Why the market is keeping an eye on Iran and Saudi Arabia when the Palestinian-Israeli conflict erupts?

Andrea Tueni, head of sales and trading at Saxo Bank in France, said it was not possible to compare the current situation in the oil market to 1973.。If there was another dimension to the conflict, such as Israel's direct attack on Iran's infrastructure, it would be a completely different story.。

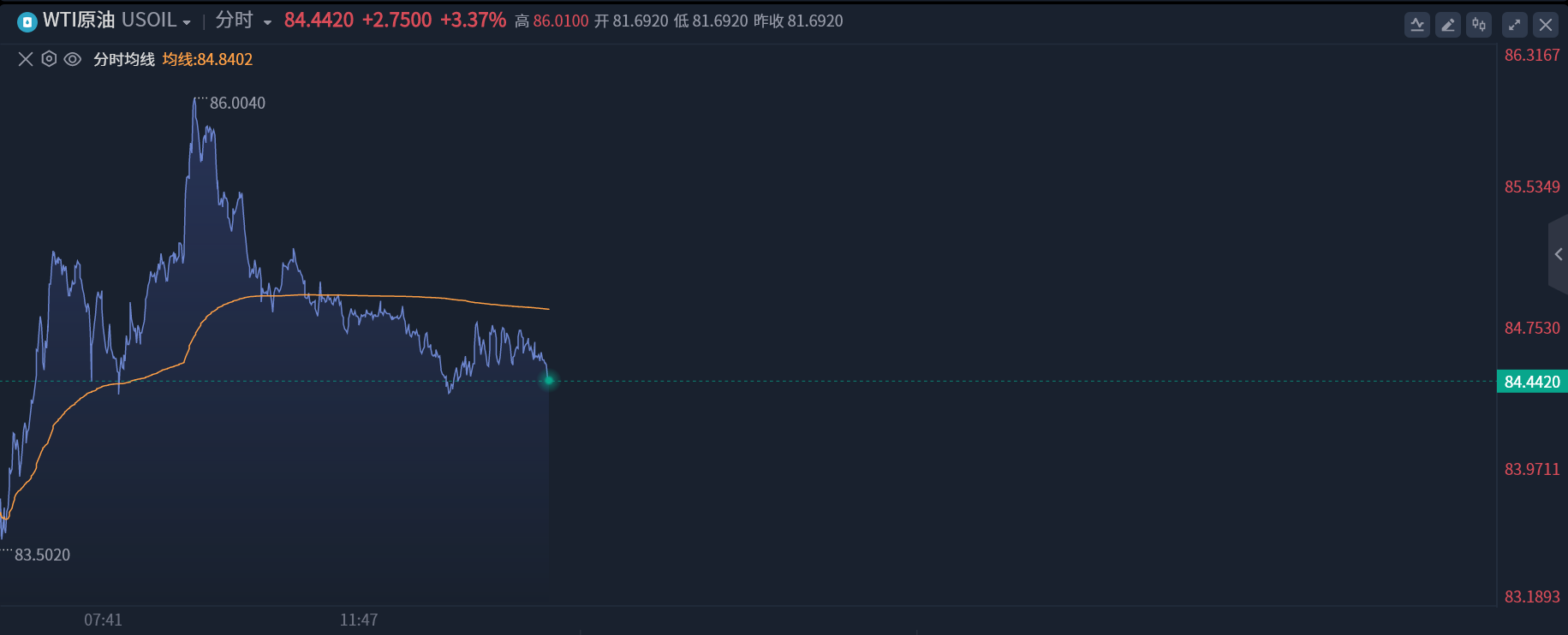

On October 9, affected by the outbreak of large-scale conflict between Palestine and Israel, WTI crude oil opened higher at the beginning of the session, jumping more than 4% at one point, hitting a three-day high of 86.$45 / bbl, now slightly down, at 84.$44 / barrel。

Will the political crisis turn into an energy crisis??

