Cloud business "competition," Microsoft 2023Q3 performance exceeded expectations! Blizzard acquisition deal also made positive progress

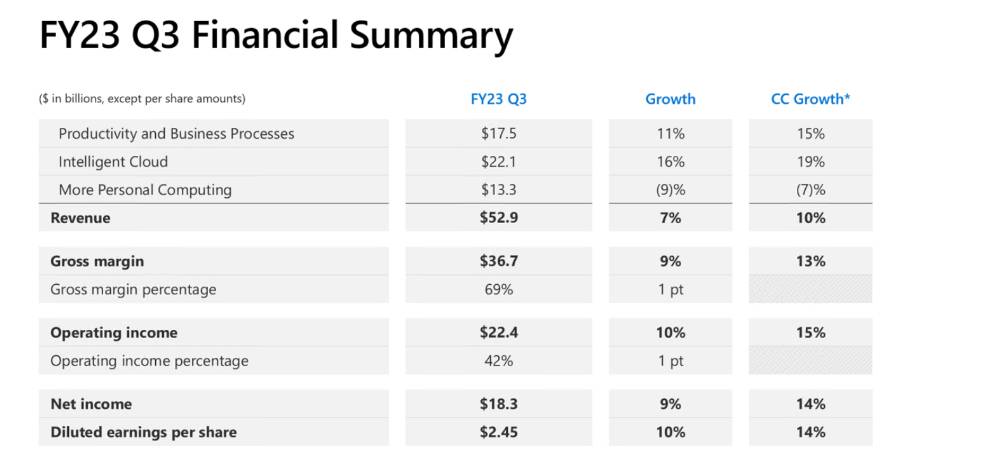

After the U.S. stock market on April 25, Microsoft announced its third-quarter 2023 results for the fiscal year ended March 31.。Financial data show that Microsoft's revenue in the last quarter was $52.9 billion, up 7% year-on-year, higher than market expectations of 510.$300 million; Microsoft operating profit up 10% YoY to $22.4 billion; net profit up 9% YoY to $18.3 billion; net earnings per share up 10% YoY to $2.$45, higher than market expectations of 2.$2.4 billion。

As the first Silicon Valley giant to trigger the "AI war," Microsoft's earnings report will undoubtedly be the focus of investors' attention this week.。

After the U.S. stock market on Tuesday, April 25, Microsoft announced its third-quarter 2023 results for the fiscal year ended March 31.。Financial data show that Microsoft last quarter revenue of $52.9 billion, an increase of 7%, although only single-digit growth, but still higher than the market expectations of 510.$300 million; Microsoft operating profit up 10% YoY to $22.4 billion; net profit up 9% YoY to $18.3 billion; net earnings per share up 10% YoY to $2.$45, higher than market expectations of 2.$2.4 billion。

The reason why Microsoft's quarterly profit and sales exceeded market expectations was mainly due to the elasticity of enterprise cloud computing demand and an optimistic outlook for its artificial intelligence services.。

By business, the production and commercial business contributed $17.5 billion to Microsoft's revenue last quarter, up 11% year-over-year.。Among them, driven by Microsoft Office 365 software revenue growth of 14%, office commercial products and cloud services business increased by 13% year-on-year; office consumer products and related cloud services business increased by 1% year-on-year; LinkedIn contributed revenue growth of 8% year-on-year; dynamic products and related cloud services revenue increased by 17% year-on-year。

The smart cloud business performed more brightly in the last quarter, with revenue of $22.1 billion, a year-on-year growth rate of 16%, the highest among the three businesses.。The reason for this high revenue was mainly driven by a 27% year-over-year increase in revenue from Azure and other cloud services, and a 17% year-over-year increase in revenue from server products and related cloud services.。

PC business revenue fell 9% year-on-year to $13.3 billion。Microsoft's device business revenue fell 30% year-over-year and Windows system revenue fell 28% year-over-year due to weak global PC business。But fortunately, the rest of the sub-business slightly averaged its total revenue position, with Windows business products and related cloud services revenue up 14% year-over-year, Xbox content and services revenue up 3% year-over-year, and search and news advertising revenue up 10% year-over-year.。

Although total revenue growth has slowed to single digits after five years of relatively strong growth, products such as Microsoft's Azure and Office 365 cloud products continue to attract customers。Microsoft also laid off 10,000 employees this year, including those in key businesses such as Azure and security software, in a bid to ward off a further economic slowdown worldwide.。

Amy Hood, Microsoft's chief financial officer, said in an interview that the quarter had improved compared to the previous quarter and that Microsoft was better able to convince customers to add new products to their contracts when they re-signed them.。That includes security software and Teams conferencing tools, she said.。For the fourth quarter, Hood forecasts that Azure will continue to grow by 26% or 27%, excluding the impact of currency movements.。

For Microsoft's better-than-expected earnings, Synovus Trust Co.Dan Morgan, senior portfolio manager for the company, said: "This is a solid report on a low-threshold quarter.。He said the company's tepid January forecast for the quarter lowered expectations.。

It's worth noting that Microsoft shares surged nearly 8% in response to after-hours U.S. stocks on Tuesday, boosted by better-than-expected earnings。

How Microsoft's AI business is evolving?

