This article will start from multiple high-frequency indicators to split the market's views on the path of interest rate cuts.

On December 18, the Federal Reserve is about to cut interest rates in December, but bond traders have been increasing bets on options and futures, believing that the Federal Reserve is about to signal a larger rate cut next year than the market expected.

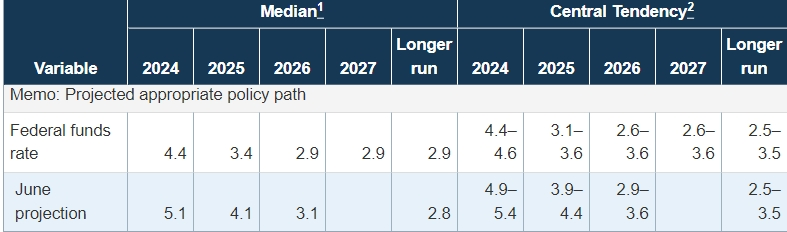

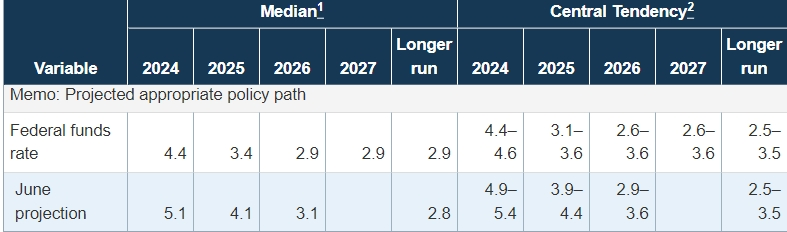

Since this week's 25 basis points interest rate cut has become a market consensus, the Federal Reserve's SEP quarterly forecast update will become the focus of market attention.In September, the median forecast by Fed officials for their policy path, known as the "dot chart", showed that the total rate cut this year and next was a full percentage point.

However, as inflation continues to rise, Wall Street banks are beginning to predict that the Federal Reserve may cut interest rates once next year, or a total of three-quarters of a percentage point.Some predict that the central bank could cut by only half a percentage point, a level that is roughly in line with pricing in the swap market.

But in the interest-rate options market, some traders believe the market's expectations of interest rate cuts are too hawkish, betting that the Fed's policy will be closer to the path it predicted in September.Specifically, they expect the Federal Reserve to cut interest rates four times in 2025, each time by 0.25 percentage points (a quarter-point cut), resulting in a cumulative interest rate cut of 1 percentage point.Such expectations will cause the implicit federal funds target rate to fall to 3.375%.

These traders may be considering two factors: first, how potential signs of labor market weakness increase bets on the Fed's policy of greater easing; and second, how Treasury prices will rebound on data that unexpectedly soared in unemployment.

The guaranteed overnight financing rate is highly sensitive to Fed policy expectations. Among options linked to the guaranteed overnight financing rate, demand is mainly concentrated on the dovish bet structure that expires early next year, with the target of early 2026.These positions will benefit if the central bank's policy forecasts are more dovish than the market expects.

At the same time, traders are also increasing their positions in Fed funds futures.Open interest contracts due in February have risen to record levels, and their pricing is closely related to the Federal Reserve's December and January policy statements.Recent capital flows for this period have been biased towards buying, suggesting that new bets will benefit from a December interest rate cut and then price additional easing in the next decision on January 29.

Morgan Stanley's recommendation this month to buy February Fed funds contracts appears to have driven bullish activity.Strategists said investors should prepare for the market's higher probability of a quarter-point rate cut on January 29.Assuming the Fed fulfills its promise as scheduled on Wednesday, the probability of a rate cut next month is about 10%.

