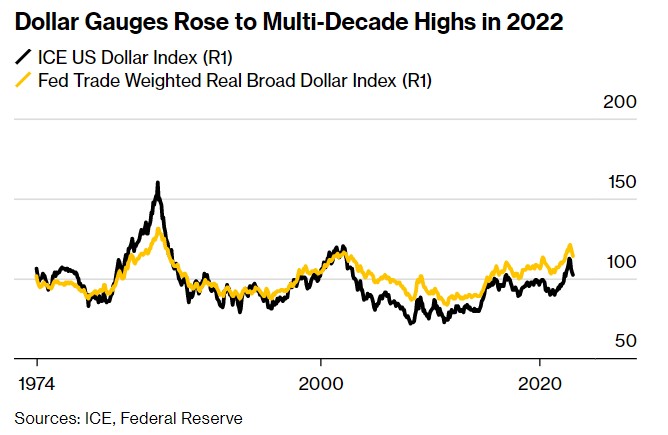

"The dollar peaked" voice more and more! A number of institutions threatened: the dollar will be structurally weaker

After the dollar strengthened and upended the global economy in a way rarely seen in modern history, some of the world's top investors are now betting that the worst of the dollar's surge is over and into what will be a multi-year downward trend。

After the dollar strengthened and upended the global economy in a way rarely seen in modern history, some of the world's top investors are now betting that the worst of the dollar's surge is over and into what will be a multi-year downward trend。

Investors say the dollar is moving lower as the Fed's cycle of rate hikes nears its end and almost every other currency strengthens as central banks continue to tighten monetary policy.。While recent data has traders rethinking how high US interest rates will go, risk assets have shifted from US stocks to emerging markets as they bet the dollar's strength will ease。

George Boubouras, head of research at hedge fund K2 Asset Management, said: "The dollar's peak is definitely over and a structurally weaker dollar is coming.。Inflation in the U.S. is stubborn and the interest rate market is signaling that U.S. interest rates will remain high for longer, but that doesn't erase the fact that the rest of the world's economies are catching up with the U.S.。"

A weaker dollar will bring significant benefits to the world economy.。Import prices in developing countries will fall, helping to reduce global inflation。As market sentiment improves, the price of risky assets from gold and stocks to cryptocurrencies may also rise。

This could mitigate some of the disruption to global markets in 2022。At the time, a stronger dollar had all sorts of effects: countries such as Ghana were pushed to the brink of defaulting on their debt as food and oil costs rose and inflation rose, while equity and bond investors suffered huge losses.。

The dollar's strength will follow the Fed's yield premium as other central banks show similar determination to the Fed in reducing inflation。Policymakers in the euro zone and Australia have said they need to keep raising interest rates to curb inflation, while speculation is mounting that the Bank of Japan will abandon ultra-loose monetary policy this year.。

US borrowing costs likely to peak in July, swap data shows。With inflation back to the Fed's target, the Fed could cut rates as early as 2024, when it holds its first meeting。

These bets are reflected in the movement of the dollar, which has fallen about 8 per cent since it rebounded to all-time highs in September.。Meanwhile, investors bought bonds and stocks in emerging markets last month at the fastest pace in nearly two years.。

DOLLAR DOWN

Siddharth Mathur, Asia Pacific Head of Emerging Markets Research at BNP Paribas Singapore, said: "We believe the dollar has peaked and the downward trend that will last for many years has begun.。We are structural dollar shorts and expect the currency to weaken in 2023, especially in the second half of the year。"

Some market participants believe the Fed chose a modest rate hike because it expects price pressures to ease。This view is at odds with the Fed's assessment that inflation remains a concern and that further rate hikes are needed to bring it down to its 2 percent target.。

Eric Stein, chief investment officer for fixed income at Morgan Stanley Investment Management, said: "The Fed has a lot of tightening measures that haven't worked yet, it claims to bring inflation down to 2%, but I think it's actually targeting around 3%.。The Fed will not continue to push interest rates up to 6% as a result.。"