Due to the special location of the Middle East, historically, large-scale military conflicts surrounding the region have often evolved into energy crises.。

In October 1973, due to the outbreak of the Fourth Middle East War, OPEC's Arab member states cut production and raised prices against Western countries, which directly caused the surge in international oil prices that year;。

From the results alone, since the establishment of OPEC, the three energy crises in the past 50 years are closely related to the Middle East。In this case, the market is concerned about whether the large-scale conflict between Palestine and Israel will turn into a fourth oil crisis.?

For now, if the two sides in this military conflict are confined to Palestine and Israel, the chances of the conflict turning into an oil crisis will be slim.。But once larger oil-producing countries are drawn into the war, the risk of an oil crisis will increase significantly。

Tamas Varga, senior market analyst at crude oil broker PVMOil Associates, said that the impact of the two countries on global crude oil supply itself is almost negligible, "but if you consider the impact of the war in the Middle East on oil prices in the past five decades, if the situation escalates further and lasts longer, the risk of oil crisis often arises after the intervention of oil producers.。"

Guillermo Santos, head of strategy at iCapital, a Spanish private banking company, also said that as long as stability in the region and Iran's violent expansionism in the security sphere do not further complicate the conflict, which is limited to Palestinians and Israelis, the consequences of all this should not have a particularly negative impact on financial markets.。

So, while the Palestinian-Israeli conflict is taking place, the market is watching closely the movements of the other two major oil producers in the Middle East, Iran and Saudi Arabia.。

Iran announces support for Hamas, U.S. hopes to stabilize Saudi Arabia

It is understood that Iran, as the world's major oil producer, is the main supporter of the Palestinian Hamas organization.。After the start of the military conflict, members of the Iranian parliament have expressed support for the Palestinian Hamas military campaign against Israel.。A Hamas spokesman claimed Saturday that the group's strike against Israel was directly supported by Iran。Earlier, a senior adviser to Iran's Supreme Leader Ayatollah Ali Khamenei said Iran provided support for the attack, but he gave no specifics.。

The analysis points out that if Israel is angry with Iran because of the military conflict, it does not rule out the possibility of a disruption in the country's crude oil supplies.。In a more extreme scenario, Iran could respond to any direct provocation by blocking the Strait of Hormuz, and if so, oil prices would see another surge.。Bob McNally, a former White House official, said that if the conflict spilled over to Iran and Israel responded by hitting any of Iran's infrastructure, crude prices would immediately spike because of the risk of disruption.。However, he also said that at this time, it is unlikely。

Andrea Tueni, head of sales and trading at Saxo Bank in France, said it was not possible to compare the current situation in the oil market to 1973.。If there was another dimension to the conflict, such as a direct Israeli attack on Iranian infrastructure, it would be a completely different story, but it's too early。

On the Saudi side, sources note that Brett McGurk, coordinator of the U.S. National Security Council for the Middle East and North Africa, and Barbara Leaf, assistant secretary of state for Near East affairs, have begun a visit to Saudi Arabia in an effort to normalize Israel's relations with Saudi Arabia, which has refused to recognize Israel's legal status since its founding in 1948.。

The White House is concerned that the political instability in the Middle East has cast a shadow over the global oil market, and if Saudi Arabia continues to pursue an irregular "voluntary production reduction strategy," it will undoubtedly add to the current situation.。The White House wants to trade U.S. arms sales, security guarantees and support to help build civilian nuclear facilities for normalizing Saudi-Israeli relations。According to the latest news, the Saudis have agreed to increase production early next year to balance market supply if oil prices continue to be high。

John Leiper, chief investment officer at Titan Asset Management, noted that while the geopolitical landscape in the Middle East is very different from that of the early 1970s, there is a real risk that Israel will react strongly, which would disrupt Saudi-led negotiations and could lead to tighter U.S. sanctions on Iran, leading to higher oil prices.。

He also said recent supply constraints, lower U.S. strategic reserves and Friday's stronger-than-expected non-farm payrolls data suggest oil prices could top $100 a barrel, a claim further fueled by the recent escalation of tensions, which could cause oil prices to continue to rise.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.