalyst。HSBC Global Research raised its 2023 smartphone shipment forecast by 7% to 1 in a report last week..500 million units, up 6% to 1 in 2024.600 million units。

As for Huawei's mobile phones, the market expects its sales to reach around 35 million units this year, which is likely to once again rank among the top five in the industry.。If the supply chain is guaranteed, it could expand further to around 60 million units by 2024.。

Glory finished the third quarter with 18.3% market share lead, mainly due to the new Glory X50 and Glory 90。Analyst Alicia Kon said: "Both Glory and Xiaomi are focused on offering more affordable mid-range products and promotional prices to retailers and consumers to offset any potential downward pressure.。This strategy has proven to be effective。"Although the glory of the new model to maintain a certain degree of competitiveness, but other mobile phone brands menacing, and the third quarter glory only ahead of the second 0.5 percentage points, so it seems that Glory can retain first place in the fourth quarter is still in suspense。

In addition, Counterpoint data show that OPPO, vivo and Apple's sales in the third quarter have seen double-digit decline。Apple's iPhone 15 series has failed to detonate the Chinese market for a number of reasons, with sales largely unchanged from last year, which may not help it retain its market share。OPPO and vivo, the overlords of the unified line, were affected by weak consumption in second-tier and lower cities, resulting in a decline in sales in the third quarter, and failed to show strong growth in October, with growth and market share in the fourth quarter remaining to be seen.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.