Sequoia China has reduced its stake in Meituan three times this year to 1..86%

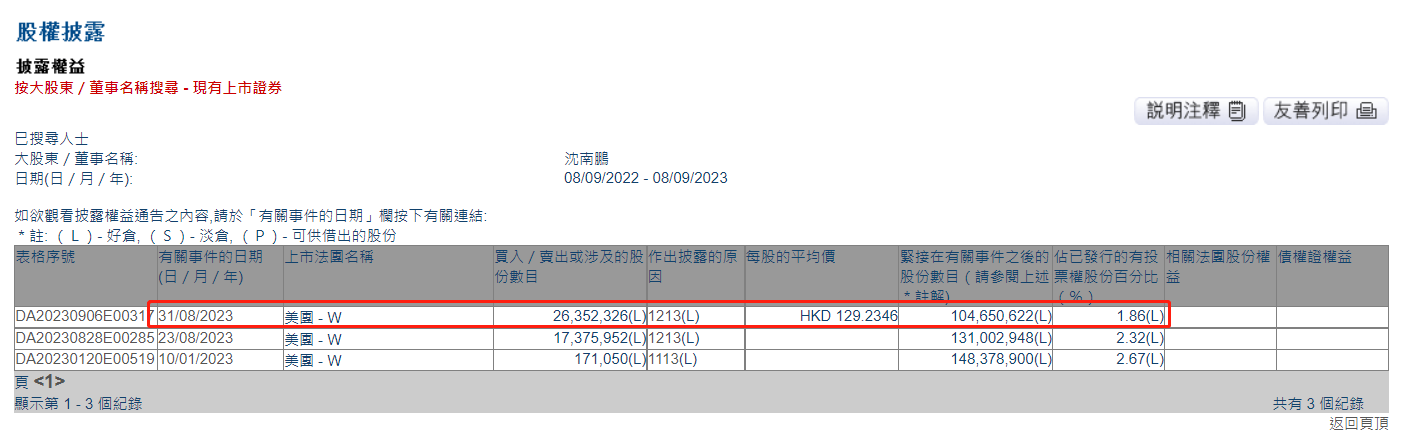

According to HKEx, on August 31, Red Shirt China Managing Partner Shen Nanpeng reduced his holdings of about 26.35 million shares of Meituan at an average price of about HK $129 per share, for a total of about HK $3.4 billion.。After the reduction, Shen Nanpeng's shareholding ratio increased from 2.32% down to 1.86%。

Recently, the US group was once again reduced by Sequoia China.。

According to HKEx, on August 31, Red Shirt China Managing Partner Shen Nanpeng reduced his holdings of about 26.35 million shares of Meituan at an average price of about HK $129 per share, for a total of about HK $3.4 billion.。After the reduction, Shen Nanpeng's shareholding ratio increased from 2.32% down to 1.86%。

Supplementary information shows that the share reduction is related to fund entities controlled by Shen Nanpeng, and a number of Sequoia China funds headed by him and Shen Nanpeng are considered to hold interests in such shares.。

For the reduction, some market participants said that this is the normal exit of the fund, Sequoia China is a long-term investor of the US group, has invested for 17 years, the reason for the reduction is to return the investment principal and profits to investors, not to look down on the fundamentals of the US group.。