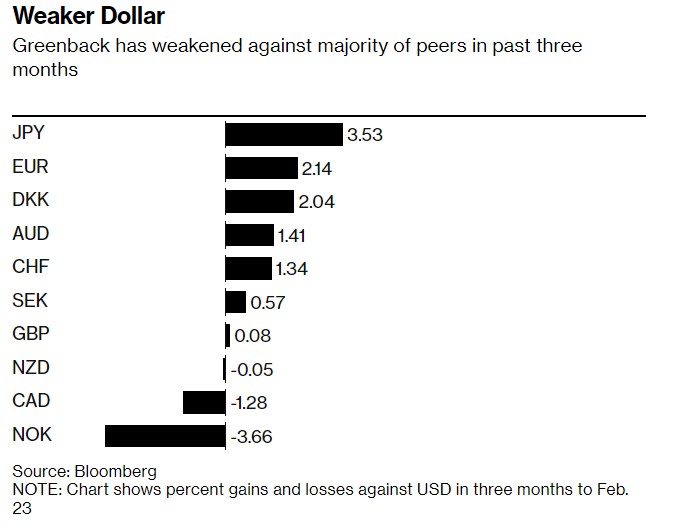

All this means that currencies affected by the strength of the dollar may rise.。The yen has risen more than 12% against the dollar since falling to a 30-year low in October, and some strategists expect it to rise a further 9% by the end of the year.。

The euro has risen about 11 per cent from a low hit in September last year, while the dollar has fallen against most currencies in the Group of 10 over the past three months.。The Asian dollar index has risen more than 5% since falling to a trough in October。

Dwyfor Evans, head of macro strategy for Asia Pacific at State Street Global Markets, said: "Many of the factors supporting the dollar in 2022 have weakened and other central banks in the G-10 are catching up on interest rates.。Cautious safe-haven buying at a disadvantage if China reopening will boost global demand。"

Short Dollar

Some investors are already testing the "dollar's dominance is over" theory。At the end of last year, Abrdn, a capital management giant with a long position in the dollar, was neutral on the dollar, while Jupiter, another capital management giant, was directly shorting the dollar.。

K2 Asset Management has scaled back its long exposure to the US dollar since October last year and believes currencies such as the Canadian and Australian dollars will perform well this year.。Hedge funds' bearish bets on the dollar rose to their highest level since August 2021 in early January, while Morgan Asset Management expects the yen and euro to rise further.。

Some investors like James Athey, director of investment at Abrdn, are waiting for the time to short the dollar to confirm whether the reality of a weak global outlook will stimulate a new round of dollar demand.。

He said: "Once this happens, the Fed has cut interest rates and risk assets have bottomed out, we will be pro-cyclical shorting the dollar.。"

Dollar lovers can also look for clues about their prospects from the so-called "dollar smile theory."。The theory, coined by investor Stephen Jen and his Morgan Stanley colleagues in 2001, predicts that the dollar will rise when the U.S. economy is in a deep recession or growing strongly, and underperform during periods of moderate growth.。

Still a safe haven?

It's important to note that no one thinks the dollar will plummet as U.S. interest rates continue to rise, the threat of a global recession and geopolitical risks spur demand for safe-haven assets。

Omar Slim, co-head of fixed income for Asia (excluding Japan) at Perry Investments Singapore, said: "The dollar has peaked, but we don't expect it to completely reverse the strength of the past two years.。With inflation still hovering high, the Fed is likely to keep interest rates high, which will help ease dollar weakness。"

Others even think rising U.S. yields may continue to attract investors and support the dollar.。Elsa Lignos, head of foreign exchange strategy at RBC Capital Markets, said: "We expect the dollar to recover before the end of the year, it remains the highest yielding currency in the Group of 10 and is higher than multiple emerging markets.。"

Deutsche Bank's Stefanie Holtze-Jen says recognizing that the Fed is likely to slow the pace of rate hikes is key to predicting the dollar's course in 2023。He noted that the dollar has peaked but will continue to be supported as it still enjoys safe haven status.。

(Author: Honglin)

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.