Q2 barely passed Q3 "splash cold water" ahead of schedule?

After the U.S. stock market on August 3, technology giant Apple releases its fiscal 2023 third-quarter results。Data show that Apple's third-quarter revenue reached 817.$9.7 billion, down 1.4%, Apple's third consecutive quarterly revenue decline since 2016; net profit of 198.$8.1 billion, up 2.3%。

After the U.S. stock market on August 3, technology giant Apple released its third fiscal quarter 2023 (second quarter 2023) results report。Report data shows that Apple's third-quarter revenue reached 817.$9.7 billion, down 1.4%, Apple's third consecutive quarterly revenue decline since 2016; net profit of 198.$8.1 billion, up 2.3%; adjusted EPS is EPS 1.$26, up 5% YoY, the market had expected 1.21美元。

By business。Sales of Apple's core product iPhone in the third quarter were 396.$6.9 billion, below market expectations of $40.2 billion, down 2.4%; Mac business revenue of 68.$4 billion, down 7.34%; wearable (AirPods, Apple Watch), home and accessories business revenue of 82.$8.4 billion, up 2.47%; iPad revenue was 57.$9.1 billion, down 19.84%; services (App Store, Apple Music, Apple TV +, etc.) revenue of 212.$1.3 billion, up 8.21%。

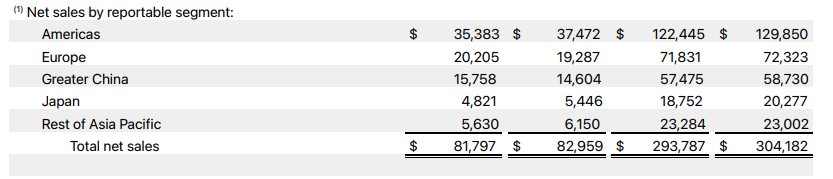

by region.。Apple's Americas segment revenue was 353 in the third quarter..$8.3 billion, compared with 374.$7.2 billion; European segment revenue of 202.$05 billion, up from 192 in the same period last year.$8.7 billion; Greater China revenue 157.$5.8 billion, compared with 146 in the same period last year..$04 billion compared to an increase of 7.9%, and revenue as a percentage of Apple's total revenue was 19.26%; Japan segment revenue 48.$2.1 billion, compared to 54.$4.6 billion; Rest of Asia Pacific revenue 56.$3 billion, compared to 61.$5 billion。

Commenting on the quarter's performance, Apple CEO Tim Cook (Tim Cook) said, "Our services revenue is at an all-time high, boosted by more than 1 billion paid subscribers, while iPhone sales in emerging markets continue to be strong, further fueling iPhone expansion.。"

Cook also said that iPhone sales in China achieved double-digit percentage growth, and sales of other products were also high.。Cook said: "We also set quarterly records for wearables, home and accessories and services in China.。"

Apple CFO Luca Maestri said fiscal third-quarter results improved year-over-year from the previous quarter, with an all-time high base of active device installations in all geographic segments。Operating cash flow for the quarter was as high as $26 billion, with more than $24 billion returned to shareholders.。

In addition, Masteri warned that fiscal fourth-quarter year-over-year results would be similar to fiscal third, suggesting that revenue may continue to fall year-over-year, unlike Wall Street's expected return to growth.。He expects iPhone and services revenue to grow from the third quarter, but the iPad and Mac are likely to see double-digit percentage declines.。

"Apple knows brother" Guo Mingxuan: new iPhone demand or further reduced!

From the perspective of the global smartphone industry, market research firm Canalys released the second quarter of 2023 global smartphone market shipment data show that in the second quarter of 2023, the global smartphone market fell 10% year-on-year to 2.5.8 billion units, the market recession has slowed。

Among them, Apple shipped 43 million units in the second quarter, 49.5 million units in the same period last year, an annual growth rate of 13%, but Apple still ranked second in the global smartphone world with a 17% market share in the quarter, Samsung ranked first, Xiaomi (including POCO), OPPO (including one plus), Chuanyin followed closely.。

It is worth mentioning that the entire consumer electronics industry has entered the traditional peak season, according to previous years, every September, Apple will release new iPhone products, this year will be the iPhone15 series, Huawei and other companies will also launch heavy new products in the quarter.。Previously, the market generally expected that the consumer electronics industry will gradually recover from the beginning of the third quarter of this year.。

On August 3, Apple's leading analyst, Ming Kuo, predicted that demand for the upcoming iPhone 15 series this year would be lower than for the iPhone 14 series, and that lower demand could put Apple suppliers under pressure to grow revenue in the second half of 2023.。He pointed out that despite the decline in shipments in the fourth quarter of 2022, most of the component shipments are scheduled to remain unchanged in the fourth quarter of 2022, and unless demand for the iPhone 15 is better than market expectations, most suppliers will face growth pressure in the second half of the year due to lower demand for the iPhone 15 than for the iPhone 14.。

Regarding Apple's previous remarks on generative AI, Guo Mingyi said there is no indication that Apple will integrate AI edge computing with hardware products in 2024, indicating that AI is unlikely to contribute to boosting Apple's stock price or supply chain in the near future.。

He believes that Apple's progress in this technology is significantly behind competitors。In contrast, companies like OpenAI and Google have made major announcements in the space.。Google has even integrated AI into many of its services, such as Google Maps and YouTube.。And Microsoft is also integrating its Bing chatbot with apps like Office 365。

What does Apple management say??

