US non-farm payrolls in September still beat expectations under strike tide

Experts' hawkish view of the future is supported by market pricing - after the data was released, the relevant markets bet that the probability of the Fed raising interest rates again during the year has increased。For now, the market prefers that the Fed will raise interest rates again at its December meeting。

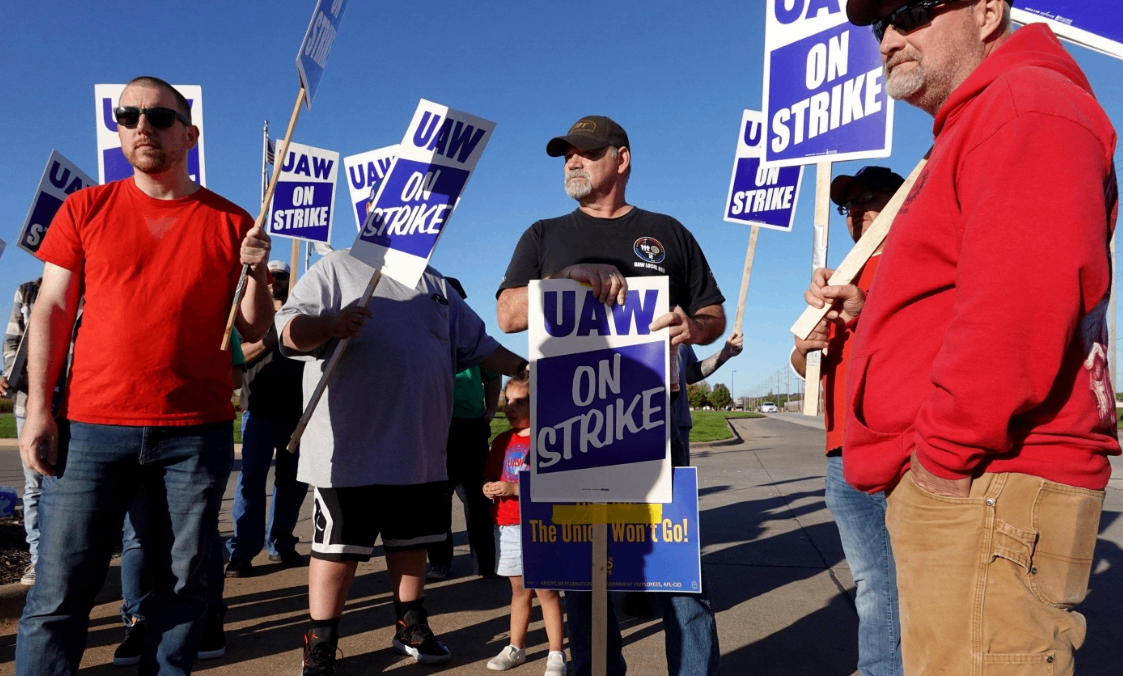

On October 6, local time, the U.S. Department of Labor released U.S. non-farm payrolls data for September.。According to statistics, the U.S. labor market remained hot in September, despite recent strike action by the National Auto Workers Federation (UAW) and Kaiser Permanente Health System.。

Non-farm payrolls rose more than expected in September, with average hourly wages falling year-on-year.

Data show that the United States in September new non-farm payrolls reached 33.60,000, significantly higher than market expectations of 170,000 and the previous value of 22.70,000 people。Among them, two industries related to strike action - the automotive industry and the health care and social assistance industries - had zero new jobs each..890,000 people and 6.60,000, representing its negative impact was not reflected in the September data。Experts expect the recent widening of the strike wave to have an impact on next month's non-farm data。

In addition, the U.S. Department of Labor also revised the July and August non-farm payrolls data: increasing the July 2023 data by 15.70,000 people up to 23.60,000, increasing the August 2023 data by 18.70,000 people up to 22.70,000 people, a total of 11 in July and August.90,000 people, the resilience of the U.S. labor market is further reflected。

On the other hand, the market is concerned that the growth rate of hourly wages has remained unchanged on a year-on-year basis, a factor that is considered to be closely related to the level of inflation in the United States.。U.S. hourly wages rose 0% month-on-month in September, report shows.2%, flat at 0 of the previous value.2%, slightly below market expectations of 0.3%; YoY increase of 4.2%, slightly lower than the previous value and market expectations of 4.3%。

Elsewhere, U.S. jobless rate held steady at 3 in September.8%; labor force participation rate remains at 62.8% unchanged。

Specifically, in September, new non-agricultural, service production increased by 23.40,000, up 130,000 from the previous value; commodity production increased by 2.90,000, up by 4.70,000 people。Among them, health care and social assistance, leisure and hospitality, government, construction, and manufacturing added 6.60,000 (average monthly increase of 9 in the first three months.40,000), 90,000.60,000 (average monthly increase of 3 in the first 3 months.60,000), 7.30,000 (average monthly increase of 5 in the first 3 months.30,000), 1.10,000 (average monthly increase of 2 in the first 3 months.60,000 people), 1.70,000 (average monthly increase of 0 in the first 3 months.40,000 people)。It can be seen that this month's new non-farm employment is mainly concentrated in the leisure hotel industry, government and education and health care industry.。Among them, the new employment in the leisure hotel industry increased the most from the previous month.。

Data better than expected market pricing will raise interest rates again this year

Commenting on the data, Seema Shah, chief global strategist at Principal Asset Management, said the surge in non-farm payrolls data may not be good news for the market.。Not only do they signal that the economy is overheating and the Fed will need to respond with more rate hikes, but they reinforce the claim that "the Fed will keep interest rates at higher levels for longer" that has dogged bond markets over the past few weeks.。Markets want a perfect landing, but they're dealing with an upward-sloping economy。

In addition, the downward pace of wage growth has failed to satisfy experts。Shah said the slight slowdown in wage growth simply could not offset the much higher-than-expected increase in employment and the upward revision to previous months' data.。Caitong Securities also said that because the year-on-year payroll and the U.S. CPI service items in addition to housing and other sub-items are closely related, its resilience or high inflation has a certain supporting effect, making it difficult for inflation to fall back to the target level of 2% in a short period of time.。

Experts' hawkish view of the future is supported by market pricing - after the data was released, the relevant markets bet that the probability of the Fed raising interest rates again during the year has increased。According to Fed Watch data from CME, after the release of the non-farm report, the market is betting that the probability of the Fed suspending rate hikes in November and raising rates by 25bp is 72.9% and 27.1%, the previous values were 79.9% and 20.1%; market bets on the probability of the Fed not raising rates in December and raising rates by 25bp are 57.6% and 36.7%, the former value was 66.9% and 29.8%。For now, the market prefers that the Fed will raise interest rates again at its December meeting。

China Merchants Securities said, further, in the job market there is a gap stage, the strike will push up hourly wages and inflation, making the Fed more hawkish; but in the job market supply and demand balance, the strike will instead push up the unemployment rate, making the Fed policy shift。At present, the impact of the strike is shifting from the former to the latter.。But before the Fed really turns, the market may face a bigger challenge。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.