Energy Transition Technology BlackRock Q1 continues to buy Apple in large quantities, with a market capitalization of more than $170 billion!

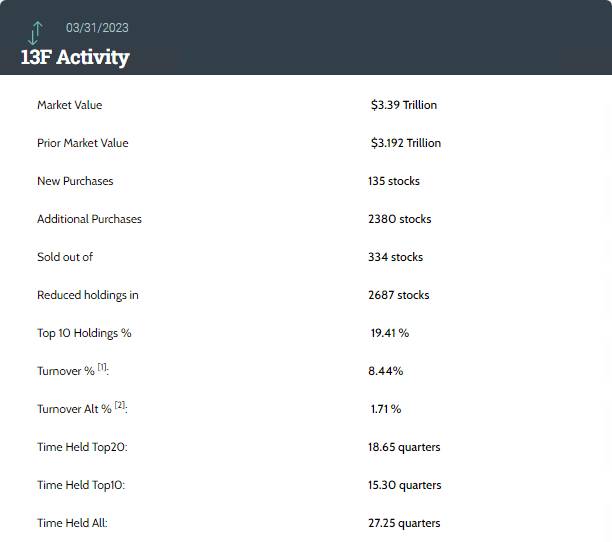

On May 15, Eastern Time, according to the Securities and Exchange Commission (SEC), BlackRock, one of the world's largest asset managers, has filed a position report for the first quarter ended March 31, 2023 (13F)。Data show that the total market capitalization of BlackRock Q1 positions increased by 6% from the fourth quarter of last year..2% to 3.39 trillion dollars。

On May 15, Eastern Time, according to the Securities and Exchange Commission (SEC), BlackRock, one of the world's largest asset managers, has filed a position report for the first quarter ended March 31, 2023 (13F)。

Report data show that the total market capitalization of BlackRock Q1 positions increased by 6% from the fourth quarter of last year..2% to 3.39 trillion dollars。In terms of positions, BlackRock increased its holdings of 2,687 stocks in the quarter, of which 135 were new stocks; BlackRock also reduced its holdings of 2,687 stocks in the quarter, of which 334 were liquidated.。

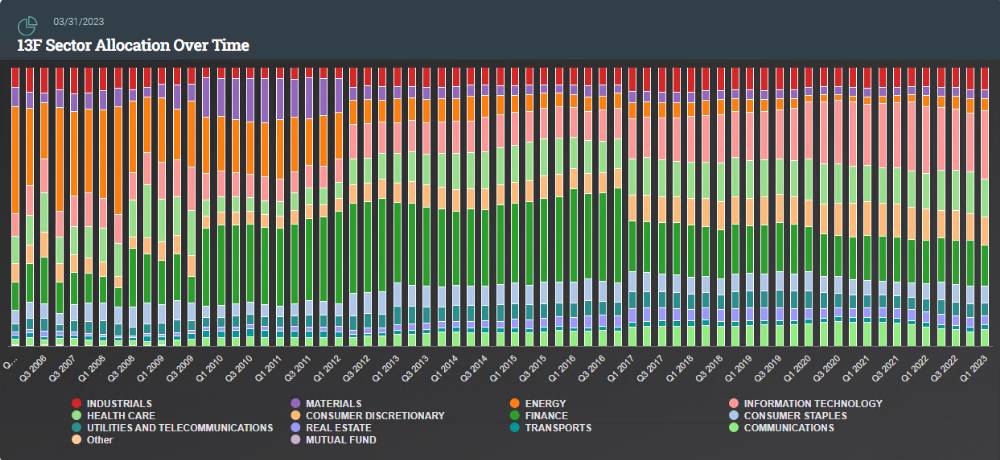

BlackRock configuration continues transition from energy to technology

BlackRock's position preferences have shifted from energy to technology in recent years, as shown by the field chart of position distribution。BlackRock's position in the first quarter focused on the technology sector, accounting for 24% of the total position..37%。followed by financial stocks and healthcare stocks, each accounting for 14.88% and 13.62%。

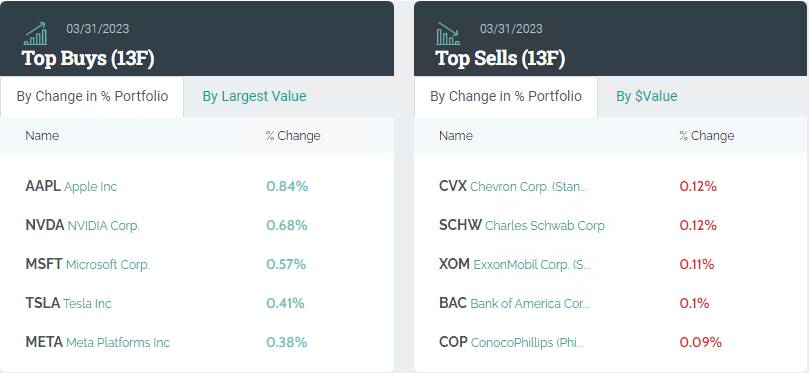

The change in the proportion of positions also confirms this.。Technology stocks as BlackRock's heart in recent years, the company's Q1 top five buying targets are technology stocks, respectively: Apple, Nvidia, Microsoft, Tesla, Meta。The top five selling targets are: Chevron, Schwab Wealth Management, ExxonMobil, Bank of America, ConocoPhillips.。

Apple is still a heavy position TOP1 Mobil, Johnson & Johnson out of the top ten new into Nvidia, Meta.