On the post-earnings conference call, Apple executives gave updated answers on each product, business and subsequent development。

Aspects of Artificial Intelligence。Just like last quarter's conference call, Apple CEO Cook is still just passing along when it comes to artificial intelligence。Cook said, "Apple has been working on generative artificial intelligence and other models for many years, and we see artificial intelligence and machine learning as core foundational technologies.。They are embedded in almost every product we make and are an integral part of。"Building on that research, we've been working on artificial intelligence and machine learning for years, including generative AI.。"

Cook also said it will continue to focus on using these technologies to advance Apple products, and that Apple tends to "announce them as they go to market."。

Head-mounted MR aspect。At the WWDC Global Developers Conference held not long ago, Apple launched a mixed reality headset called Vision Pro, but less than two months after its launch, Apple slashed its shipments by 75%。Cook also commented on the device during the earnings call: "Apple Vision Pro is an engineering marvel, built on decades of innovation that only Apple can achieve, it is the most advanced personal electronic device ever, and we are excited by the reaction of the media, analysts, developers and content creators who have had the opportunity to try it out.。"

Service business aspects。In April, Apple and Goldman Sachs jointly launched a long-promised high-yield savings account with an annual savings rate of up to 4.15%。According to Apple CFO Maestri, the savings account has taken in $10 billion in deposits since it was launched in April.。

Masteri also said paid subscriptions for all services on Apple's Q2 platform topped 1 billion, an increase of 1 in the past 12 months..500 million, almost double the number of paid subscriptions three years ago。

In addition, Q2 saw double-digit percentage increases in the number of Apple trading and paid accounts, both record highs。

Regional aspects of India。For the current and subsequent growth opportunities in the Indian market, Cook said that the company's revenue in the Indian market reached a record high in the third quarter, achieving high double-digit growth, two Apple retail stores opened in India in the third quarter, and the initial performance has exceeded our expectations.。

India is the second largest smartphone market in the world, we should do very well in India, but the current market share is still very small, which also means that the future opportunities are great, we will fully promote the growth of the market business。

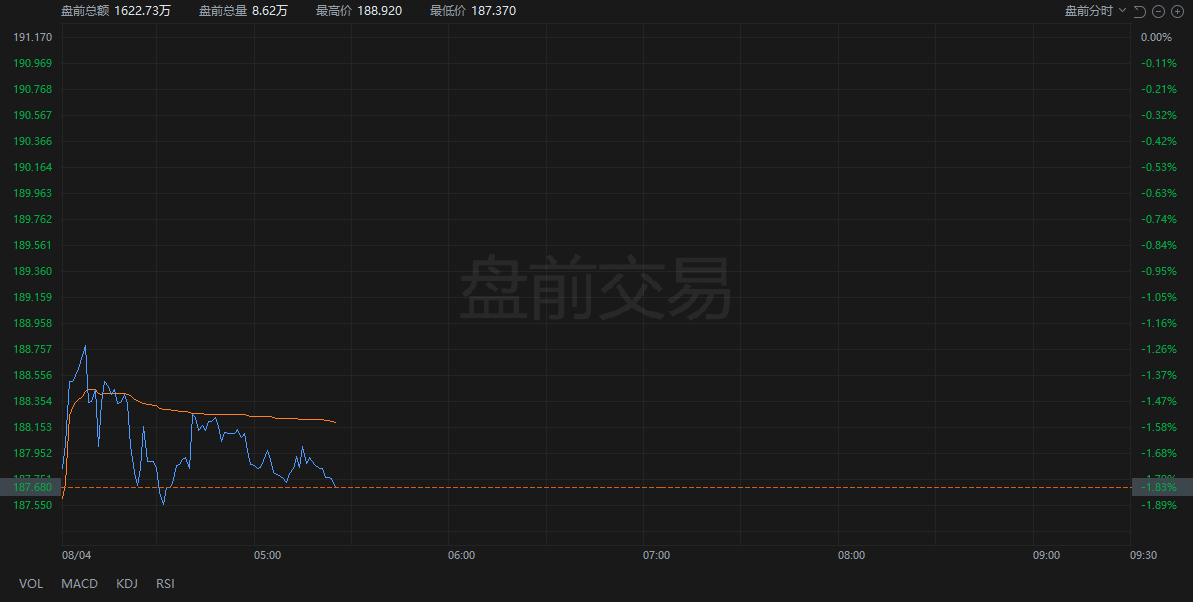

Apple's shares fell nearly 2 percent in premarket U.S. stocks on Aug. 4 on tepid third-quarter results and weaker-than-expected earnings guidance。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.