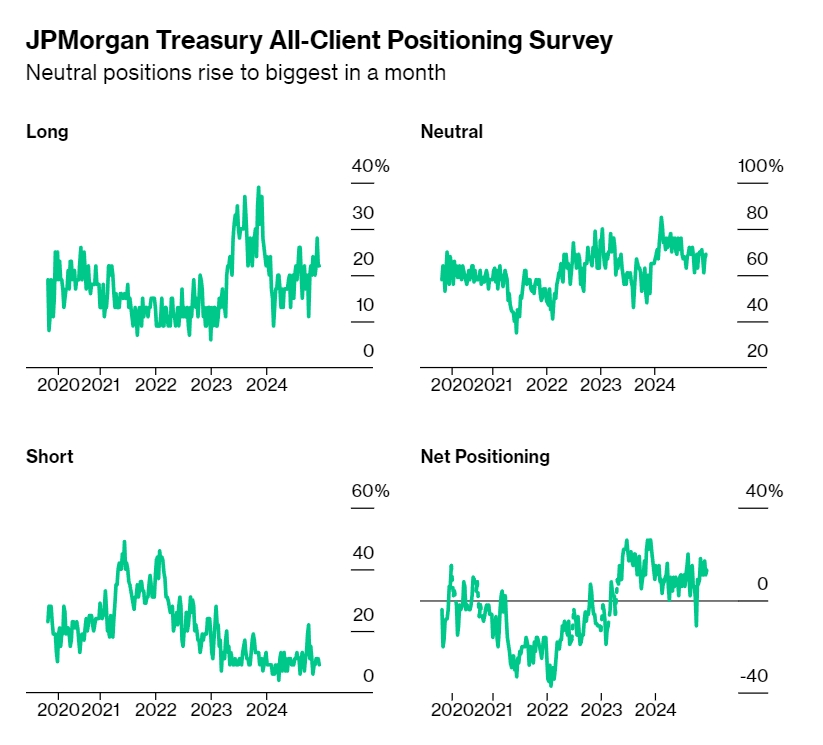

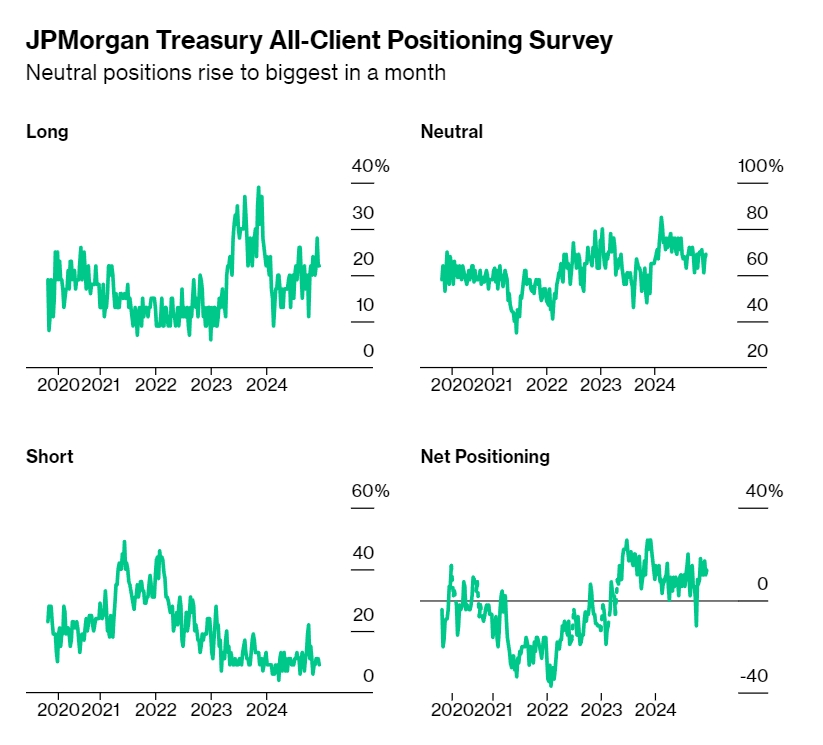

Traders began deleveraging ahead of last week's release of consumer price data.A JPMorgan survey this week showed clients 'neutral stance was the highest in a month, suggesting they were pulling chips off the table ahead of Wednesday's rate decision and heading into the end of the year.

Here are the latest pricing indicators for the entire interest rate market:

JPMorgan Treasury Client Survey

In the week ended December 16, JPMorgan's latest survey of clients showed short positions fell 2 percentage points to neutral positions, and short positions are currently at their highest level in a month.Long positions remained unchanged this week.