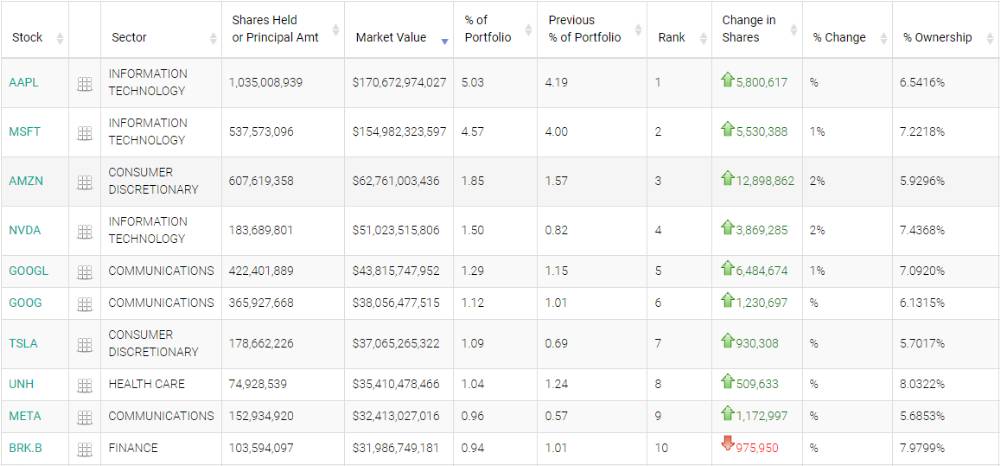

Report data show that compared to the fourth quarter of 2022, BlackRock's share of the top ten positions in the first quarter of this year have increased, now accounting for a total of 19% of the total market capitalization..41%。The current top 10 heavyweight stocks are: Apple, Microsoft, Amazon, Nvidia, Google-A, Google-C, Tesla, United Health, Meta, Berkshire Hathaway。

Apple remained at the top of BlackRock's heavy holdings during the quarter, adding about 896 positions in the fourth quarter of last year..After 30,000 shares, BlackRock added another 580 positions in the first quarter of this year.10,000 shares。Apple currently holds about 10.3.5 billion shares, with a market value of about 1706.$7.3 billion, or 5% of the total market value of the position.03%。

Unlike last year's fourth quarter, ExxonMobil and Johnson & Johnson have withdrawn from BlackRock's top 10 heavyweight stocks in the first quarter of this year, replacing them with Nvidia and Meta.。

Nvidia is currently ranked fourth among heavy stocks, with a total increase of about 386 in the quarter..90,000 shares, with a current position of about 10,000.8.4 billion shares, with a market value of about 510 million.$200 million, accounting for 1% of the total market value of the position..5%; Meta also significantly increased its holdings by 117.90,000 shares ranked ninth, with a current position of about 1.5.3 billion shares, with a market value of about 324.$100 million, accounting for 0% of the total market value of the position..96%。

In addition, technology stocks such as Microsoft, Amazon and Tesla all gained varying degrees of overweight in the first quarter。其中。Microsoft has increased its holdings by approximately 5.53 million shares and currently has a total market capitalization of approximately 1,549.$800 million, second in heavy positions; Amazon increased its holdings by about 1,289.90,000 shares, with a total market capitalization of approximately 627.$600 million, third place; Tesla also gained about 930,000 shares, with a total market capitalization of about 370.$700 million, ranked seventh。

It is worth noting that only Berkshire was the only one of the top 10 heavyweight stocks in the first quarter to be underweight, with Berkshire being underweight by about 97 in the quarter..60,000 shares, the position ranking has been lowered to 10th, with a total position of about 1.04 billion shares, with a market value of about 31.9 million..$900 million, accounting for 0% of the total market value of the position..94%。

For the first quarter swap, BlackRock said the debt ceiling issue is currently a source of widespread concern。In response, BlackRock's latest warning that the U.S. debt ceiling crisis will exacerbate financial pressures triggered by rising interest rates, sending stocks through another round of volatility and a possible sell-off。

Finally, BlackRock recommends increasing its holdings of emerging market stocks, which could benefit in the short term from China's economic growth, the end of central bank tightening and a weaker dollar, and reducing its holdings of developed market stocks, citing the financial and economic damage caused by interest rate hikes and corporate earnings expectations that do not fully reflect the recession.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.