Rupee Dips 0.3% as RBI Pours $10 Billion into Forex Swaps to Tackle Liquidity Crunch Rupee Dips 0.3% as RBI Pours $10 Billion into Forex Swaps to Tackle Liquidity Crunch

Key momentsIndias central bank conducted a $10 billion foreign-exchange swap auction on Friday to address a significant liquidity shortage.The recent $10 billion injection brings the total funds added

Key moments

- India’s central bank conducted a $10 billion foreign-exchange swap auction on Friday to address a significant liquidity shortage.

- The recent $10 billion injection brings the total funds added to India’s banking system to $47 billion within the past month.

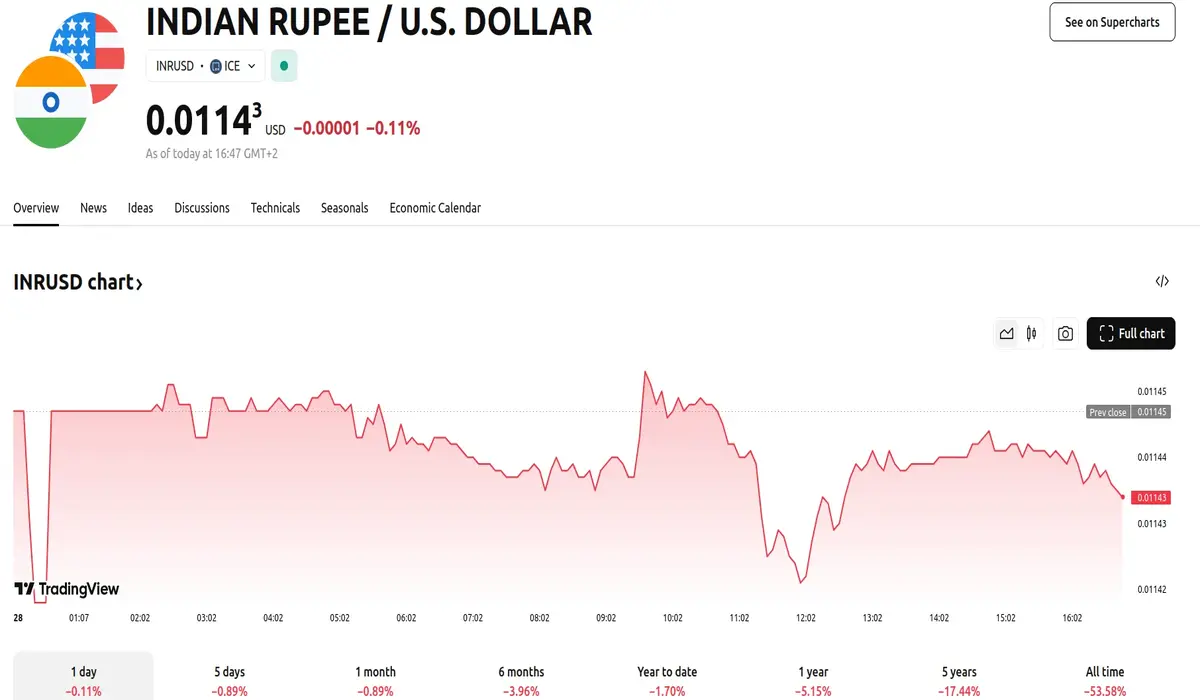

- The rupee responded with a 0.3% dip, dropping to 87.4900 per dollar.

India Battles 14-Year-High Deficit of ₹3.3 Trillion

India’s central bank, the Reserve Bank of India (RBI), is stepping up its efforts to alleviate a severe liquidity deficit within the nation’s financial system by injecting $10 billion through a foreign-exchange swap auction. Said auction is part of a broader strategy to stabilize domestic currency markets, which have experienced significant tightening since late 2024. The deficit reached a 14-year high of ₹3.3 trillion in January.

The RBI’s intervention involves purchasing dollars from banks in exchange for rupees, with an agreement to sell the dollars back at a later date. This mechanism effectively injects rupee liquidity into the system. The cumulative amount of funds injected by the RBI in the past month now totals approximately $47 billion. This infusion is in addition to other measures taken by the RBI, including auction-based open-market-bond purchases worth ₹1 trillion ($11.5 billion) and a prior foreign-exchange swap of $5 billion.

Despite these efforts, the rupee experienced a decline following the announcement of the auction results, falling 0.3% to 87.4900 per dollar. The crunch poses a threat to India’s slowing economy and is partly attributed to the central bank’s interventions in the foreign exchange market to protect the rupee from global volatility. The RBI has also added ₹1.8 trillion through longer-term repurchase auctions and reduced interest rates.

The central bank set a cutoff premium of 655.10 paise at Friday’s swap auction. The three-year onshore forward premium in the secondary market was last at 698.25 paise. Analysts suggest that the RBI is likely to implement further measures to address the persistent liquidity shortage. The rupee closed at 87.5125 per dollar, a 0.4% decrease.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.