The Plunge of the US Dollar and Treasuries: A Stark Warning to Trump from the Market

After Trump suspended some tariffs, the US market only held up for one day. Subsequently, as the US stock market fell overnight, US Treasuries and the US dollar once again entered a downward spiral, r

After Trump suspended some tariffs, the US market only held up for one day. Subsequently, as the US stock market fell overnight, US Treasuries and the US dollar once again entered a downward spiral, reflecting a fundamental lack of confidence in the US economy and financial system.

On Thursday, the US stocks, Treasuries, and the US dollar were hit by a wave of massive selling. The S&P 500 Index closed 3.5% lower as investors seized the opportunity of the previous day's historic rally to sell their positions. Long - term US Treasuries continued to decline, and yields soared again after a brief lull. The US dollar fell for the third consecutive day. Investors sold US assets and turned to safe - haven currencies such as the Swiss franc, which saw its largest one - day gain in a decade.

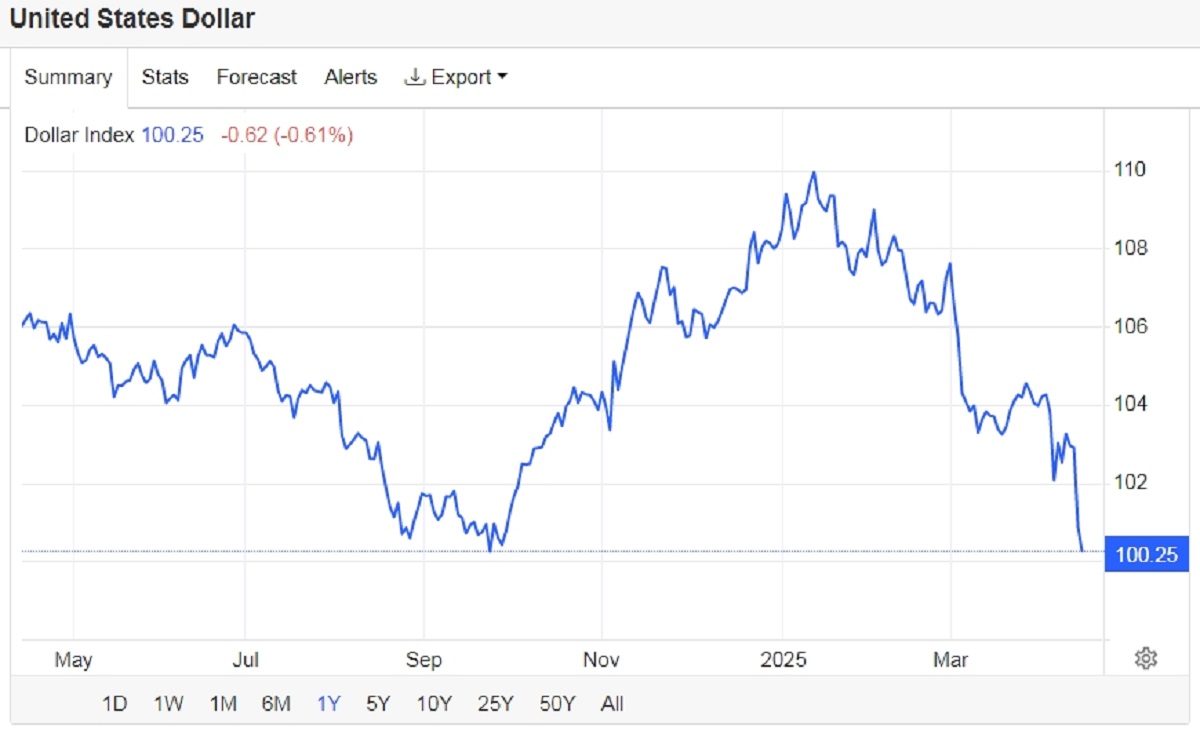

What makes this market decline unusual is that despite widespread investor panic, the US dollar and Treasuries, typically regarded as safe - haven assets, failed to attract safe - haven funds. Since the S&P 500 Index reached its peak on February 19, the US Dollar Index has dropped 4.5%. Since Trump announced reciprocal tariffs on almost all countries on April 2, the yield on US Treasuries has increased by approximately a quarter of a percentage point.

Renowned investor Peter Schiff pointed out in a statement that he had never witnessed such a large - scale sell - off of US assets. The US dollar, bonds, and stocks were all severely hit. He emphasized that the era of the US leveraging global economic advantages was coming to an end, and the market was about to face significant changes.

This abnormal phenomenon indicates a collapse in global investors' trust in US assets and serves as a serious warning to Trump.

When the US Becomes Unpredictable

The chaotic implementation of Trump's tariff policies, regardless of the ultimate outcome, has rapidly eroded market confidence in the US economy and is likely to continue to disrupt the market in the next three months.

The Wall Street Journal analyzed that in recent years, the US's faster growth rate compared to other major economies, technological advancements, and abundant supply of cheap energy had attracted global investors to pursue the so - called American Exceptionalism by purchasing US assets.

However, currently, the US has become less predictable, more confrontational, and more isolated. For foreign investors, the US is no longer as safe as it once was. This shift is altering the way global investors perceive the US.

Kim Forrest, Chief Investment Officer and Founder of Bokeh Capital Partners, noted that even in emerging markets, economic policies are relatively clear - cut. In contrast, in the US, it has become difficult to conduct fundamental analyses of some of the leading companies.

On Thursday, billionaire Ray Dalio, the founder of bridgewater Associates, stated that after the recent global market turmoil, investors remained in a state of shock and concern. He believed that the situation had a major impact on investors' psychology and their perception of the US's reliability, suggesting that more effective measures could have been taken to handle the situation.

Potential Decline in US Treasury Demand

In Dalio's view, the weakening of the US dollar and the change in the yield spread between 30 - year and 10 - year US Treasuries are crucial indicators, which may reflect whether investors are starting to shy away from assets that have long been considered the safest. He emphasized that the fundamental supply - and - demand issue of debt was a major concern.

Investors are worried that the Trump administration, having already imposed high - level tariffs on many countries in disregard of existing trade rules, may take more extreme economic measures in the future. This has increased the risks associated with holding US dollar - denominated assets.

After the Russia - Ukraine conflict, the US froze the foreign exchange reserves of the Russian central bank, causing many countries to worry about the security of their US dollar assets. Coupled with Trump's recent trade policies indicating a reduced role for the US in global trade, the importance of the US dollar as an international settlement currency may be undermined. As a result, global investors and central banks are becoming less willing to increase their holdings of US Treasuries.

For Trump, a weakening US dollar has one potential benefit: it can prevent the strong dollar from offsetting the trade - related impact of tariff policies.

However, this also comes at a cost. A decrease in demand for US dollar assets makes it more difficult for the US to finance its massive borrowing. The US still relies on foreign investors to roll over their existing bond holdings and purchase new bonds. Even a small - scale divestment can lead to a significant jump in yields.

Jay Barry, Head of Global Interest Rate Strategy at jpmorgan chase, estimated that for every $300 billion reduction in foreign official holdings of US Treasuries, the yield would increase by one - third of a percentage point.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.