As Microsoft CEO Satya Nadella turns to a massive investment in artificial intelligence, including a previously reported $10 billion investment in OpenAI, and a new Bing Internet search chatbot, all will boost Microsoft's strategy for future sales of businesses such as Azure, search advertising and office tools.。

Despite the tech industry's enthusiasm for generative AI and the belief that the technology could spark a new wave of growth in cloud computing customer spending, some analysts say generative AI is unlikely to drive meaningful sales for the time being.。

In this regard, Stifel Financial Corp analyst Brad Reback (Brad Reback) said: Microsoft's influence in AI is unique, but this obviously will not have the slightest impact on revenue.。

Microsoft is not satisfied, in the last quarter, Microsoft made full use of its investment and cooperation with OpenAI, launched a large-scale reform of the new Bing search engine。The engine, enhanced with AI chat, tries to mount a real challenge to market leader Google。And Microsoft told analysts at the launch of the product that any earnings from the search business could generate billions of dollars in revenue in the future.。

Hood also said that the company will invest enough money in infrastructure to support its own, partner OpenAI and other customers' systems.。"We are committed to leading the wave of AI platforms and investing to support it."。"She said to。

In addition, Microsoft has reorganized its Office, accounting and security software, adding artificial intelligence capabilities.。Artificial intelligence products, especially those from Bing and Office, have been launched in recent weeks, Hood said, and while they haven't delivered much of a boost in sales yet, the company is seeing promising initial signs in terms of usage and customer demand.。

During the earnings call, Nadella told analysts that Microsoft's Azure OpenAI service is a cloud service that can use OpenAI products, and the number of customers increased 10 times from the previous quarter to 2,500.。The GitHub division for software developers, which launched its AI Copilot code generation tool for enterprises three months ago, has now registered 10,000 organizations, he said.。

Nadella also said that the new Bing, which was newly launched this year, has a place in the US search market, but did not provide specific indicators.。He said that since the launch of the AI version of Bing in February, the search engine has more than 100 million daily active users, and the number of mobile Bing applications installed has quadrupled.。

"We look forward to continuing this journey in search, the largest software category, which is a shift of the times."。"。Nadella said。

Activision Blizzard acquisition expected to be approved this week

Since Microsoft announced its acquisition of Activision Blizzard, the game industry's most sensational deal ever has been the focus of attention from institutions, media and game users, but the deal process has been fraught with twists and turns。In fact, Microsoft's acquisition was mainly due to the fact that the size of the money involved in the transaction was too large and the review process involved was too complicated, which led to a series of subsequent problems.。

A year ago, Microsoft first announced the acquisition of Activision Blizzard for $68.7 billion in cash at a 45% premium.。In its biggest acquisition ever, Microsoft wants to add blockbuster titles like Call of Duty and World of Warcraft to a business that already includes Xbox consoles, Halo and Minecraft world-building software.。

The transaction is expected to close in fiscal year 2023.。When the deal is completed, Microsoft will become the world's third-largest gaming company by revenue, after Tencent and Sony.。

Although the Federal Trade Commission (FTC) blocked the deal last December on antitrust grounds。But recently, according to sources, Microsoft is optimistic about getting approval from the UK this week, as antitrust regulators in the UK and the EU have made surprising progress in approving the merger in recent weeks, with Microsoft promising to give rivals including Sony and Nintendo a Call of Duty video game franchise。

Upon approval, Microsoft plans to close the deal quickly at $95 per share.。Microsoft is understood to have made concessions to keep the UK Competition and Markets Authority (CMA) happy with the controversial acquisition.。Microsoft has agreed to provide cloud game streaming services for Activision Blizzard games for companies like Ubitus and Boosteroid for the next 10 years, and has signed a deal with Nintendo.。

But the acquisition process will still not be smooth sailing, as even if UK and European regulators approve the deal, the deal will still face litigation challenges from US regulators。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.