Bitcoin Exchange Supply Sinks to 7.53%, BTC Falls Below $87,000 Bitcoin Exchange Supply Sinks to 7.53%, BTC Falls Below $87,000

Key momentsA notable reduction in Bitcoins exchange supply has been documented by Santiment, with figures dropping to 7.53%.Bitcoins price remains susceptible to short-term volatility. The currency is

Key moments

- A notable reduction in Bitcoin’s exchange supply has been documented by Santiment, with figures dropping to 7.53%.

- Bitcoin’s price remains susceptible to short-term volatility. The currency is hovering around $87,000 at press time.

- Donald Trump’s announcement regarding a 25% tariff on auto imports contributed to market uncertainty surrounding speculative assets.

An Increasing Number of Individuals Are Choosing to Hold Onto Their Bitcoins

A recent analysis by Santiment revealed a significant shift in Bitcoin’s exchange supply, which has reached a mere 7.53%. This figure, reminiscent of levels seen in February 2018, underscores a growing inclination among investors to “hodl” Bitcoin holdings for extended periods.

In addition, it is estimated that 2-3% of the global population now holds Bitcoin, with approximately 172,705 Bitcoins being purchased. Experts attribute this increased adoption to the launch of Bitcoin spot ETFs, which have facilitated easier access to the cryptocurrency for traditional investors. However, the Bitcoin spot ETF category has also experienced significant outflows, partially offsetting the gains realized after Bitcoin’s recent historic high of $109,000.

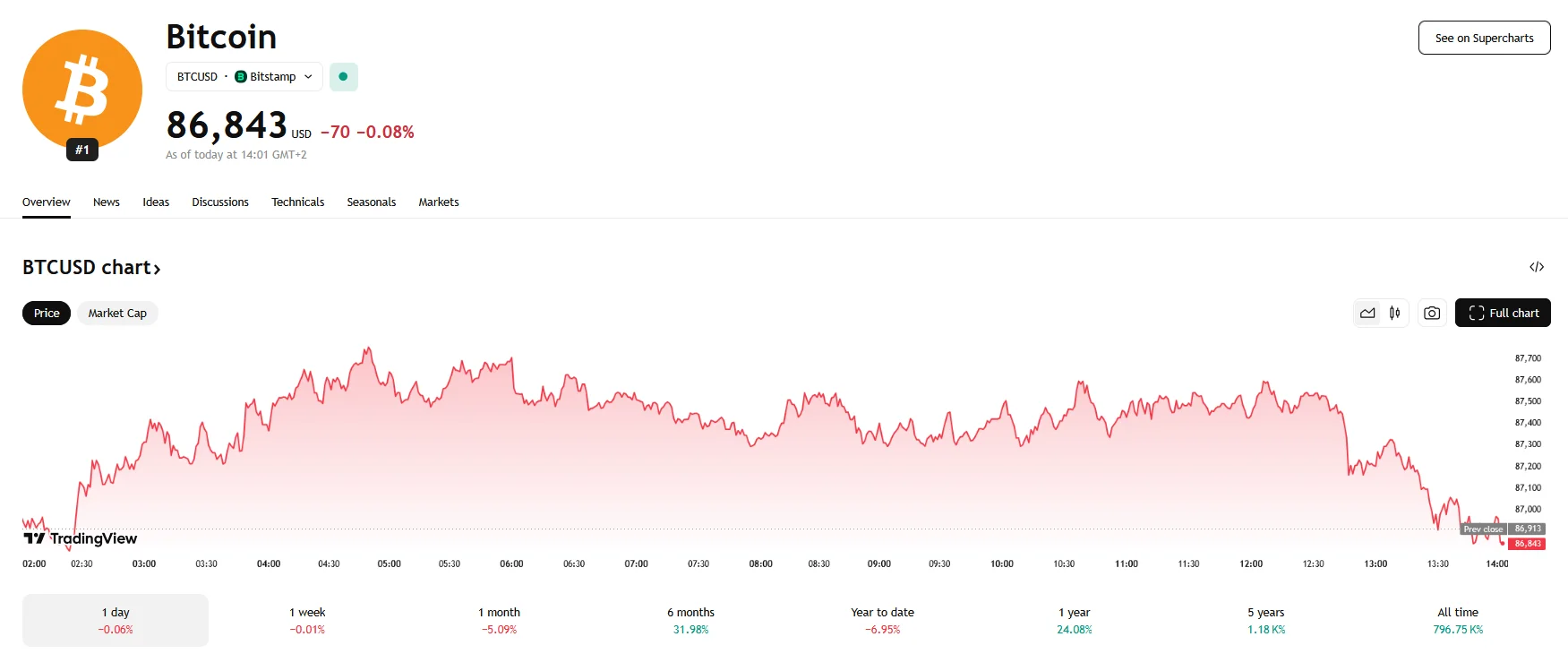

However, Bitcoin continues to be subject to short-term price fluctuations. Thursday saw Bitcoin’s price experiencing a downturn, falling below $87,000, which marked a decline of 0.08%. Further volatility saw Bitcoin trade between $86,800 and $87,020 as the currency struggled to achieve a steady rebound.

This movement occurred amidst growing global economic uncertainty, largely attributed to U.S. President Donald Trump’s 25% tariff on foreign-made automobiles and auto parts. The implementation of these tariffs, set to take effect on April 2nd, has stirred concerns about increased volatility in global equity markets, leading to a risk-off sentiment among investors.

Furthermore, a report dubbed “Forging Long-Term Holders” by Glassnode notes that short-term holders are experiencing considerable financial strain. Glassnode’s analysis indicates that Bitcoin’s value is currently confined to a trading corridor between $78,000 and $88,000. This price stability is accompanied by a noticeable decrease in both profit-taking and loss-realization transactions, signaling a decline in market demand and a reduction in selling pressure. Moreover, a significant number of investors are now holding Bitcoin at a loss, as its current market value is less than their original purchase price.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.