USDCNH Consolidates near 7.2600 amid China's 2025 Fiscal Deficit Target

Key momentsUSDCNH stabilizes near recent lows of 7.2600 amid cautious market sentiment.China raises its 2025 fiscal deficit target to 4% of GDP while maintaining a 5% GDP growth forecast.Enhanced bond

Key moments

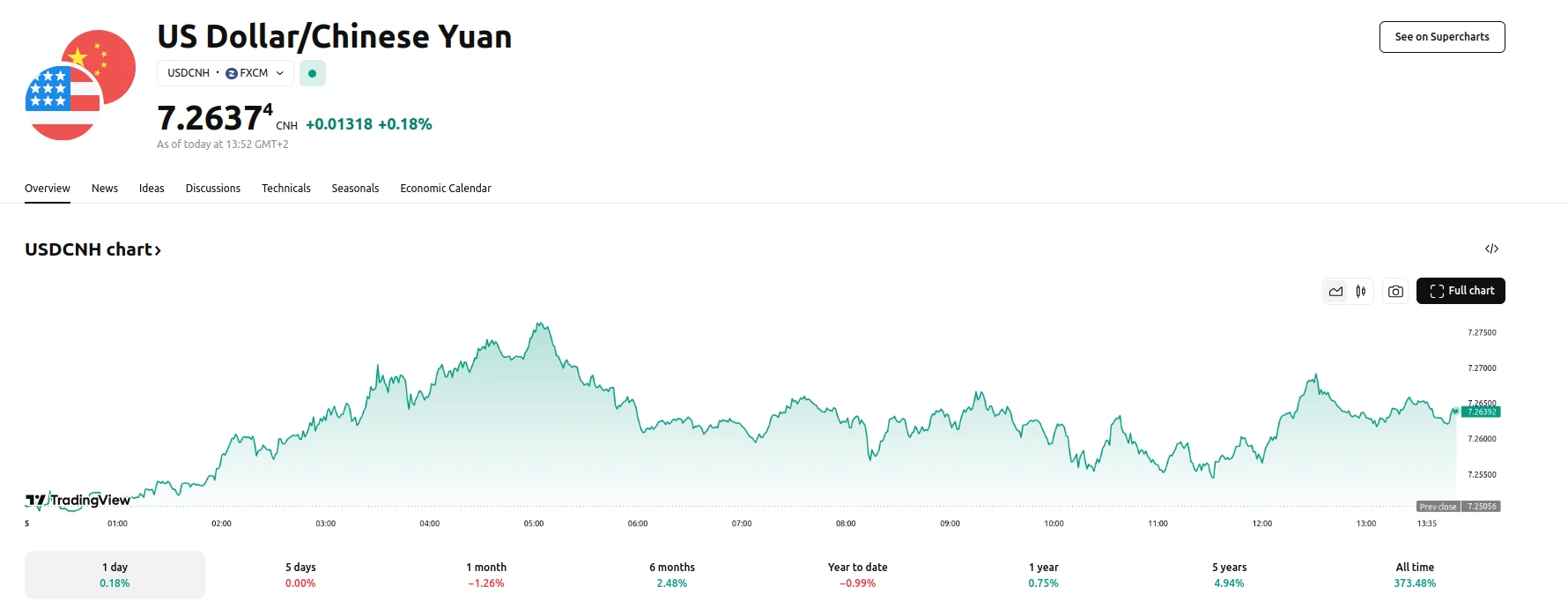

- USDCNH stabilizes near recent lows of 7.2600 amid cautious market sentiment.

- China raises its 2025 fiscal deficit target to 4% of GDP while maintaining a 5% GDP growth forecast.

- Enhanced bond issuances are set to finance consumer subsidies and infrastructure investments.

China’s 2025 Fiscal Deficit Target at Its Highest in More Than Three Decades

The USDCNH pair is currently consolidating around 7.2600 as market participants absorb China’s latest fiscal policy adjustments. This consolidation reflects a period of cautious trading, following the announcement of significant fiscal measures aimed at stimulating domestic growth. Investors are closely monitoring these developments, which have the potential to reshape market expectations amid evolving economic conditions.

In a move to boost its economic framework, China has raised its 2025 fiscal deficit target to 4% of GDP—the highest in over three decades—up from 3% in 2024, while keeping its GDP growth target steady at around 5%. As part of this strategy, Chinese authorities plan to issue 1.3 trillion yuan in special sovereign bonds in 2025, compared to 1.0 trillion yuan in the previous year. The additional 300 billion yuan is earmarked for a consumer subsidy program intended to encourage domestic spending by doubling the support offered in 2024.

Furthermore, the government has announced an increase in local government special bonds to 4.4 trillion yuan, up from 4 trillion yuan in 2024. This boost in bond issuance is designed to finance critical public investments and infrastructure projects. While these fiscal measures are expected to stimulate economic activity, challenges such as low household incomes, high precautionary savings, and elevated household debt continue to constrain domestic consumption.

Overall, the current consolidation of USDCNH near 7.2600 reflects both market uncertainty and cautious optimism as investors weigh the potential impacts of China’s enhanced fiscal spending on economic growth and infrastructure development.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.