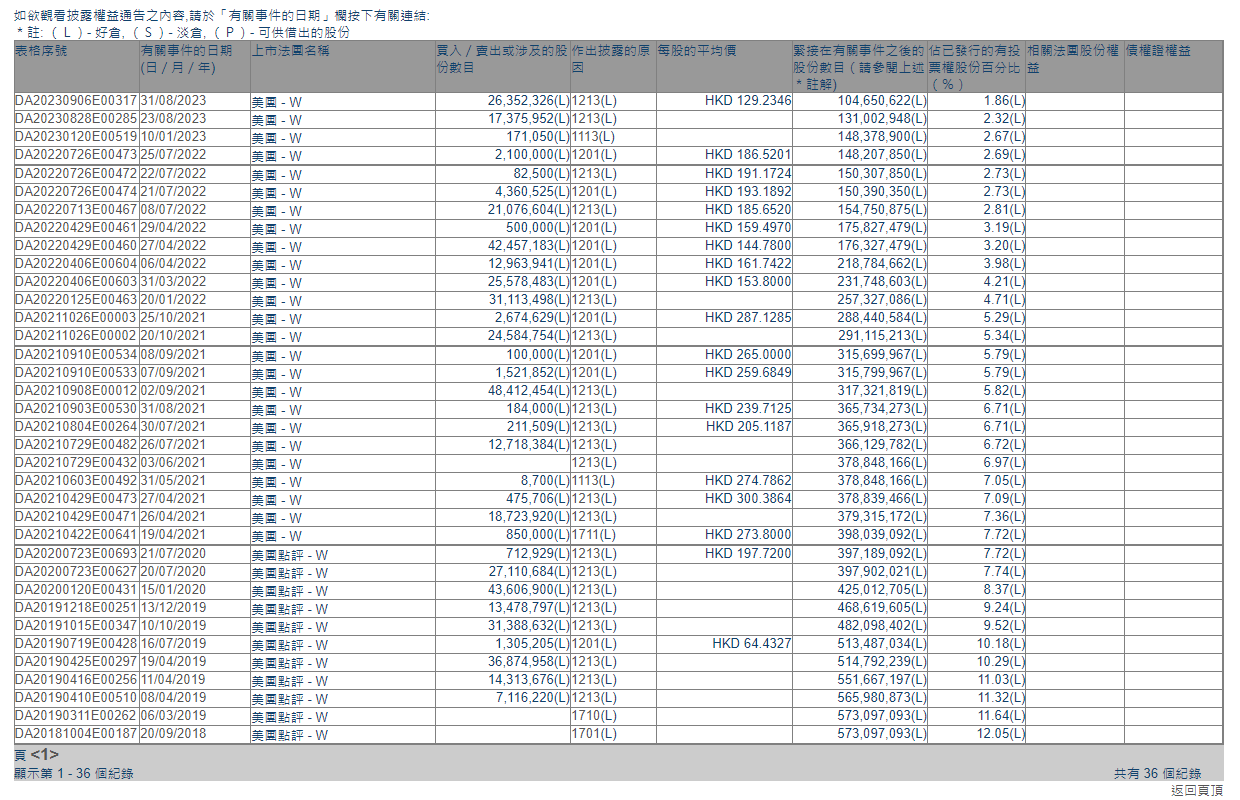

This is the third time that Sequoia China has reduced its holdings of Meituan this year.。According to HKEx data, Shen Nanpeng previously reduced his holdings by 170,000 shares on January 10 and then by 17.38 million shares on August 23.。A total of 43.9 million shares have been reduced so far this year.。

Meituan and Sequoia China have a long history。In 2006, Sequoia China was also Sequoia Capital at the time, acting as its sole investor in Dianping's Series A financing.。In 2010, Sequoia Capital became a Series A investor in Meituan again, and was also the only investor。

In 2015, Meituan and Dianping announced a joint statement formally announcing a strategic partnership to jointly establish a new company.。In 2018, Meituan landed on the Hong Kong Stock Exchange after several rounds of financing, becoming the second "same share with different rights" stock in the HKSAR after Xiaomi.。And from Round A to the listing, Sequoia Capital has been "accompanying" Meituan.。Meituan has also become one of the benchmark companies for Sequoia Capital's successful investment in China.。

Sequoia Capital's shareholding at the time of Meituan's listing was 12.05%。However, in recent years, Sequoia Capital has significantly reduced its shareholding by repeatedly selling Meituan shares or distributing shares to LPs.。According to the HKEx, Shen Nanpeng has reduced his holdings of Meituan shares as many as 36 times since 2018。

Of these, the point in time for the intensive reduction occurred in 2021, with a total of 13 reductions。Although Meituan's share price has experienced ups and downs during this period, it is generally in a high range, with the share price basically above HK $200, peaking at HK $460.。Yesterday (September 7) Meituan closed at HK $125, down 2.57%。

Sequoia China's response to the reduction of its holdings, which it said was "not bearish on Meituan's fundamentals," is still valid, as Meituan just released strong second-quarter earnings at the end of August.。According to the financial report data, the Company achieved revenue of 68 billion yuan (RMB, the same below) during the reporting period, up 33.4%, exceeding analysts' expectations of $67.2 billion。Net profit of 4.7 billion yuan, net loss of 11 in the same period last year..1.6 billion yuan, year-on-year turnaround。Adjusted EBITDA76.800 million yuan, exceeding analysts' expectations of 66.600 million yuan, up 102% year-on-year, a record high。

Meituan's outstanding performance comes from a strong recovery in consumption.。On the online side, Meituan's food and beverage delivery business and Meituan flash sales both recorded strong growth.。Among them, the peak daily orders of the US group flash purchase exceeded 11 million in the second quarter.。On the offline side, driven by the recovery in tourism, Meituan's inbound, hotel and travel business transactions grew by more than 120% year-on-year, with the number of active merchants and annual trading users both hitting new highs.。

However, with the expansion of short video platforms such as tremolo to takeout, Ctrip and other travel software carve up travel, hotels and other offline business, the pressure on the US group is not easy。Meituan can withstand the pressure, hand over the turnaround Q2 results have been pretty good。

For the follow-up performance of the US group, the big banks such as Xiaomo, Bank of America and HSBC still give it a "buy" or "overweight" rating.。

According to Xiaomo, investors were previously concerned about the competitive pressure on Meituan, and Meituan's second-quarter results should be gratifying to investors, as it shows that the company's competitive strategy has achieved initial results this year and has a good return on investment.。Xiaomo expects that due to Meituan's effective competitive strategy and sound execution, investors' concerns about competition will be alleviated in the next few quarters, so Meituan-W "overweight" rating, the target price slightly increased from HK $190 to HK $195.。

But unlike Komo, Bank of America and HSBC have lowered their target prices to varying degrees.。

Bank of America released a research report saying it is aware that Meituan is actively exploring new demand and launching several new products, including more affordable group purchase delivery products for price-sensitive users and upgrades to its membership system.。However, due to the macroeconomic impact of the third quarter of the food and beverage delivery business may slow down, so the Bank of America will be the United States group Q3 food and beverage delivery revenue growth forecast from 22% to more than 10%, while the order volume growth is expected to rise slightly, but the average revenue will decline slightly.。Finally, the bank reiterated Meituan's "buy" rating and lowered its target price slightly from HK $189 to HK $186.。

HSBC, on the other hand, believes that Meituan is actively increasing subsidies to users and incentives to merchants in response to competitive pressure from Douyin.。Based on Meituan's strong defense, the bank raised its GTV forecast for its store, hotel and travel business this year by 9%, increasing gross margin by 2 percentage points; and expects Meituan's third-quarter revenue to grow 21% year-on-year, with adjusted EBITDA of approximately RMB 9 billion.。In this regard, HSBC will maintain Meituan-W "buy" rating, but its target price is lowered from HK $215 to HK $200.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.