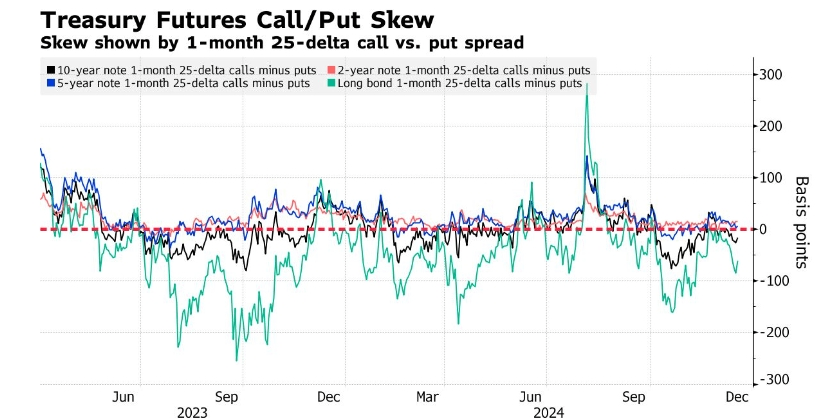

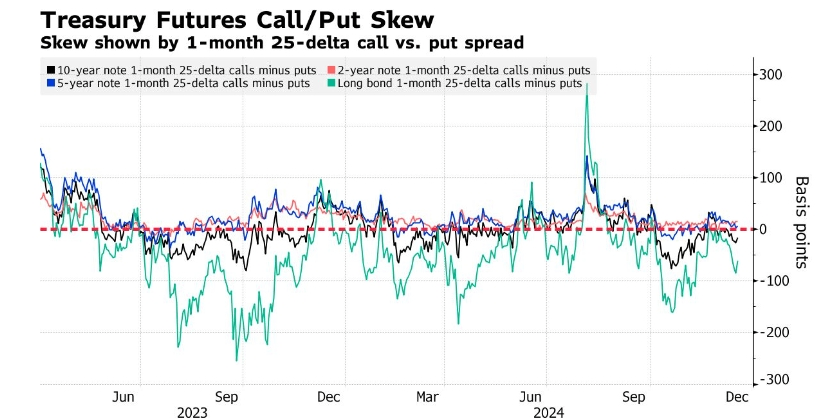

Treasury options premium tends to put options

The cost of hedging against selling off at the long end of the Treasury curve has increased in the past week.Long-term debt options are biased towards put options by the largest margin since the first week of November.On Tuesday, the yield on the 30-year Treasury note hit its highest point since November 18.In the options market, there has been a demand for call option structures in the past week, where capital flows are expected to downplay the skewed trend.One example is a February call option that targets a 4% yield on the 10-year bond by the end of January, compared with the current yield of about 4.4%.

