iShares Bitcoin Trust Down 11% as Trading Volume Surges

Key momentsIBIT price drops below $46.07, the lowest since early November, representing an 11% decline.Trading volume reaches a peak of over 331 million shares traded on Nasdaq.Investors withdraw over

Key moments

- IBIT price drops below $46.07, the lowest since early November, representing an 11% decline.

- Trading volume reaches a peak of over 331 million shares traded on Nasdaq.

- Investors withdraw over $1 billion from the ETF, as per data from Farside Investors.

ETF Sees Significant Outflows and Price Decline Amid Increased Market Activity

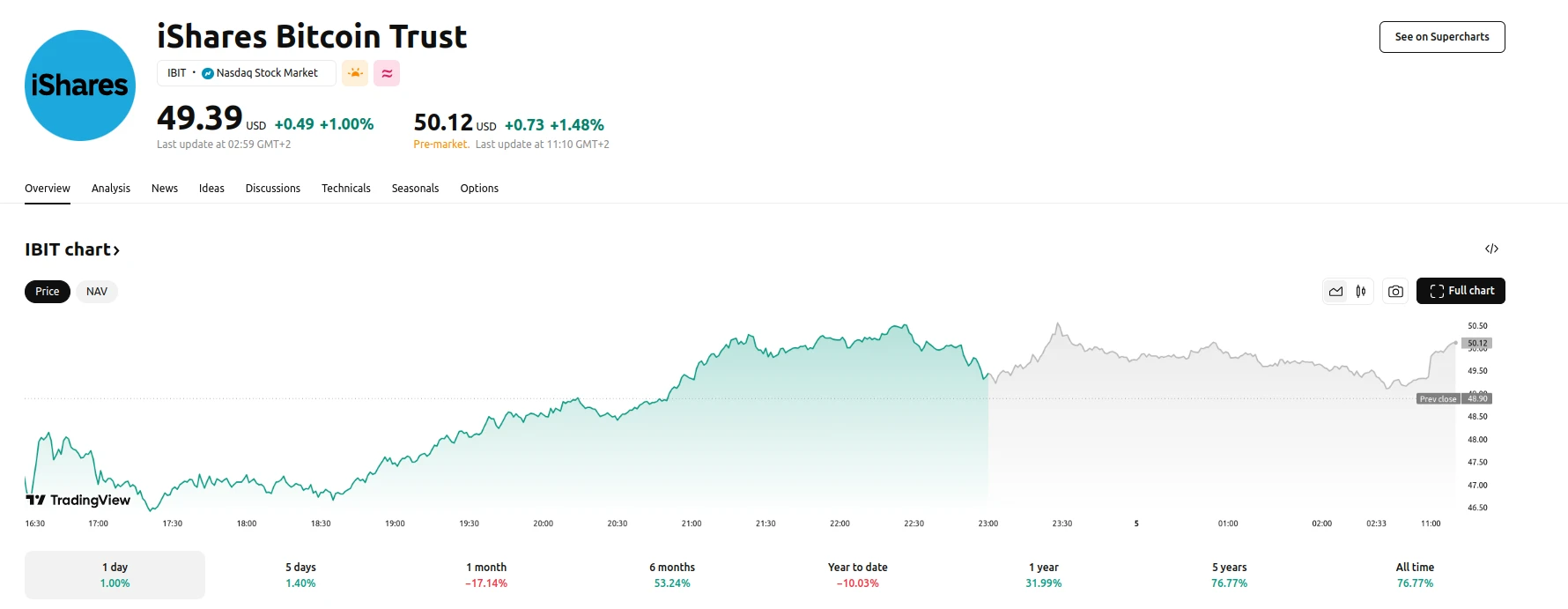

The iShares Bitcoin Trust (IBIT), launched by BlackRock in June 2023, has experienced a notable downturn, with prices falling by over 11% amidst a surge in trading volume. This decline marks a significant shift for the ETF, which allows investors to gain exposure to Bitcoin through a traditional brokerage account, simplifying the process of investing in the cryptocurrency. The price drop below $46.07 represents the lowest value since early November, breaking through previous support levels and signaling a shift in market sentiment.

The substantial increase in trading volume, exceeding 331 million shares traded on Nasdaq, coincides with this price decline. This surge in activity reinforces the credibility of the bearish price action, as market principles suggest that significant price movements should be confirmed by corresponding trading volume. Furthermore, data indicates a substantial outflow of over $1 billion from the ETF, reflecting a decline in investor confidence. This withdrawal is attributed, in part, to the shrinking CME futures basis, which has contributed to increased selling pressure.

Despite these challenges, IBIT retains its position as the largest Bitcoin ETF globally, with assets under management worth $39.6 billion. However, the technical outlook for the ETF remains bearish, particularly as prices remain below the previously established support level of $50.69, which has now transitioned into resistance. The surge in trading volume when IBIT broke this support level indicated the potential for further losses, a prediction that has since materialized. Ten other US listed ETFs also saw outflows, showing a broader market trend. The current market conditions necessitate a cautious approach for investors, as the ETF’s performance remains subject to prevailing market volatility and investor sentiment.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.