Jingdong shares surge: Q4 results exceeded expectations announced dividend and repurchase plan

On March 6, JD Group released its fourth quarter and full year 2023 results and announced its annual dividend and share repurchase program.。

On March 6, Jingdong Group ("Jingdong") released its fourth quarter and full-year results for 2023 and announced its annual dividend and share repurchase plan.。

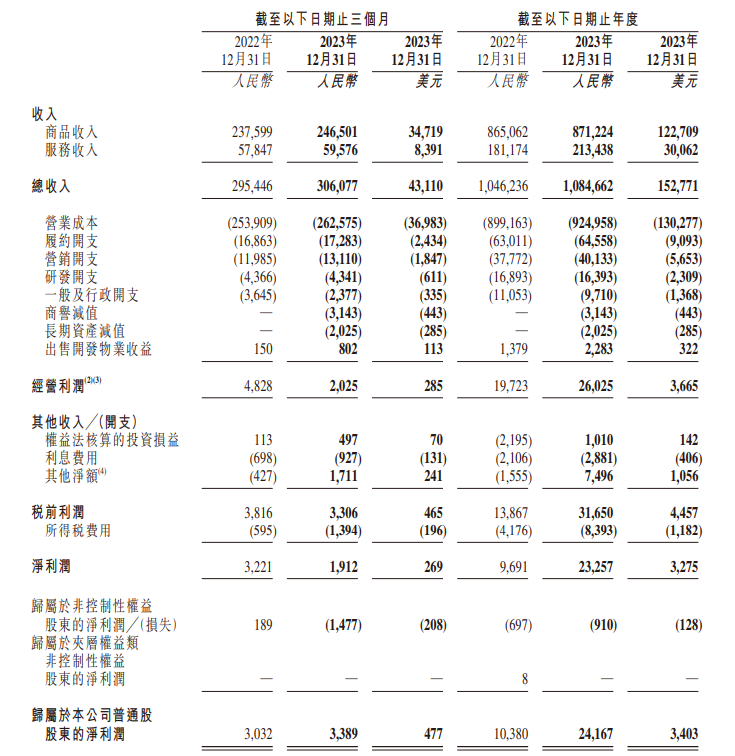

Performance data show that the Group's revenue in the fourth quarter of 2023 was RMB306.1 billion (RMB, the same below), an increase of 3% year-on-year..6%。Non-GAAP net profit for the fourth quarter was $8.4 billion, up 9.9%, significantly exceeding market expectations。Corresponding net profit margin 2.7%, compared to 2.6%。

For the full year, JD's revenue for 2023 was $1,084.7 billion, up 3.7%。Full-year Non-GAAP net profit was $35.2 billion, up $24.7%。Net profit margin of 3.2% for the full year 2022, 2.7%。

Free cash flow for the full year 2023 was $40.7 billion, compared to $35.6 billion in 2022。As at 31 December 2023, the Group's cash and cash equivalents, restricted cash and short-term investments totaled $197.7 billion, compared to $226.2 billion for the previous year.。

Jingdong also announced an annual dividend of $1.2 billion, or 0 per share..$38, up from $1 billion in 2022。The increase in the dividend amount is due to the rapid growth in profits last year, which will create a real cash gain for the company's shareholders, Chief Financial Officer Shannon said on a conference call。At present, the company has accumulated dividends of $4.2 billion for three consecutive years.。Next, Jingdong's goal is to continue to pay annual dividends and share the company's value creation with shareholders.。

At the same time, Jingdong's board of directors has also approved a new buyback plan, with the company planning to buy back $3 billion over the next three years.。The company will firmly execute the buyback and communicate with investors on a regular basis, Shan said.。"I believe the market will see a real effort by the company in terms of shareholders sharing the value of the company."。

Due to the overall revenue net profit exceeded market expectations, coupled with dividends and buybacks and other positive stimulus, Jingdong Group-SW today (March 7) opened higher, or nearly 10% at one point。After the share price fell back, closing at 94.HK $45, up 5.89%。

Charged category revenue growth higher than peers

Specifically, Jingdong's income in the fourth quarter。

Jingdong's total revenue can be simply divided into two parts: commodity revenue and service revenue.。

● Commodity income

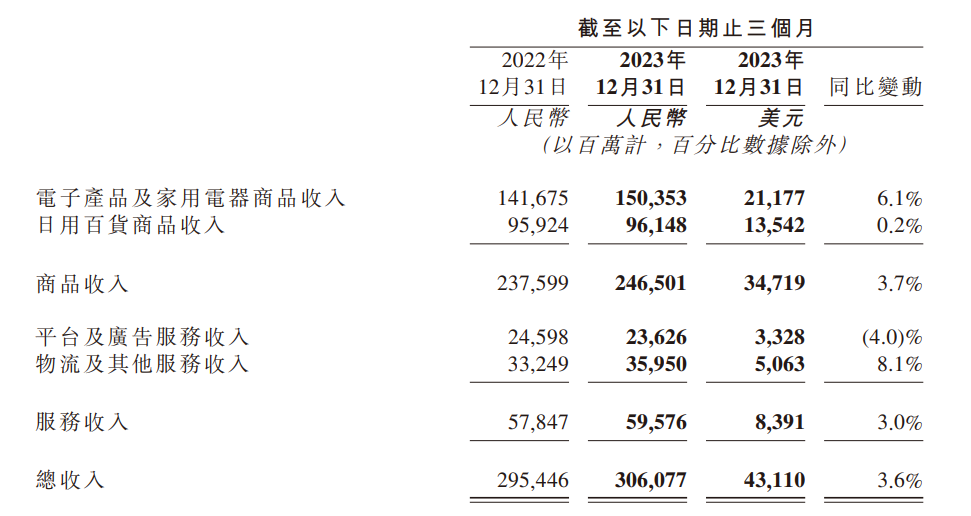

In the fourth quarter, merchandise revenue increased by 3% compared to the same period in 2022..7% to $246.5 billion。Among them, the fourth quarter charged category revenue increased by 6.1%, the growth rate is higher than the same industry, Jingdong's core advantages have been further consolidated.。Daily products, on the other hand, held steady year-on-year, up only slightly by 0.2%。

