Executive shock! Xu Ran takes over Jingdong CEO sinking market battle officially begins

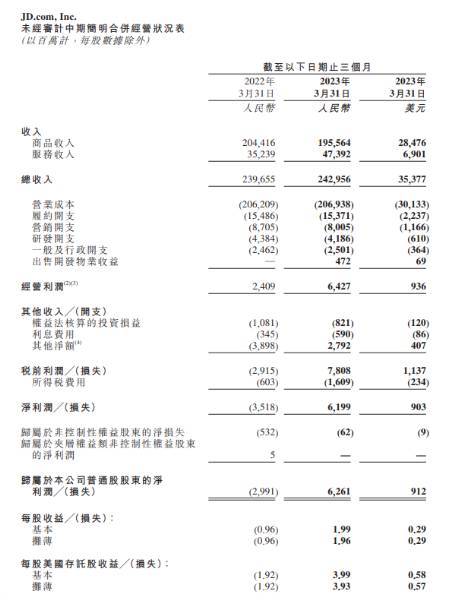

On the evening of May 11, the domestic e-commerce giant Jingdong Group released its first quarter 2023 results report.。Report data show that Jingdong Group Q1 revenue of 2429.5.6 billion yuan (RMB, the same below); operating profit of 6.4 billion yuan; net profit turnaround reached 62..$6.1 billion; diluted earnings per ADS 3.93 yuan。

On the evening of May 11, the domestic e-commerce giant Jingdong Group released its first quarter 2023 results report.。Report data show that Jingdong Group Q1 revenue of 2429.5.6 billion yuan (RMB, the same below), up 1.4%, higher than expected 2404.900 million yuan; operating profit of 6.4 billion yuan, compared with 2.4 billion yuan in the same period last year; net profit turnaround reached 62.6.1 billion yuan, with a net loss of 29% in the same period last year..$9.1 billion; diluted earnings per ADS 3.93 yuan, a loss of 1 per ADS was recorded in the same period last year..92 yuan。

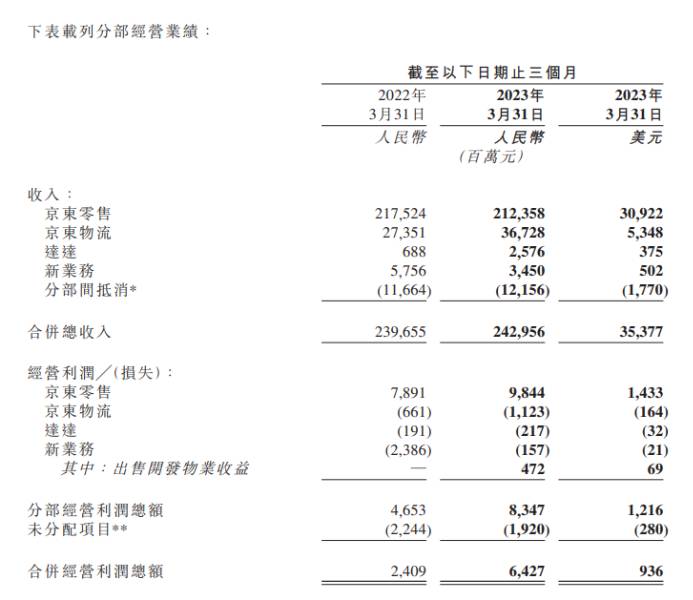

By business, Jingdong Mall Retail Q1, the core business of Jingdong Group, had a revenue of 2123.5.8 billion yuan, down 4 billion yuan from the same period in 2023 affected by the epidemic..3%。Jingdong Logistics improved from the same period last year, with revenue reaching 367.2.8 billion yuan; Dada Express delivery nearly tripled year-on-year to 25.7.6 billion yuan。Jingdong's new business, on the other hand, declined from last year to 34.500 million yuan。

As you can see, under the main theme of the Group's continued cost reduction and efficiency increase, Jingdong's profit level improved significantly this quarter, with adjusted net profit reaching 7.6 billion yuan in the first quarter, up 88% from 4 billion yuan in the same period last year..3%; net profit margin also reached 3.1%, the best profit level in the company's first quarter history.。

In addition, as of the end of the first quarter, JD PLUS membership reached 35 million。Jingdong disclosed that the average annual consumption level of PLUS members is 8% of that of non-PLUS users..4 times。

Jingdong CEO Xu Lei said in the report that in the first quarter, Jingdong's profitability improved significantly, mainly due to our efforts in refining operations, optimizing the product mix, and enriching the scope of services, and that in the coming quarters, we will further improve our business structure to serve a wider range of user groups across China.。JD has built China's most trusted retail brand and has developed a unique advantage. While meeting users' expectations for a more, faster, better and less expensive shopping experience, it maintains flexibility to seize growth opportunities in business development。

How is Jingdong after tens of billions of subsidies?

On March 8 this year, the domestic e-commerce giant Jingdong plans to launch a 10 billion yuan (about 1.5 billion U.S. dollars) shopping subsidy campaign on March 8 to match the tens of billions of subsidies, which also means that a "price war" in the e-commerce industry has begun.。

Due to the economic environment of the global market in the past two years are in a relatively depressed state, the consumption capacity of the masses has declined, resulting in the loss of part of the market share of Jingdong, on the other hand, Pinduoduo has been mainly to sink the market, has been in the second, third and fourth-tier cities to stabilize its market share.。

At the same time, the main thrust of the fight is low-priced good goods, after people's spending power degradation, will naturally succumb to the price and choose to fight a lot.。Although the overall service quality of Jingdong is relatively better than that of Pinduoduo, buying good goods at low prices is always the retailer's most attractive nirvana.。

