Crude oil supply tightens in the fourth quarter, says oil will rise to $150

The market is concerned that there will be a significant shortage of crude oil supply on the market into the fourth quarter, which is one of the important reasons for the rapid rise in oil prices recently.。

It seems only a matter of time before international oil prices break the $100 / barrel mark。

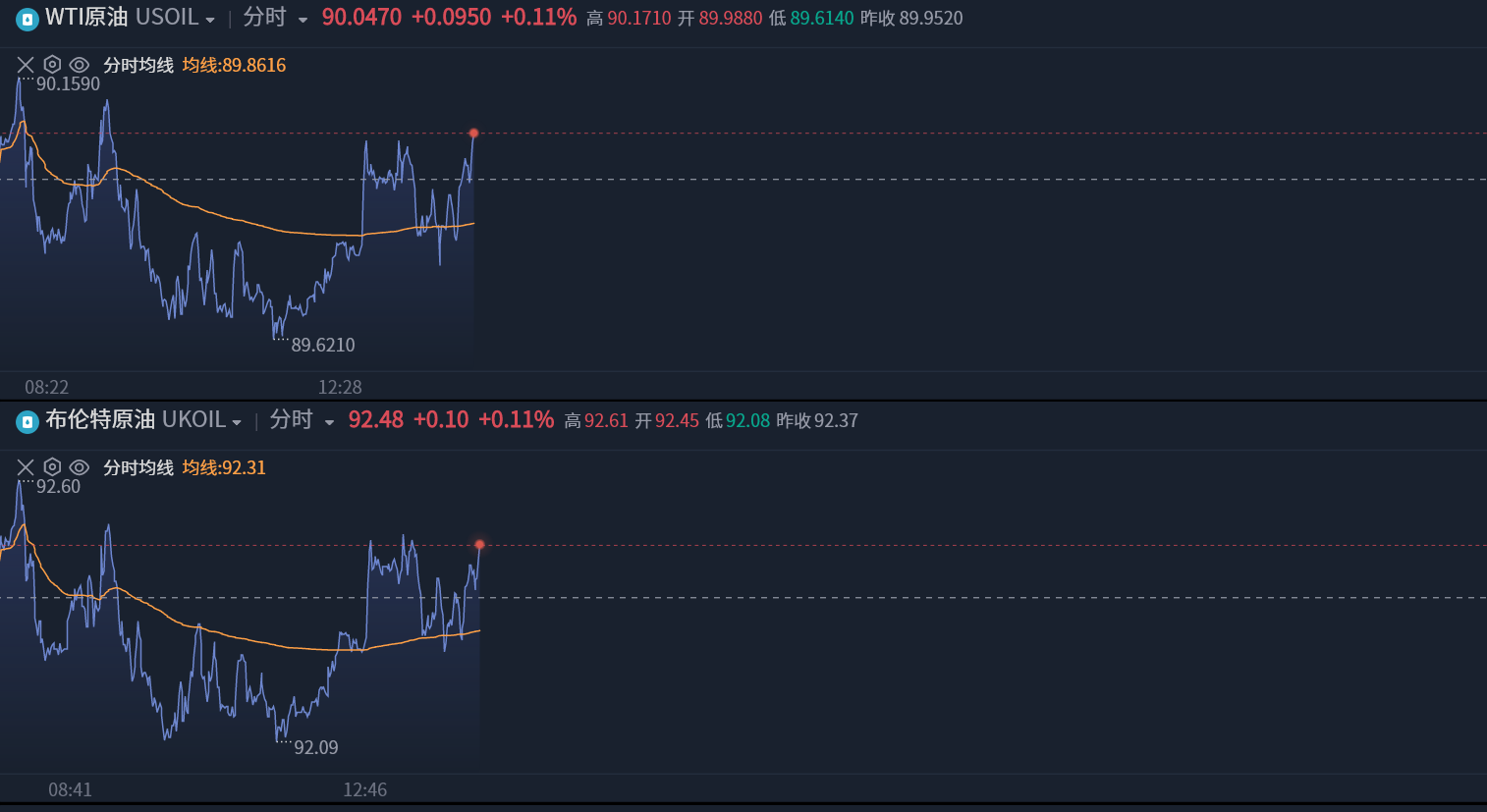

On September 25, U.S. oil and cloth oil both rose 0.11%, trading above $90 / bbl, sword refers to the $100 / bbl mark。

On Friday, cloth oil futures closed at 93.$27 / bbl, down 0 for the week.3%, ending three weeks of gains at the weekly level。U.S. oil, affected by the decline in the total number of U.S. oil drilling, the variety rose 0 on Friday.5% to 90.03 USD / bbl, down 0 for the week.03%, first decline in 4 weeks。Data show that the total number of oil drilling in the United States for the week to September 22 was 507, down from the previous value of 515。

At the price level, the recent rapid rally in oil prices finally calmed down a bit last week。The reason is that the Fed's hawkish signal last week added to the market's worries about the outlook for the oil market.。Although the Fed announced that it would maintain the target range for the federal funds rate at 5.25% -5.5% unchanged, but still maintained the judgment that another rate hike would be made during the year, while maintaining long-term interest rates at 2.5%, up from the past, to fight stubborn inflation。

In addition, Fed officials have raised the overall PCE inflation level in the U.S. this year to 3.3%; make a downward revision to the core PCE inflation level to 3.7%。As the core PCE statistics in the United States exclude food and energy prices, which are more affected by the season, the Fed wants to show that it has taken note of the impact of high energy prices on the inflationary environment in the United States and does not rule out more tightening measures in the future.。

Fed Michelle Bowman said: "Inflation remains too high, and I expect that further rate hikes by the Federal Open Market Committee (FOMC) and keeping rates at restrictive levels for some time may be appropriate."。"She also pointed out that energy prices could rise further, which is a particular risk she is monitoring, which confirms this view.。

In addition, Dennis Kissler, senior vice president of trading at BOK Financial, said: "As refineries enter the maintenance phase, investors expect demand to slow in October and higher interest rates will further pressure the market.。"It is understood that refineries in the United States usually operate at high load during the summer season due to the demand for fuel production during the summer season.。As a result, these refineries will usually be maintained in the fall, corresponding to a decline in fuel demand, which again seems to be bad news。

However, with Moscow issuing a temporary fuel export ban, the market is once again predicting that the outlook for future crude oil supplies will become increasingly tight.。

In recent months, the market price of diesel and gasoline in Russia has risen to record highs.。According to the Russian National Statistics Agency, from the beginning of 2023 to September 18, the retail price of gasoline and diesel in Russia increased by 9.4%。As a result, on September 21, local time, the Russian government announced temporary restrictions on gasoline and diesel exports to stabilize the domestic market.。According to a government decree published on the same day, the restriction will take effect immediately and it is not clear when it will be lifted.。

This temporary ban on Russian fuel exports, coupled with the previously announced additional production cuts by Saudi Arabia and Russia that will continue until the end of the year。The market is concerned that there will be a significant shortage of crude oil supply on the market into the fourth quarter, which is one of the important reasons for the rapid rise in oil prices recently.。

Possible future energy supply shortages have quickly caught the attention of some analysts, with JPMorgan energy analysts writing in their latest research paper that they are expected to trigger multiple oil-led energy crises over the next decade, potentially much more serious than the gas crisis that erupted in Europe last year.。The bank expects that in the short or medium term, the price of cloth oil may rise to $150 / barrel, 62 higher than the current.6%, the global oil gap is expected to widen to 7.1 million barrels per day by 2030。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.