Fantom (FTM) Falls 12% as Whale Wallets Hit Monthly Low

FTM price falls 12% in 24 hours as bearish momentum intensifies. ADX and declining whale wallets hint at further downside risks.

- FTM drops over 12% in 24 hours, nearing key support at $0.84. A further breakdown could see the price target $0.64, a 33% correction.

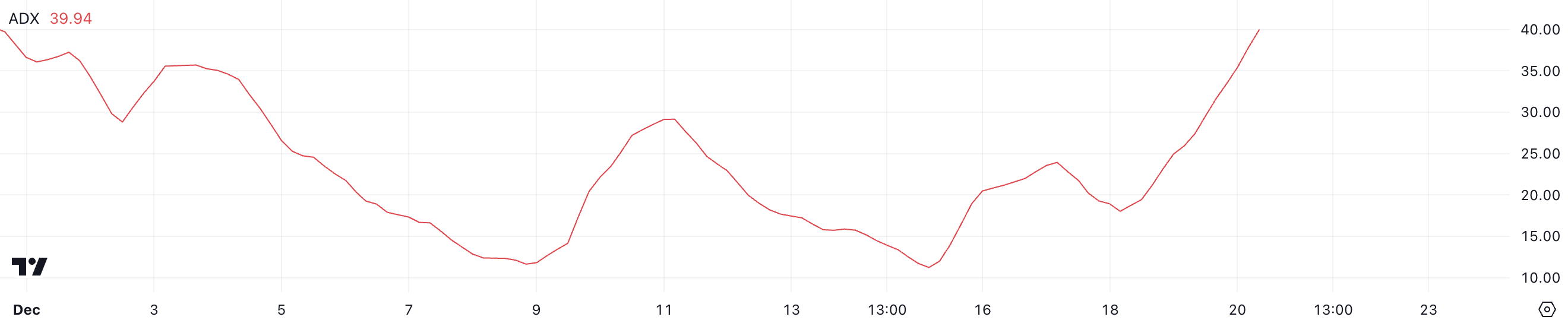

- ADX rises to 39.94, signaling strengthening bearish momentum. Sustained selling pressure keeps FTM in a strong downtrend.

- Whale wallets holding 1M–10M FTM hit lowest level since December 1. Reduced participation by large holders highlights weak sentiment.

Fantom (FTM) price is down over 12% in the last 24 hours as the network transitions to its new token, Sonic. This sharp decline has intensified FTM’s ongoing downtrend, with technical indicators like the ADX highlighting strengthening bearish momentum.

Meanwhile, the number of whale wallets holding between 1 million and 10 million FTM has steadily declined, reflecting reduced confidence among large holders. With FTM moving near critical support at $0.84, traders are closely watching for a potential break lower to $0.64 or a recovery that could target resistance levels at $1.13 and beyond.

Fantom’s Current Downtrend Is Showing Its Strength

The ADX (Average Directional Index) for FTM is currently at 39.94, a sharp increase from below 20 just two days ago. This surge indicates that the strength of the current trend has grown significantly in a short period.

Since FTM price is currently in a downtrend, the elevated ADX suggests that the bearish momentum is becoming more pronounced, making it likely that the price will continue to face downward pressure in the near term.

The ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values below 20 indicate a weak or directionless trend, values between 20 and 40 suggest a moderate trend, and values above 40 reflect a strong trend.

With FTM’s ADX near 40, the downtrend is approaching strong levels, signaling sustained selling pressure. In the short term, unless significant buying interest emerges, FTM price is likely to face continued declines, with traders closely monitoring support levels for potential stabilization.

Whales Are Not Accumulating FTM

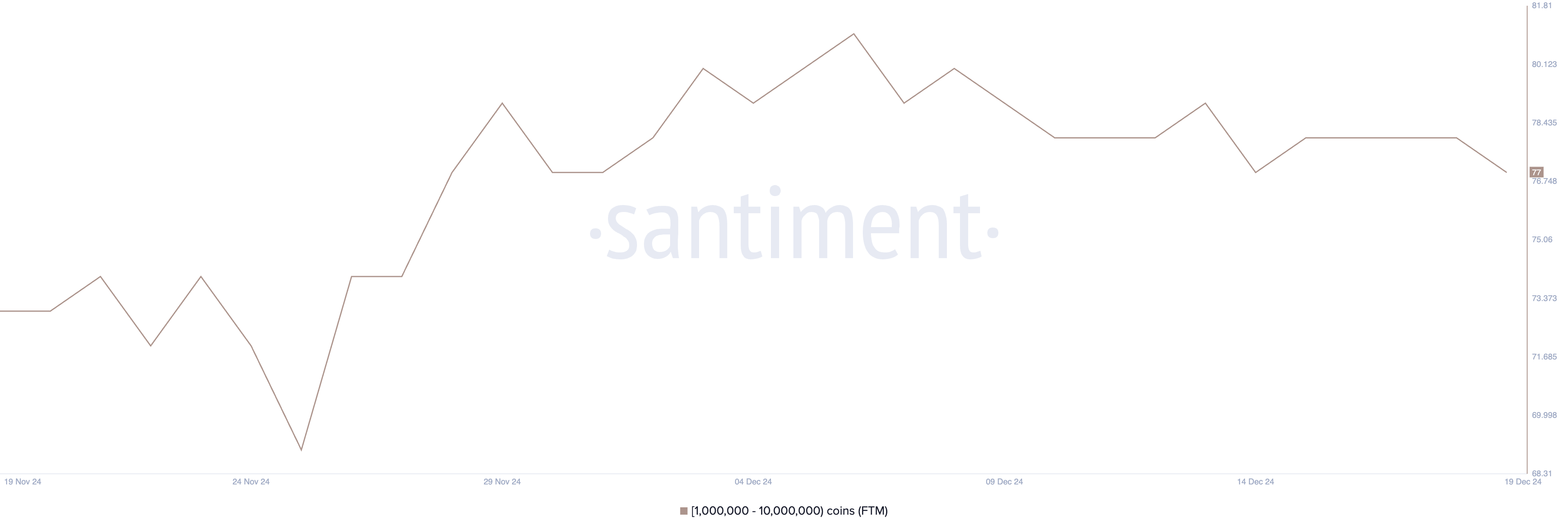

The number of wallets holding between 1 million and 10 million FTM has dropped to 77, marking its lowest level since December 1. Tracking these wallets, often referred to as “whales,” is crucial because they can significantly influence the market due to the large volume of tokens they control.

Changes in the number of these wallets often reflect shifts in sentiment among major holders, which can precede notable price movements.

This number of whales reached a month-high of 81 on December 6 but has steadily declined since, without any major token dumps being observed.

This gradual decrease suggests a lack of aggressive selling but could indicate reduced confidence among large holders. In the short term, this trend might signal underlying weakness for Fantom, as declining whale participation often aligns with lower buying support and potential price stagnation or further declines.

Fantom Price Prediction: Can FTM Correct By 33% Next?

Fantom is currently trading within a range defined by a support level of around $0.84 and a resistance level of $1.

If the $0.84 support fails to hold, the price could drop significantly. The next key support is at $0.64, representing a potential 33% correction from current levels.

On the other hand, if FTM price manages to break above the $1 resistance, it could signal a shift in sentiment, opening the path for a rise to $1.13.

Should bullish momentum persist beyond this point, Fantom price could potentially test the next resistance at $1.32, marking a strong recovery. The ability to break above $1 and sustain an uptrend would depend heavily on increased buying interest and a reversal in the current strong downtrend.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.