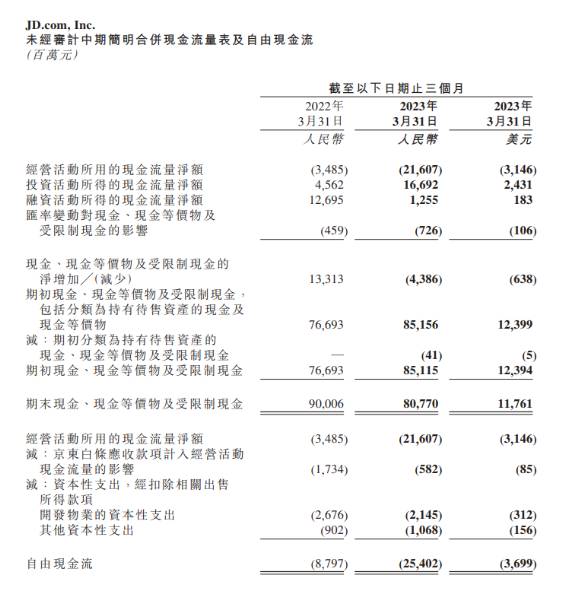

But for Jingdong, the biggest challenge is funding.。Financial data show that Jingdong had $80.7 billion in cash on its books as of the first quarter of this year, compared with negative operating cash flow of $21.6 billion in the first quarter.。

In this regard, Xu Ran, who was previously the CFO of Jingdong, said, "Jingdong's 10 billion subsidy has been on the line for two months and is generally in line with our expected results.。However, in terms of revenue growth and investment, the "10 billion subsidy" has not yet shown obvious actual results.。

In addition to the financial difficulties, the Jingdong model is mainly self-employed, if the subsidy to replenish the self-employed channels, equal to the left hand to the right hand, and Jingdong cooperation of the major brands, want to control the price and pricing power, the price is also difficult to play through。These are all problems that Jingdong needs to solve in implementing the 10 billion subsidy plan in the future.。

Jingdong executive shock Liu Qiangdong will return to the helm?

In addition to the quarterly results, Jingdong also announced an important announcement。According to the report, Xu Lei, former CEO of Jingdong Group, applied for retirement for personal reasons, and after retirement, he will serve as the first chairman of the Jingdong Group Advisory Committee, and Xu Ran, CFO of Jingdong Group, will be promoted to CEO, reporting to the board of directors and chairman of Jingdong Group Liu Qiangdong.。

During the outbreak, Xu Lei successfully held Jingdong's basic plate。Public data shows that the year-on-year growth rate of Jingdong's net income in 2019-21 continued to remain above 26%。Xu Lei announced his retirement at this moment, which is also considered a successful retirement.。The change of CEO also means that Jingdong will bid farewell to the comfort zone and rejoin the ranks of Kaijiang.。

Although Xu Lei took over Jingdong, the stage task has been completed, Jingdong's basic disk has not collapsed。But the user side has fallen back。In 2022, the number of active users of Jingdong dropped to 9% year-on-year..2% - After more than two years of high growth, it has once again fallen back to the 10% growth range.。

Obviously, this is not what Liu Qiangdong wants。Liu Qiangdong previously said that the sinking market is the breakthrough of Jingdong's future growth, but according to previous media reports, on the sinking market, Xu Lei and Liu Qiangdong disagreement, Xu Lei and Jingdong Retail CEO Xin Lijun advocated to give up sinking, concentrated fire to serve the first and second tier cities in the same city retail users, but Liu Qiangdong does not recognize。

In order to win the battle of sinking market, CFO Xu Ran is a good choice, her professional can help Jingdong to improve financial efficiency, to raise funds for Jingdong.。

It is reported that during his tenure as CFO of Jingdong Group, Xu Ran and his team completed the merger and acquisition of listed companies such as Dada, Debang and China Logistics Real Estate, the business restructuring of Jingdong Technology, further improving the strategic layout of Jingdong Group's business, promoting the secondary listing of Jingdong Group in Hong Kong, and the spin-off and listing of Jingdong Health, Jingdong Logistics and Jingdong Storage Facilities.。

Xu Ran responded that he was honored to be the CEO of Jingdong Group and thanked Liu Qiangdong and the Board of Directors for their trust, "Mr. Liu Qiangdong and Mr. Xu Lei have laid a solid foundation for Jingdong's future development and will continue to provide valuable support for the Group's strategic planning.。I also look forward to continuing to lead the group to promote sustainable and high-quality development, creating more value for users, business partners and society.。"

Liu Qiangdong also stated: "We believe that Ms. Xu Ran, as the group's chief executive officer and Mr. Shan Su, as the chief financial officer, will continue to lead the future development of Jingdong Group.。Ran Xu has performed prominently during his tenure as Chief Financial Officer and has provided insight and strong support for business development and strategic decision-making.。In addition, Shan Su's outstanding performance and professional achievements as Chief Financial Officer of JD Logistics make him an ideal candidate to succeed JD Group as Chief Financial Officer.。"

Regarding Jingdong's later strategic positioning, Liu Qiangdong added, "In the future, I will continue to devote myself to Jingdong's long-term strategy, young talent development and rural revitalization, and Xu Ran will lead the management team and be responsible for the company's daily operations.。"

For now, Jingdong needs to face the big test is the next year's big promotion 618 activities, this year's 618 is not only Jingdong announced 10 billion subsidies and strengthen the low-cost mind after the first 618, or Jingdong's 20th anniversary of the 618, but also after Xu Ran took office the first 618。

Therefore, the first challenge facing the new CEO is how to fight this year's 618 campaign, how to carry out Liu Qiangdong's extreme cost-effective strategy, so that Jingdong's main business back to the growth track.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.