The European Central Bank May Lead a Global Rate Cut Wave, Gold Prices Hit a New Record High

The ECB is already on the verge of cutting interest rates, with several officials putting doves on the table.

On May 20th, the spot gold price set a new record high for the second time since April, closing up 0.7% at $2,430.79 per ounce, after reaching a record high of $2,449.89 earlier in the session.

In terms of news, the European Central Bank (ECB) is poised to cut interest rates, with several officials signaling dovish sentiments. ECB Executive Board member Isabel Schnabel stated that she is open to a rate cut in June but does not see a need for one in July. ECB Governing Council member Peter Praet also said that June is an appropriate time for a rate cut, but remains open to future actions. French central bank governor Francois Villeroy de Galhau also stated, "Given that we have sufficient confidence, it is very likely that we will begin to lower central bank interest rates at our meeting in early June."

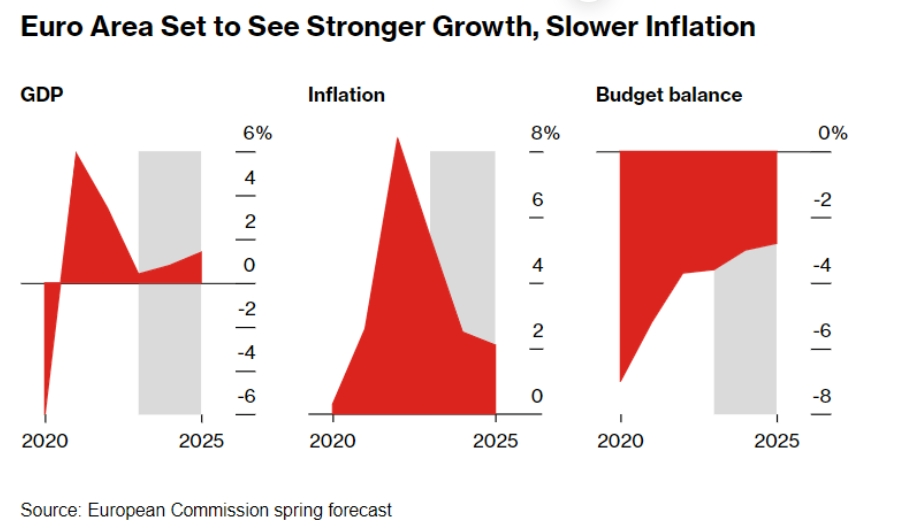

The eurozone has reasons and confidence to do so. Last Wednesday, the EU's executive body said in a report that inflation rates for this year and next year will fall to 2.5% and 2.1%, respectively, lower than the previous forecast of 2.7% and 2.2%. In terms of economic development, the eurozone's GDP growth is expected to be 0.8% this year and 1.4% in 2025, almost unchanged from the previous forecast three months ago. EU Economic Commissioner Paolo Gentiloni said in a statement, "We expect the eurozone's economic growth to gradually accelerate over the next two years, supported by falling inflation, rising purchasing power, and continued employment growth."

On the Federal Reserve's side, due to a series of weak data, traders once expected a 66% chance of a rate cut in the U.S. in September, but as Fed officials made hawkish remarks, the probability of a September rate cut fell to around 60%. The U.S. dollar index rebounded by 0.12% on Monday, and U.S. Treasury yields rose for three consecutive trading days, causing gold prices to fall from near historical highs.

On May 20th, Cleveland Fed President Loretta Mester said that due to the stagnation of inflation progress this year, she might lower her expectations for a rate cut in 2024 at the next Federal Open Market Committee (FOMC) meeting. Mester believes: "Overall, inflation will fall back, I just don't think it will fall back quickly. The current level of interest rates is already restrictive enough. The latest Consumer Price Index (CPI) data can be considered good news, but it is too early to judge the direction of inflation."

At the same time, Federal Reserve Vice Chairman Philip Jefferson remains cautiously optimistic about the path to continue fighting inflation. He said that although the data for April is encouraging, it is too early to determine whether the slowdown in the progress of reducing inflation will last for a long time. The Fed needs more time to assess inflation data before lowering interest rates from the current level. Jefferson refused to reveal his expectations for whether there will be a rate cut this year.

On May 15th, data released by the U.S. Bureau of Labor Statistics showed that the U.S. CPI rose by 3.4% year-on-year in April, and the core CPI rose by 3.6% year-on-year, both in line with market expectations. On a month-over-month basis, the U.S. CPI rose by 0.3% in April, lower than the market expectation of 0.4%; the core CPI rose by 0.3%, higher than the market expectation of 0.2%. The Fed's next meeting will be held from June 11th to June 12th local time in the U.S., and the latest Summary of Economic Projections (SEP) and dot plot will be released.

As of midday on May 21st, data from the Chicago Mercantile Exchange (CME Group) showed that the market expects a 96.4% chance of keeping the interest rate unchanged at 5.25%-5.5% in June, and a 3.6% chance of a 25 basis point cut; in July, there is a 76.4% chance of keeping the interest rate unchanged at 5.25%-5.5%, and a 22.8% chance of a 25 basis point cut.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.