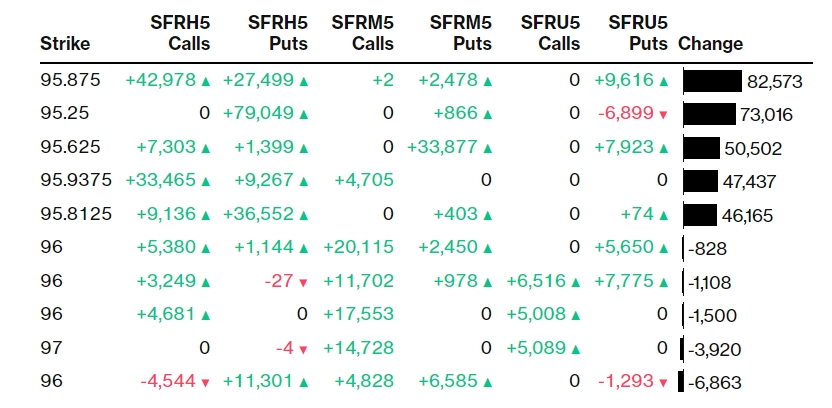

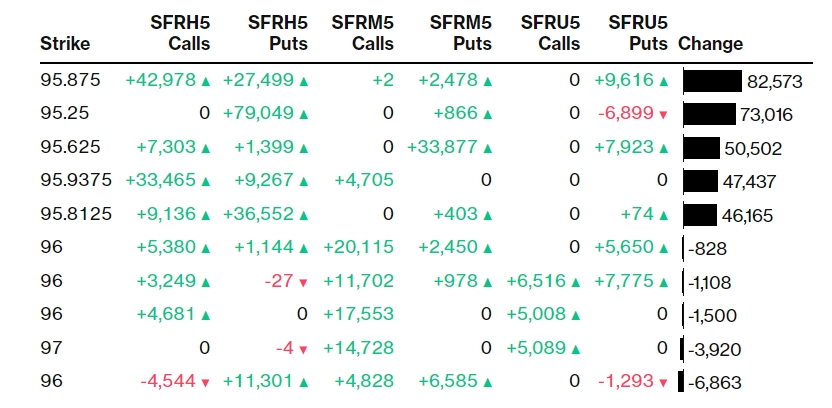

Most active SOFR options

In the past week, SOFR options have seen a large number of additions and liquidations on September 25 contracts.Open interest contracts exercised at 95.875 have climbed significantly after recent trading, including buyers buying SFRH5 95.625/95.875/96.125 call options, sellers selling SFRH5 95.8125 put options, and recent demand for SFRH5 95.8125/95.875/95.9375 2x1x1 call options.Demand for the 95.25 strike price has also increased, mainly due to aggressive direct buying of the SFRH5 95.25 put option, which is seen as a new risk.The increase in demand for the 95.625 strike price was mainly due to increased positions in buying the spread between SFRM5 96.00/96.125 call options and selling the spread between SFRM5 95.625/95.4375 put options.

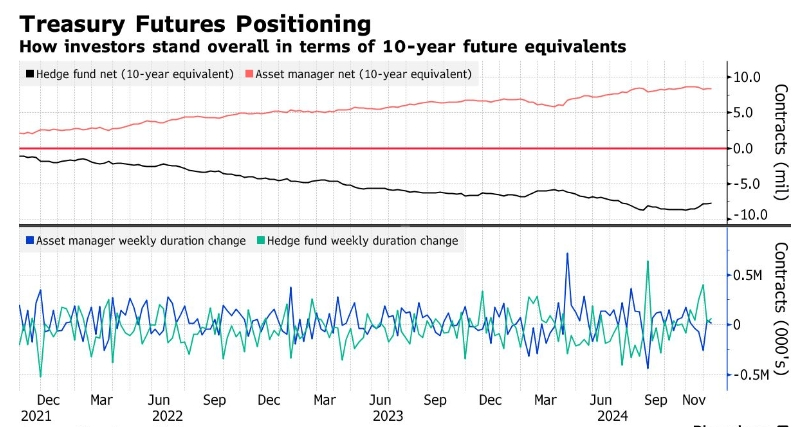

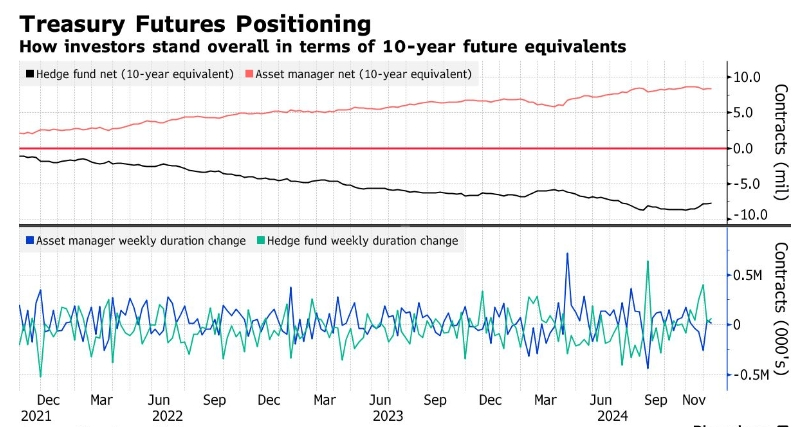

CFTC futures positions

Data from the U.S. Commodity Futures Trading Commission showed that hedge funds covered short positions at the long end of the Treasury curve in the week ended December 10.During the reporting week, hedge funds covered net short positions equivalent to approximately 65,000 10-year Treasury futures across the entire futures category, while asset managers added net long positions equivalent to approximately 18,000 10-year Treasury futures.Asset management companies are most optimistic about Treasury futures over 10-year, with net long positions increasing by approximately $2.8 million per basis point.In this week's SOFR futures, hedge funds added net long positions, while asset managers added net short positions.