At the conference, Jingdong Group CEO Xu Ran Xu Ran also mentioned that he is confident that in 2024, the growth rate of electrified and other categories will continue to be faster than that of the industry, especially in the context of the central government's encouragement and promotion of consumer goods "trade-in" and encouragement to boost bulk consumption such as electronic goods.。

In terms of business super categories, Xu Ran expects competition to remain fierce in 2024, and said that the company's business super business has undergone a year of adjustments in the past year, including focusing on the core track, improving supply chain capabilities, and improving our performance efficiency through warehouse network changes.。"So far, we have seen a relatively good recovery trend.。"

● Service revenue

On the basis of continuing to subsidize small and medium-sized businesses, Jingdong's service revenue still increased by 3% year-on-year in the fourth quarter..0% to $59.6 billion, representing net income of 1.9.5%, of which logistics and other services revenue increased 8.1%。Full-year service revenue reached $213.4 billion, up 17.8%。

However, among service revenue, platform and advertising service revenue recorded a 4% year-on-year decline.。In this regard, Shan explained in a telephone conference that the platform and advertising services revenue in the fourth quarter of the short-term small fluctuations, mainly because the company in 2023 to vigorously develop the platform ecology of the case launched a series of support initiatives, including new merchants free of commission, some categories and marketing field initiative to reduce commission revenue, making the commission revenue decreased year-on-year.。

In addition, the growth rate of advertising revenue also slowed slightly in the fourth quarter, Shan said, mainly due to the peak of last year's New Year's Festival combined with the high base of the epidemic.。Singleton expects advertising revenue to return to healthy growth in the first quarter as seasonal factors are eliminated。And along with the improvement in users and traffic, the company believes that the company's advertising revenue will gradually accelerate in 2024.。

For the impact of the macro environment, Xu Ran believes that 2024 is expected to have some macro stimulus and promote consumption policies out, including "trade-in" efforts to increase and so on.。"We also look forward to further consolidation and enhancement of the recovery and expansion of consumption, which is also good news for some of our categories."。We expect total social zero to continue to grow healthily throughout the year, and we are confident that we will be able to maintain a growth rate that exceeds total social zero and continue to gain market share.。"

Jingdong: 2024 will attract more merchants

Jingdong's platform ecosystem includes self-employed and 3P (third-party merchants)。According to the official introduction, the number of third-party merchants in 2023 increased by 188% year-on-year, and the number of new merchants increased by 4.3 times。

Despite the good results, Shan still said in the earnings call that there is still a lot to improve in the development of 3P.。Shan said Jingdong will continue to increase investment and supply to attract more merchants and help them operate better on the Jingdong platform.。

Dan added: "The rapid realization of the current 3P is not our top priority in the short term.。The focus of 2024 is still to attract more merchants, especially small and medium-sized merchants in the industrial belt, enrich our commodity supply, and at the same time continuously optimize the business growth and governance tools of the platform ecology, continue to optimize the traffic distribution mechanism, create a clear growth path and fair business ecology for merchants, enhance the user experience in 3P business, and promote the common prosperity and development of self-management and POP.。"

Jingdong Subsidiary Dada Financial Thunder Follow-up

In early January this year, Jingdong announced that its consolidated subsidiary Dada Nexus Limited (hereinafter referred to as "Dada") in the regular internal audit process found some suspicious behavior, these behaviors may cause some online marketing service revenue and operating support costs of Dada in 2023.。Subsequently, Dada internally conducted an independent review of a number of suspicious acts, led by the Audit Committee of the Board of Directors and assisted by independent professional advisers.。

On March 5, Dada announced that the independent review was now almost complete.。The results show that the Company did overestimate certain revenues and related costs in its past financial statements。

The company's review found that a number of online advertising and marketing services transactions conducted during the review period were primarily aimed at meeting revenue targets, the announcement said.。These transactions, which involved payments from certain upstream customers, as well as payments of substantially the same amount of cash to certain downstream suppliers, lacked any apparent business substance, were not supported by credible documents, business records or other evidence and, in some cases, involved undisclosed connections between customers and suppliers。

The announcement further noted that the independent review did not find any direct evidence that executives from the company's management, including the president and former chief financial officer, orchestrated the transaction.。As a result of these transactions, certain revenues and related costs in the company's past financial statements have been overstated。Specifically, the Company's net income for the four quarters from Q4 2022 to Q3 2023 was overstated by approximately $69 million, $40 million, and $20 million, respectively..1.4 billion yuan and 2.$4.5 billion。The company's operating and support costs were overstated in the above four quarters by approximately $70 million, $42 million, and $2 million, respectively..1.4 billion yuan and 2.5 billion yuan。

The announcement also mentions that the Company has a remedial plan in place for the independent review, including but not limited to (1) termination, request to resign or give disciplinary warnings to employees found to have acted improperly and / or failed to comply with Company policies or otherwise meet expectations; (2) termination of contracts with suppliers and customers involved in the related transactions;。Dada said the company has begun to implement the rectification plan。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.