Yield spreads still huge Yen regains favor with carry trade investors

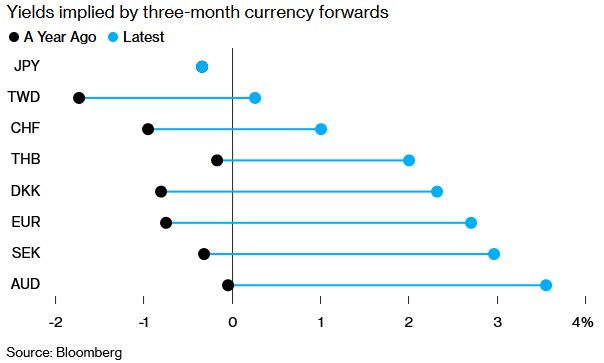

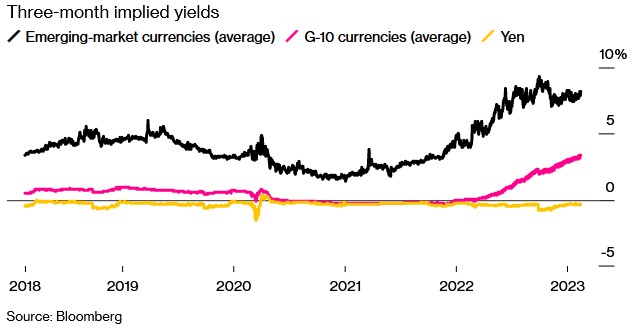

The yen is back as the most attractive option for arbitrage traders。Yen yields remained unchanged, while other currency yields rose, as the Bank of Japan firmly pursued ultra-loose monetary policy。The data shows that in terms of the three-month implied yield in the foreign exchange forward market, the yen's yield is -0.4%, the lowest of the 31 currencies analyzed。

The yen is back as the most attractive option for arbitrage traders。Yen yields remained unchanged, while other currency yields rose, as the Bank of Japan firmly pursued ultra-loose monetary policy。The data shows that in terms of the three-month implied yield in the foreign exchange forward market, the yen's yield is -0.4%, the lowest of the 31 currencies analyzed。

1, the yen regained the favor of arbitrage traders.

In carry trades, investors borrow "cheap" currencies (such as the yen) and invest in high-yielding government bonds of other countries to obtain spreads.。Yen has long been the most popular currency for arbitrage traders due to perennial weakness。However, in 2022, as the yen plummets and hedging costs soar, it becomes unprofitable for investors to borrow yen for carry trades。

Hideki Shibata, senior interest rate and foreign exchange strategist at the Tokai Tokyo Research Institute, said: "As a funding currency, the yen now has no competitors.。"The yield spread is large enough that the market will eventually realize that the yield spread won't close anytime soon."。"

The carry trade remains one of the highlights of the foreign exchange market。The Bloomberg GSAM FX Spread Index is up about 1 this year after surging 8% in 2022.7%。Instead, an indicator of global bond markets is up less than 1% this year after falling a record 16% last year.。

As the European Central Bank and the Swiss central bank began to tighten monetary policy in July and September last year, the implied yields on the euro and the Swiss franc, two equally common sources of carry trade funding, soared.。Arbitrage traders have many options when it comes to buying currencies, with the three-month implied returns of the US dollar, New Zealand dollar and Canadian dollar all exceeding 4 per cent, while the implied returns of some emerging market currencies, such as the Hungarian forint, the Brazilian real and the Mexican peso, are as high as nearly 17 per cent.。

2, the Bank of Japan policy adjustment or bring risks.

It is worth noting that arbitrage traders may move back away from the yen as a potential policy correction by the Bank of Japan could push the yen higher。Bank of Japan management will usher in a major change in April, economist and former Bank of Japan monetary policy committee member Kazuo Ueda (Kazuo Ueda) will succeed Haruhiko Kuroda as the next governor of the Bank of Japan。

While some investors expect Kazuo Ueda to end the Bank of Japan's negative interest rate policy, such a move won't necessarily be enough to close the huge yield gap between the yen and other currencies.。Kazuo Ueda's vote against ending the zero interest rate policy when he was a member of the Bank of Japan's board of directors in 2000 and his recent comments about easing monetary policy suggest that he will not be in a hurry to raise interest rates。

Strategists seem to be starting to be bullish on the yen's funding potential。Goldman Sachs strategists, including Kamakshya Trivedi, recommended the yen to arbitrage traders in emerging markets in a recent report (if economic growth in emerging markets exceeds expectations)。The yen "could be the best provider of funds for unexpectedly positive global economic growth and rising U.S. Treasury yields," strategists said.。

Adam Cole, chief foreign exchange strategist at RBC Capital, agrees that the changing relationship between the yen, bonds and stocks is making the yen a more "effective" funding currency.。Trading in the yen is no longer a safe haven as it once was, the strategist said, eliminating the historical inefficiency of arbitrage traders, "If this is no longer the case, does this mean that the yen is becoming an alternative financing option??The answer is yes。"

(Author: Zhuang Lijia)

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.